Ripple Price Analysis: XRP jumps above $0.43 with no resistance ahead – Confluence Detector

- Ripple's XRP is the best-performing digital asset with over 30% of day-to-day gains.

- The price may continue moving upwards with no barriers ahead.

Ripple's XRP is the best-performing digital asset out of the top-10 on Saturday. The coin has gained over 30% in the past 24 hours to trade at $0.40 at the time of writing. The price hit $0.436, the highest level since July 2019, and the upside momentum is gaining traction

Ripple's market value jumped to $18 billion, while its average daily trading volume settled at $10 billion. Bullish cryptocurrency market sentiments and positive technical factors have been driving the price of the coin higher since the beginning of the week.

XRP is unstoppable

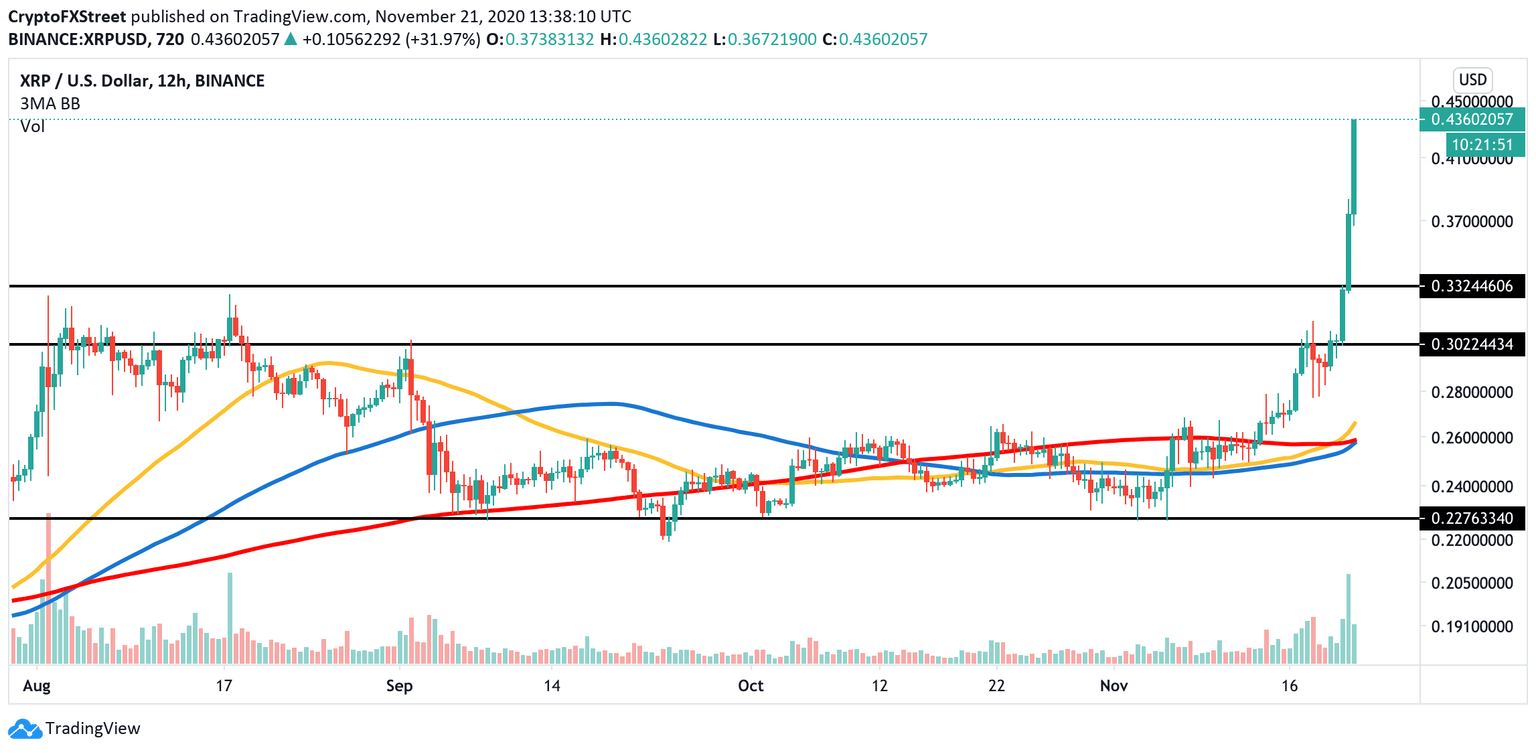

From the technical point of view, a sustainable move above $0.33 served as a robust bullish catalyst for the coin. The price got a significant boost that pushed it above $0.4. With little to no barriers on the way to the North, XRP/USD has the potential to revisit $0.45 before the end of the week.

XRP/USD, 12-hour chart

Ripple's daily confluence chart shows several clusters of support levels on the way down. The first local barrier comes on approach to $0.4. It is the lowest level of the previous hour and a prior resistance area. Once it is verified as a support, the price will shoot to new highs again.

If it is cleared, the downside correction may be extended towards $0.38, reinforced by the Pivot Point 1-day Resistance 3. It separates XRP from a deeper decline towards $0.35, created by Pivot Point 1-week Resistance 1 and the upper line of the Bollinger Band.

XRP's Confluence levels

On the upside, the local barrier is seen on approach to $0,43 (Pivot Point 1-week Resistance 3). Once it is out of the way, the upside is likely to gain traction with the next focus on $0.45 and potentially $0.5.

Author

Tanya Abrosimova

Independent Analyst