- XRP/USD retreats from psychological resistance of $0.3000.

- The technical correction may be limited by $0.2840.

Ripple’s XRP hit the intraday high at $0,2959 and retreated to $0,2930 by the time of writing. The third digital asset has bottomed at $0,2547 hit on August 27, and started the recovery with the critical resistance created by the psychological $0,3000. XRP/USD has gained over 4% both on a day-to-day basis and since the beginning of the day.

XRP/USD 1-hour chart

On the intraday charts, XRP/USD attempts to move back inside the 1-hour Bollinger Band with the next support created by $0.2900. It is followed by the upper line of the previous consolidation channel at $0.2840, which is reinforced by the middle line of the 1-hour Bollinger Band. Considering that the RSI has reversed to the outside, ready to exit the overbought territory, XRP may extend the correction towards the above-mentioned area.

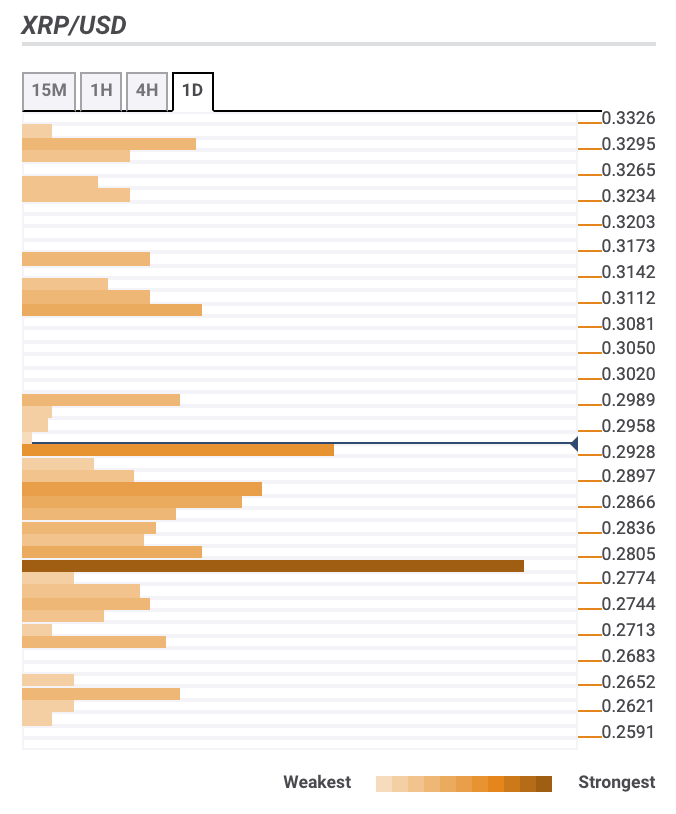

Ripple confluence levels

The majority of technical barriers are clustered both below the current price, which means the price may be better positioned for further recovery. Let’s have a closer look at support and resistance levels for XRP/USD.

Resistance levels

$0.2990-$0.300 — 38.2% Fibo retracement monthly, psychological level

$0.3100 — 23.6% Fibo retracement monthly

$0.3300 — Pivot Point 1-week Resistance 3

Support levels

$0.2880 — the middle line of the daily Bollinger Band, the upper line of the 4-hour Bollinger Band, 4-hour SMA200.

$0.2800 — 1-hour SMA200, 4-hour SMA50, 61.8% Fibo retracement weekly and monthly, the middle line of the 4-hour Bollinger Band

$0,2700 — 38.2% Fibo retracement weekly

XRP/USD, 1-day

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Solana price pumps 7% as SOL-based POPCAT hits new ATH, JITO becomes largest protocol on TVL metrics

Solana (SOL) price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

High hopes rouse for TON coin with Pantera as its latest investor

Pantera aims to introduce crypto to the masses with investment in TON blockchain. The TON blockchain has received significant recognition among crypto investors following recent partnerships and integrations. TON could see a rally following Pantera's recent investment.

Ethereum to break out of bearish move, ETH ETFs unlikely in 2024

Ethereum shows signs of recovery despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot ETH ETF may not happen in the US in 2024.

Wasabi Bitcoin privacy mixing service to shut down starting June 1, zkSNACKs cites legal certainty concerns

zkSNACKs, the company pioneering the development of Wasabi Wallet, has revealed plans to shut down its Coinjoin coordination service, effective from June 1, 2024.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

-637345480027149914.png)