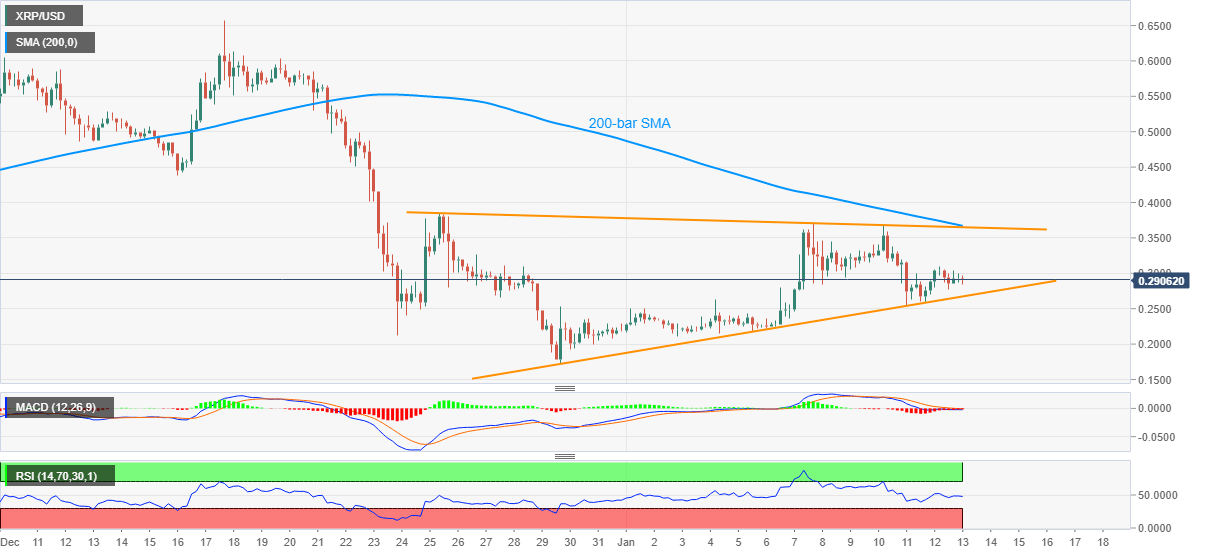

- XRP/USD fails to extend Tuesday’s recovery moves, remains sideways inside short-term triangle.

- MACD eases bearish bias but 200-bar SMA joins triangle resistance to challenge bulls.

- Sellers may eye December lows on triangle breakdown.

XRP/USD drops to 0.2875 during early Wednesday. In doing so, the ripple pair defies recovery hopes, triggered the previous day, while funneling down a symmetrical triangle established since December 25.

Despite failures to regain upside momentum, MACD signals ease bearish bias while the RSI conditions are also normal, which in turn suggest a slow grind to the north.

However, 200-bar SMA adds strength to the triangle’s resistance, currently around 0.3670, to challenge XRP/USD bulls. Also acting as an immediate upside filter is the December 25 top near 0.3850.

It should be noted that the quote’s ability to jump past-0.3850 will enable it to challenge the mid-December low near 0.4380.

Alternatively, a downside break of the triangle’s support, at 0.2673 now, may direct XRP/USD sellers towards the 0.2100 threshold ahead of highlighting the 0.2000 round-figure.

In a case where the crypto pair remains depressed past-0.2000, December’s low around 0.1720 will be the key to watch.

XRP/USD four-hour chart

Trend: Sideways

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Solana, Base and AI meme coins rally, are speculative tokens making a comeback?

Meme coins are typically considered more speculative than the rest of cryptocurrency categories. Despite the label, hedge funds and institutional investors have warmed up to meme coins this cycle.

RWA narrative could make a comeback after nearly 50% correction in CFG, ONDO, MKR

Bitcoin halving and developments in the AI sector are the key narratives this cycle. The Real World Asset (RWA) tokenization narrative gathered steam with BlackRock’s tokenized asset fund launch on Ethereum in March 2024.

These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.