Ripple Price Prediction: XRP downtrend not over as bears target another 10% drop

- The price of XRP is currently $0.2385 after a significant breakdown from an ascending triangle.

- Amid the bearish continuation to $0.23, it seems that XRP has more room to slip even further.

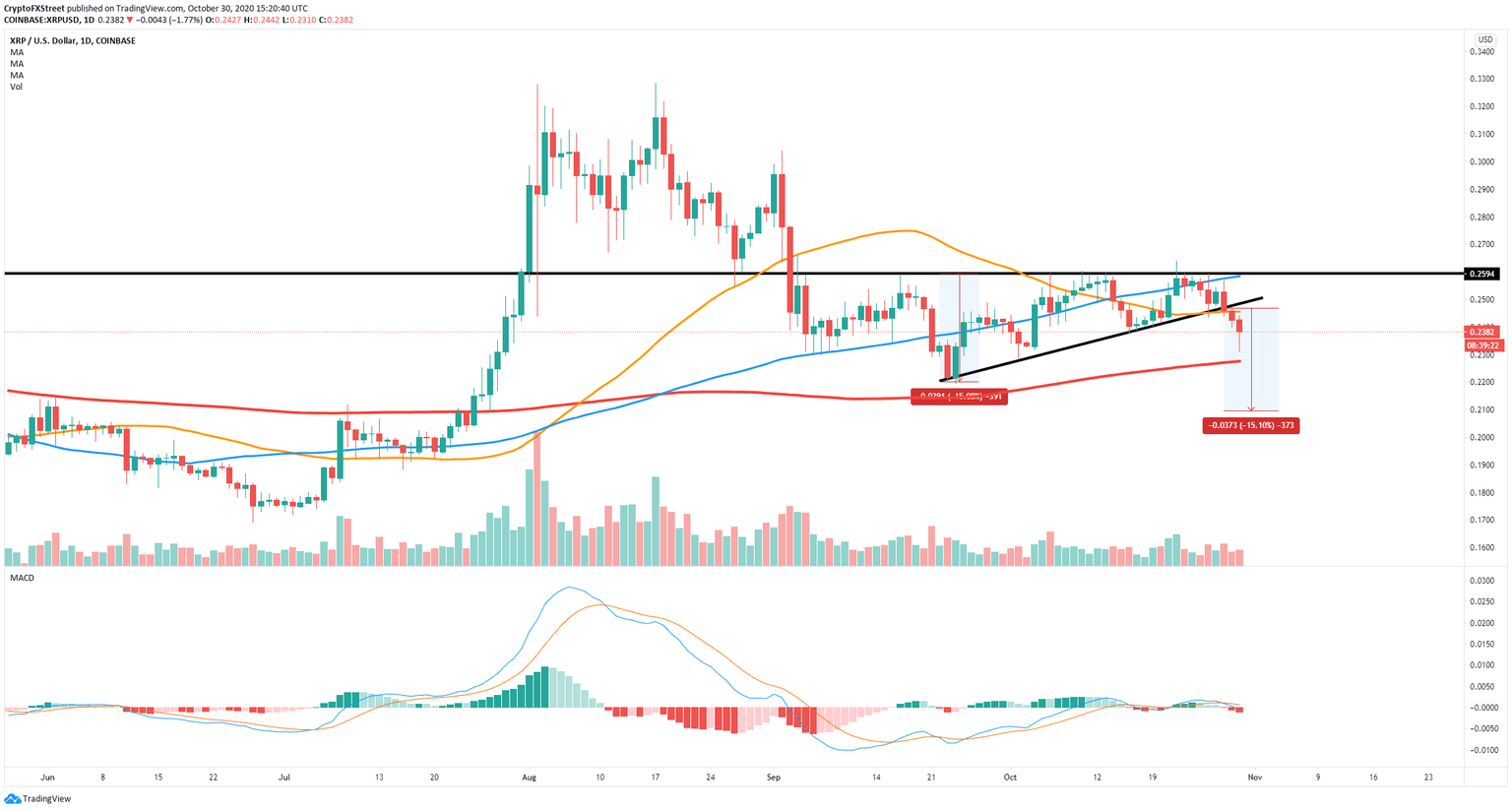

XRP was bounded inside a daily ascending triangle for around one month. On October 28, Ripple's digital asset broke down from the pattern, losing the 50-SMA support level at $0.245 and experiencing a lot of bearish continuation in the next two days.

What is the next price target for XRP after the breakdown?

The breakdown of the daily ascending triangle is significant as the lower trendline was a robust support level, which coincided with the 50-SMA. On top of that, the MACD turned bearish simultaneously and it’s gaining strength, which indicates sellers still have more power.

XRP/USD daily chart

The next potential price target would be $0.2277, where the 200-SMA is currently established. A breakdown from this point can easily drive the price of XRP towards $0.21 using the height of the triangle pattern as a reference.

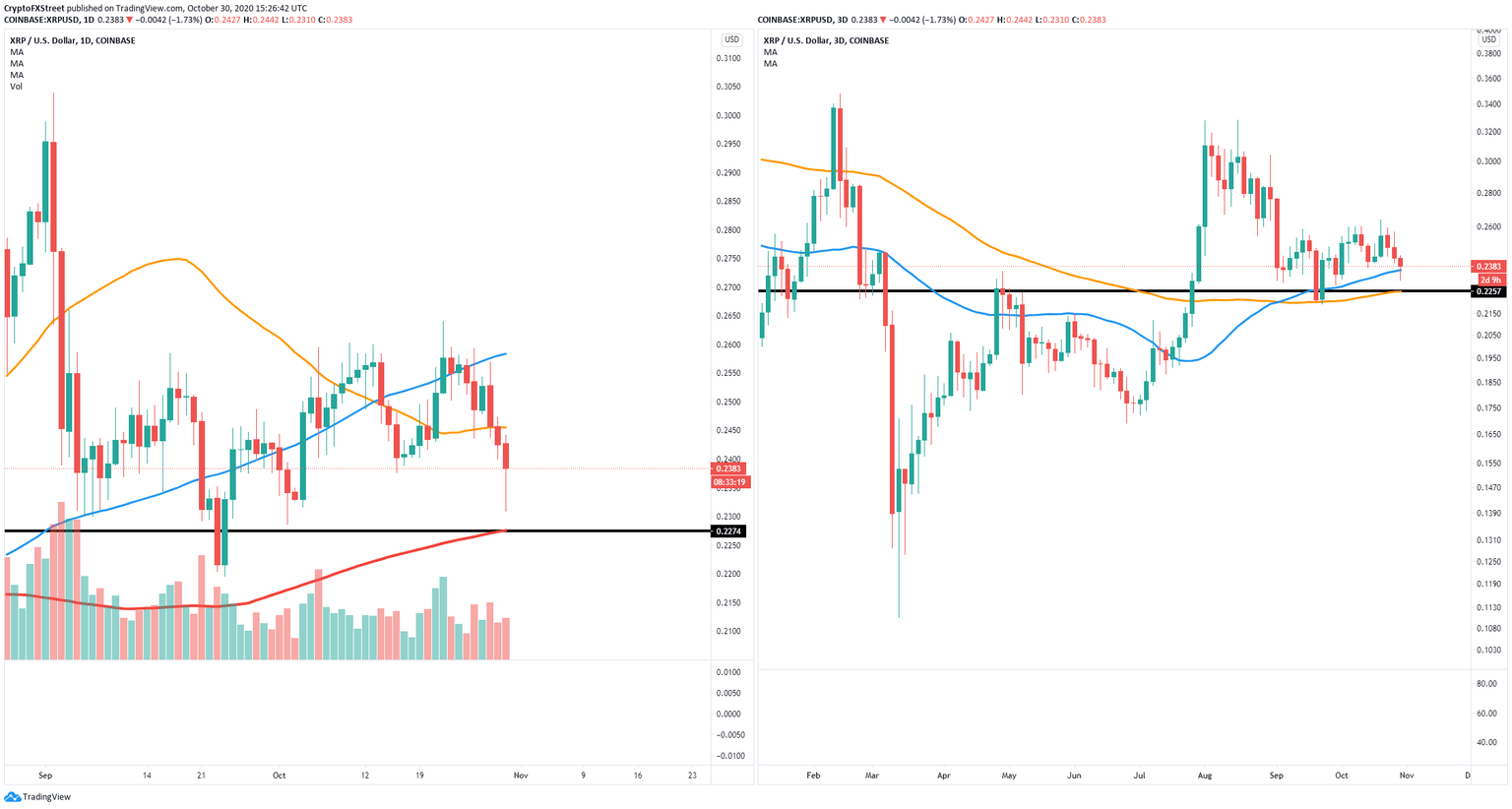

XRP 1-day and 3-day charts

However, as stated above, the 200-SMA support level at $0.225 on the daily chart will act as a healthy support level, especially considering that the 50-SMA on the 3-day chart coincides with it. Additionally, the 100-SMA at $0.236 on the 3-day chart is not lost yet and will serve as another support point.

Looking at the other side of the picture

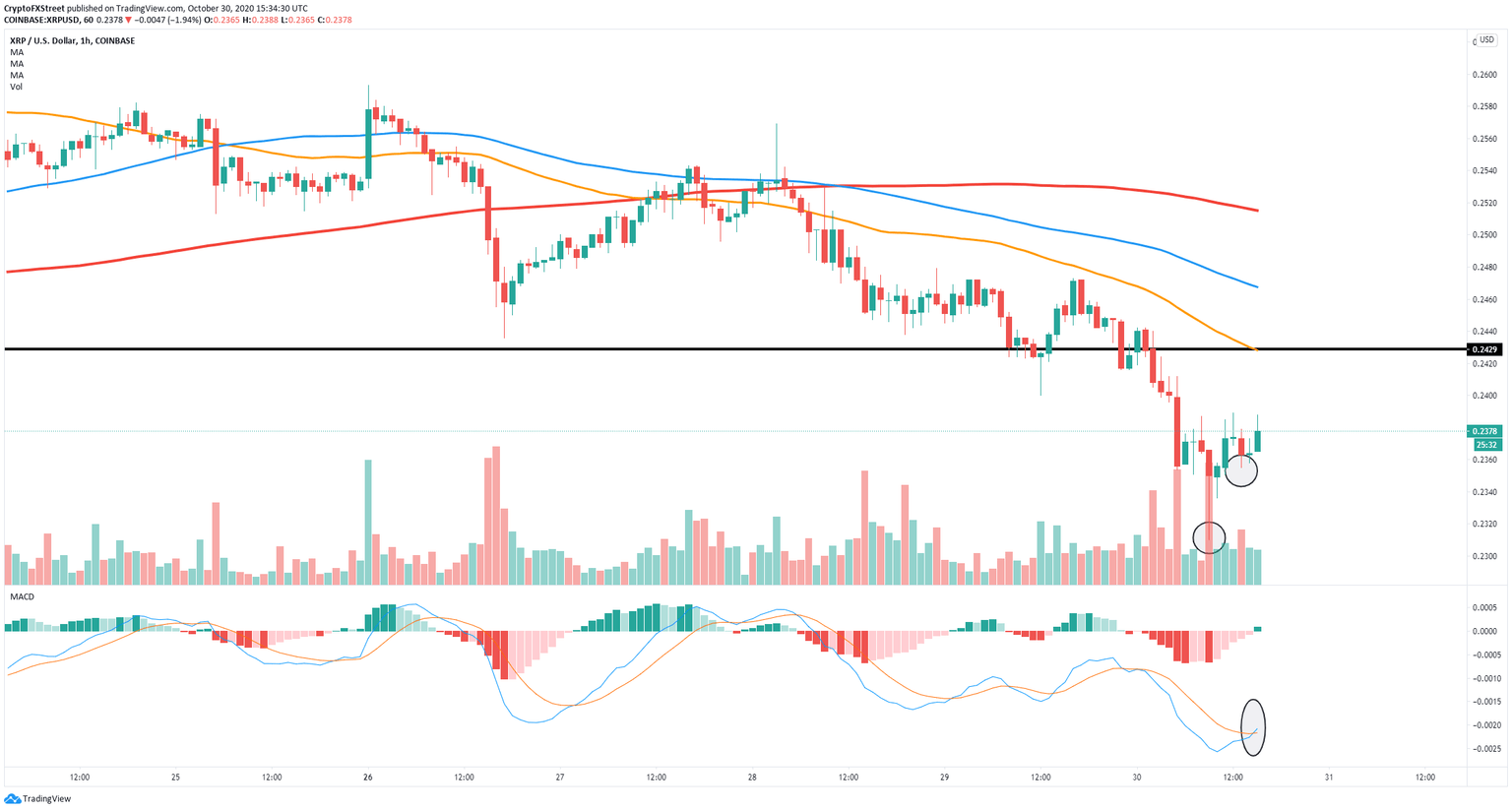

XRP/USD 1-hour chart

On the other hand, observing the 1-hour chart, it seems that XRP is close to confirming an uptrend after establishing a higher low at $0.235 compared to $0.231, which gives the bulls some hope. Additionally, the MACD flipped bullish again, which adds up the strength to this theory. The price target of XRP in this range would be the 50-SMA at $0.2429.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.