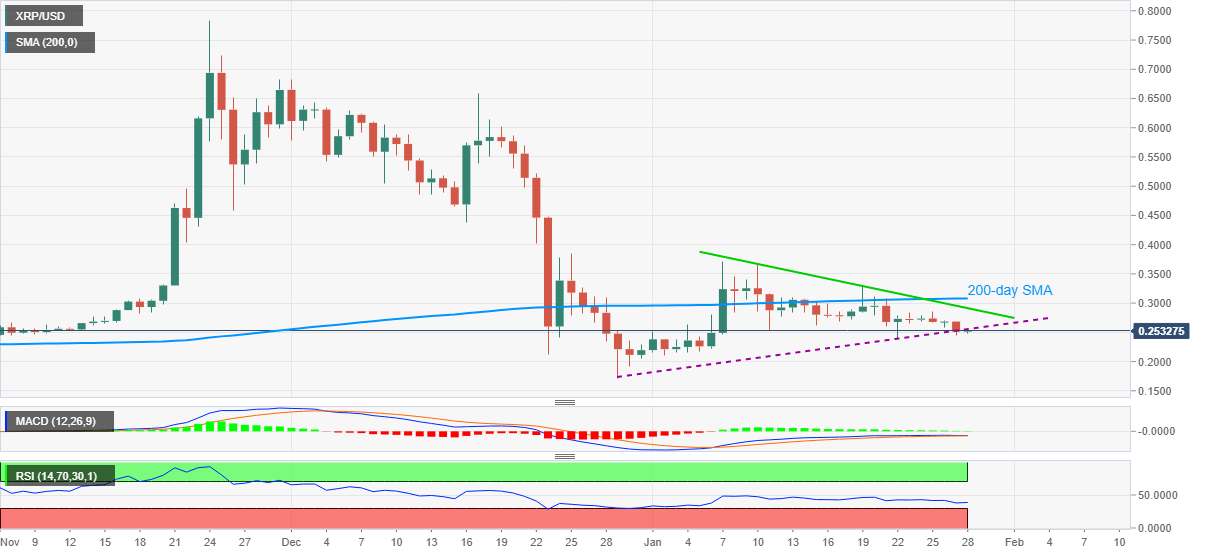

- XRP/USD keeps bounce off one-week low to regain 0.2500.

- Sustained break of previous support, trading below key SMA and 13-day-old resistance line favor bears.

- Bulls will have to cross 200-day SMA to retake controls.

XRP/USD nurses the previous day’s losses while picking up bids near 0.2520 during early Thursday. Even so, the ripple pair remains vulnerable for further downside as it keeps the break of a one-month-old support line.

Also favoring altcoin sellers is the sustained trading below 200-day SMA and a falling trend line from January 10.

As a result, the latest corrective pullback becomes less serious below 0.2555, comprising the earlier support line.

Even if the quote manages to cross 0.2555, a short-term resistance line near 0.2915 and 200-day SMA around 0.3080 will challenge the XRP/USD bulls. In a case where the pair cryptocurrency pair rises beyond 0.3080, the monthly top near 0.3685 will gain the market’s attention.

On the contrary, January 22 low near 0.2400 and the monthly bottom near the 0.2100 round-figure can lure the short-term XRP/USD sellers.

It should, however, be noted that the 0.2000 psychological magnet and lows marked during October 2020 and December 2020, around 0.1700, will be the key to watch following the XRP/USD drop below 0.2100.

XRP/USD daily chart

Trend: Bearish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

OpenAI parts ways with cofounder and chief scientist Ilya Sutskever

OpenAI cofounder Ilya Sutskever is exiting the firm for reasons not disclosed yet. Jakub Pachocki replaces Sutskever, taking the baton after running many of OpenAI’s most important projects, Altman says. Reportedly, Sutskever played a key role in the November ouster of CEO Sam Altman.

Sonne Finance suspends all Optimism markets after over $20 million exploit

With PeckShield attributing the attack to a time-locked contract, Sonne Finance has suspended all Optimism markets, adding that the Base market is safe. Noteworthy, Sonne Finance is the first platform to launch a lending protocol on Optimism.

Bitcoin Price Outlook: Will GameStop stock resurgence have downstream effect on BTC and alts?

Bitcoin continues to glide along an ascending trendline on the four-hour time frame. Meanwhile, the GameStop saga that has resurfaced after three years distracts the market, with speculation that it could inspire risk appetite among traders and investors.

Ethereum bears attempt to take lead following increased odds for a spot ETH ETF denial

Ethereum is indicating signs of a bearish move on Tuesday as it is largely trading horizontally. Its co-founder Vitalik Buterin has also proposed a new type of gas fee structure, while the chances of the SEC approving a spot ETH ETF decrease.

Bitcoin: Why BTC is close to a bottom

Bitcoin (BTC) price efforts of a recovery this week have been countered by selling pressure during the onset of the American session. However, the downside potential appears to have been capped.