Ripple Price Prediction: XRP slips below a critical support level targeting $0.21

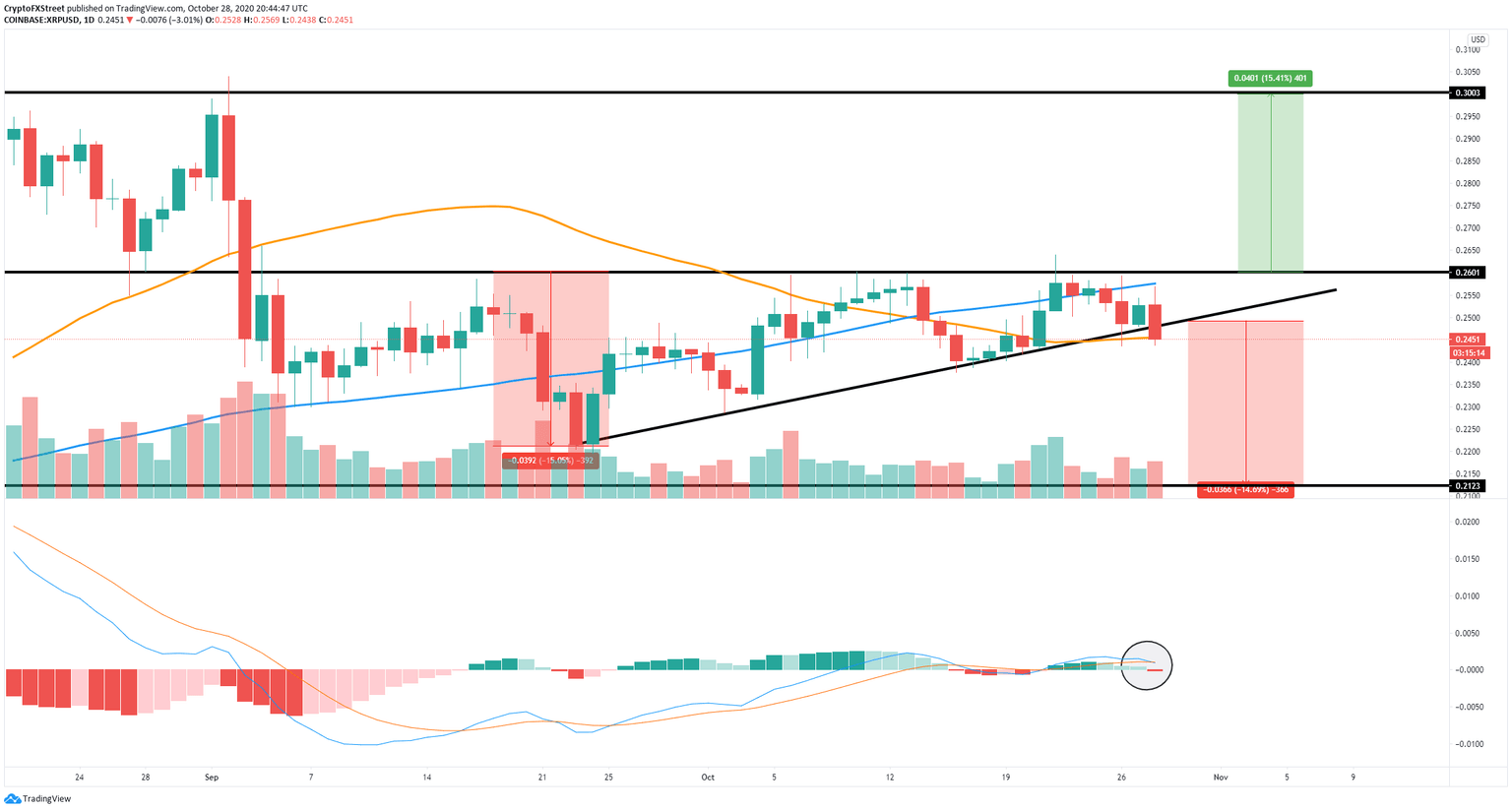

- XRP is trading at $0.245 below the lower trendline of an ascending channel formed on the daily chart.

- The digital asset is at risk of falling towards $0.21 if bulls can’t defend the critical support level at $0.248.

XRP attempted to break out of an ascending triangle on October 22 but failed. The fakeout led the digital asset into a period of correction for the next five days, losing the 100-SMA as a support level.

XRP can fall to $0.21 if this support level is lost

On the daily chart, the most critical support level is established at $0.248, the lower boundary of the ascending triangle pattern. The current price of XRP is below at $0.2451, which means bulls are at risk of losing the support level.

XRP/USD daily chart

Additionally, the MACD just turned bearish for the first time since October 16. Using the height of the ascending triangle we can determine the potential bearish price target to be at around $0.21.

The only chance for XRP to survive is to defend $0.248

On the other hand, if the bulls can defend the support level at $0.248 and close above it, it will simply be considered a re-test of the lower boundary. The last time the MACD turned bearish, the sellers didn’t see much follow-through.

Furthermore, the 50-SMA is currently acting as a strong support level at $0.245. XRP could jump towards $0.26, the upper trendline of the pattern. A breakout above this point would drive the digital asset towards $0.30.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.