Ripple price analysis: XRP/USD extends the downside correction towards $0.29

- Ripple is moving within a short-term bearish trend.

- XRP/USD needs to regain ground above $0.30 to mitigate the bearish pressure.

Ripple’s XRP has been sliding down for the third day in a row. The third digital asset topped at $0.3149 and broke below the ascending trendline from September 23 low. The coin slipped below critical $0.30 as the downside correction has gained traction. Ripple's market value decreased by 1.2% both on a day-to-day basis and since the beginning of the day.

Let's have a closer look at the technical picture for XRP/USD

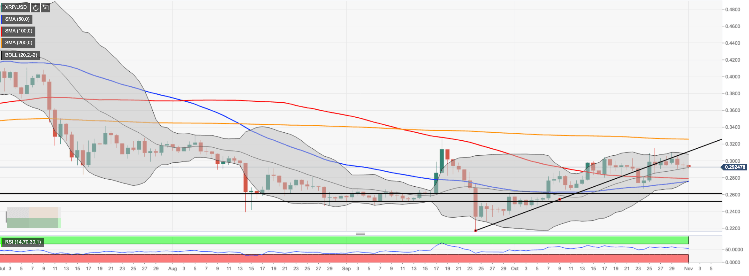

Looking technically, a sustainable move below $0.3000 can be interpreted as a short-term bearish signal. While the price is supported by the middle line of the Bollinger Band daily located on approach to psychological $0.2900, a sustainable move below this handle will take the price to $0.2800 strengthened by SMA100 (Simple Moving Average) daily and $0.2750 (SMA50 coupled with the lower line of the Bollinger Band on a daily chart).

On the upside, we will need to see a sustainable move above $0.30 for the upside to gain traction with the next bullish aim at $0.3070 (the upper line of the daily Bollinger Band) and $0.3110 (the above-mentioned ascending trend line). Once it is out of the way, the bulls will regain control and take the price to $0.3250 (SMA200 daily).

XRP/USD, daily chart

Author

Tanya Abrosimova

Independent Analyst