- XRP/USD keeps corrective pullback from 100-day SMA, previous resistance.

- Bullish MACD, sustained recovery direct buyers toward the key Fibonacci retracement levels.

- Sellers have yearly support line as an extra barrier to cross for entry.

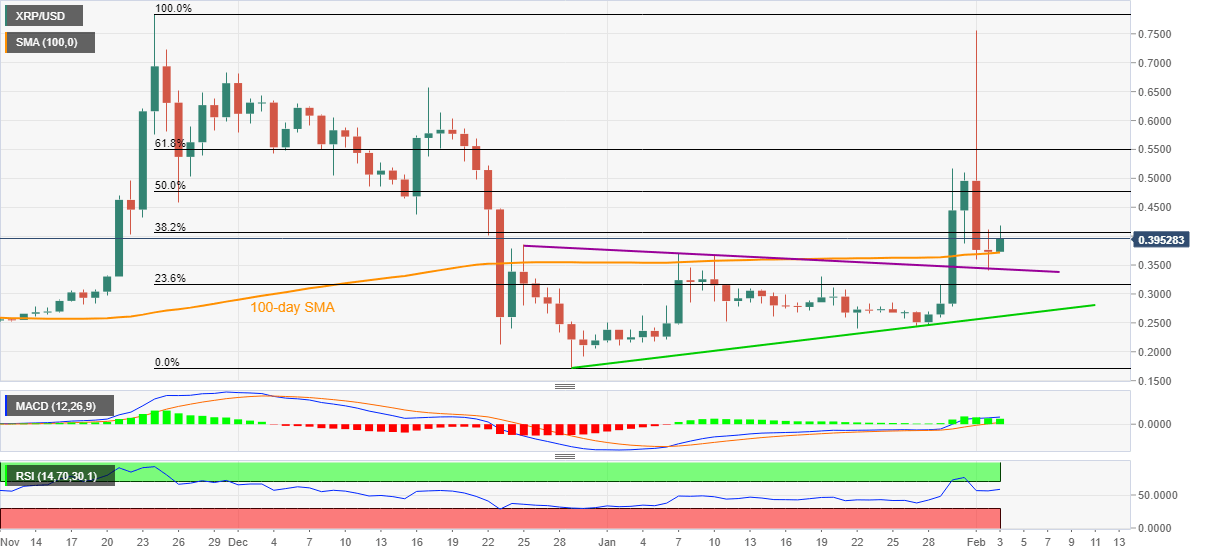

XRP/USD picks up the bids around 0.3965 during early Thursday. The cryptocurrency pair marked a reversal from 100-day SMA and a six-week-old support line, previous resistance, the previous day.

The recovery moves also gain support from bullish MACD and strong RSI conditions to suggest further upside.

In doing so, 50% and 61.8% Fibonacci retracement levels of November-December 2020 downside, respectively around 0.4780 and 0.5500, gain the market’s attention.

Also acting as an upside barrier is the weekend’s high around 0.5170 and December 17, 2020 peak surrounding 0.6580.

Meanwhile, a downside break of 100-day SMA, at 0.3715 now, will have to drop below the previous resistance line, currently around 0.3430, to revisit the sub-0.3000 area.

However, an upward sloping trend line from December 29 near 0.2600 will be a tough nut to break for the XRP/USD bears, which also holds the key to the 0.2000 threshold and December low of 0.1719.

XRP/USD daily chart

Trend: Bullish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum Spot ETF in Hong Kong sees underwhelming response with $12 million in trade volume

Bitcoin and Ethereum Spot ETFs issued in Hong Kong registered a combined trading volume of around $12 million at market close on Tuesday. When compared to the US stock market, the response from the Asian market is underwhelming.

Top 3 meme coins price prediction Dogecoin, Shiba Inu, Bonk: Memes outperform Bitcoin on two week timeframe

Crypto sector performance over the past two weeks shows meme coins emerged as clear outperformers, beating Bitcoin, AI coins and Binance coin categories. Bitcoin price losses nearly 4% of its value on Tuesday, exchanging hands at $61,657 on Binance at the time of writing.

XRP climbs past $0.51 as Ripple motion receives SEC response

Ripple trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US SEC persists, now in the form of crossed motions to determine which materials and testimonies have to be included in the case.

Worldcoin’s four buy signals hint at a reversal rally Premium

Worldcoin (WLD) price is setting the stage for a recovery rally. After more than two weeks of mounting bullish signs, WLD has not only formed a potential bottom but has also flashed a buy signal, hinting at what’s about to come next.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.