Ripple Price Prediction: XRP prepares to pullback to $0.27 before an ultimate breakout

- After days in the positive region, Xrp prepares to drop by 19% before a bounce back.

- The Fibonacci retracement tool confirms the sell signal on a daily chart.

It would seem that the price of XRP is showing signs of a potential retracement before bouncing off to the upside in the short term. Indicators show that incoming bearish momentum could see it go as low as $0.27 before it takes off.

XRP at the brink of retracement before next leg up

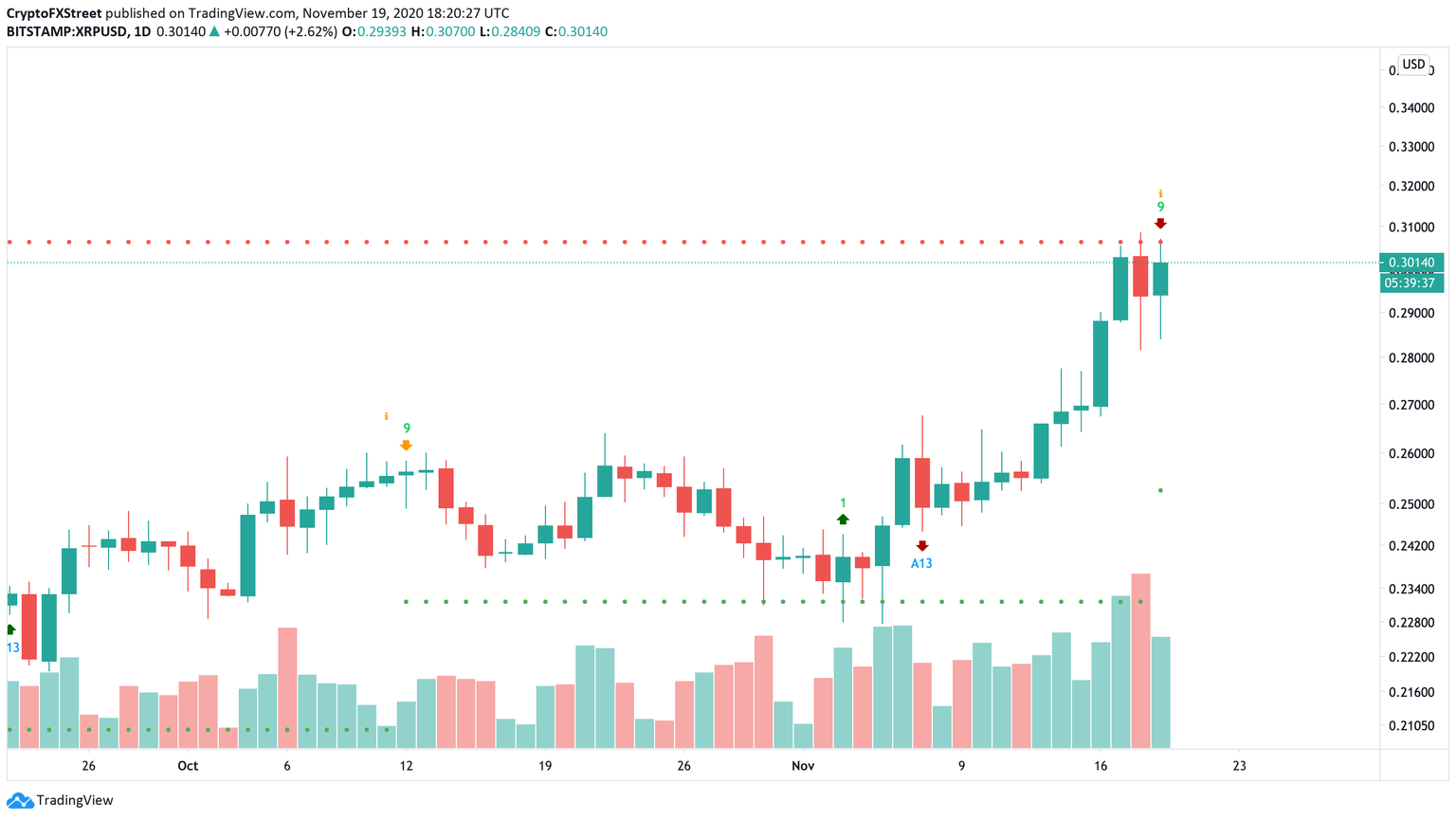

On the daily chart, a reversal in the price of XRP seems to be brewing as the TD sequential indicator presents a sell signal. The bearish formation developed in the form of a green nine candlestick, suggesting that the cross-border remittances tokens is poised to retrace for one to four daily candlesticks.

XRP/USD Daily chart

Another indicator further reinforces this bearish outlook. A movement to the downside is expected as we see XRP falling to the 61.8% or 50% on the Fibonacci retracement levels before advancing further. Meaning prices could drop to $0.27 or $0.26.

XRP/USD Daily chart

On the other hand, if the price sustains the rally above $0.31, the bearish stance will be invalidated. A spike in the buying pressure behind XRP around the current price levels could see it rise to the 127.2% or 141.4% Fibonacci retracement levels. These resistance barriers sit at $0.33 and $0.35, respectively.

Author

FXStreet Team

FXStreet