- XRP/USD steps back from day's high while keeping the upside momentum.

- Normal RSI conditions, bullish chart pattern favor buyers.

- 100-bar SMA adds to the upside filter, bears will eye June 2020 on breaking channel to the downside.

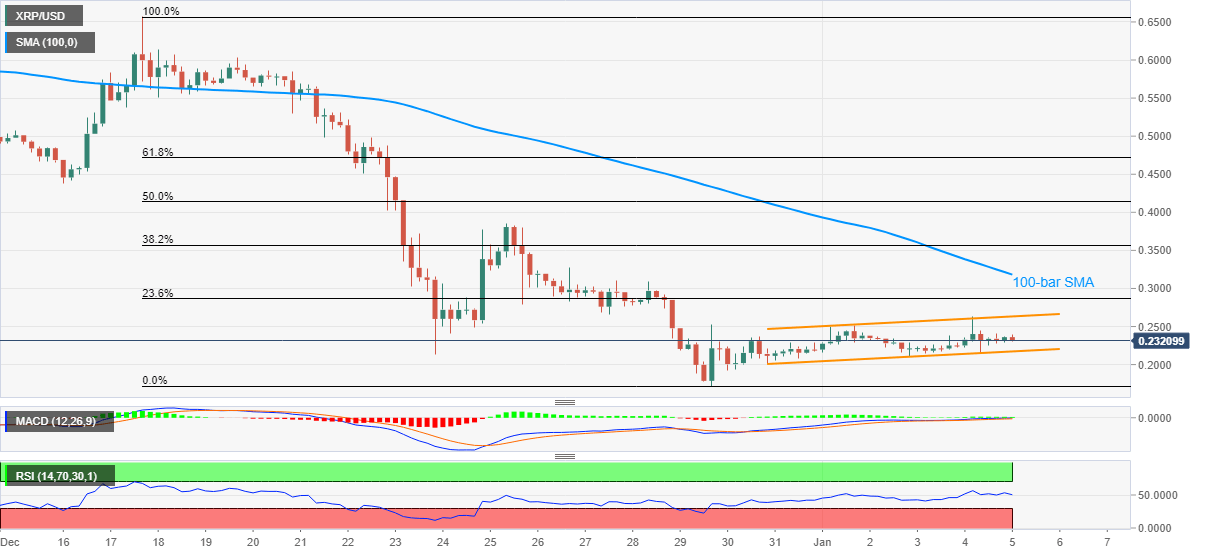

XRP/USD recedes from an intraday high of 0.2400 to 0.2306 during early Tuesday. Even so, the ripple pair remains inside an ascending trend channel formation established since December 30.

Not only the bullish chart pattern but normal RSI conditions and an absence of bearish MACD also favor the XRP/USD buyers unless breaking the stated channel’s support, at 0.2170 now.

In a case where the sellers sneak in around 0.2170, the 0.2000 psychological magnet and December low near 0.1720 will add filters to the quote’s south-run targeting June 2020 bottom of 0.1691.

Alternatively, the upper line of the stated channel near 0.2630 will probe the recovery moves ahead of 100-bar SMA, currently around 0.3180.

During the XRP/USD run-up past-0.3180, the December 25 top of 0.3848 will be the key as it holds the gate for further north-run towards the 0.5000 threshold.

Overall, XRP/USD consolidates the recent losses and is up for further rise provided fundamentals don’t deteriorate further.

XRP/USD four-hour chart

Trend: Further recovery expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Trust Wallet with over 100 million users back on Google Play Store after temporary removal

Trust Wallet is a non-custodial software wallet that allows traders to send, receive, exchange and hold digital assets. Users can hold cryptocurrencies and NFTs in their Trust Wallets. The wallet disclosed its removal from Google’s application store, Play Store, early on Monday.

Maker loses 9% in past 24 hours as whales sell MKR for profits

Maker (MKR) wiped out 9% of its value in the past 24 hours. Data from crypto intelligence tracker Santiment shows that large wallet investors are taking profit on their MKR holdings, likely driving down the asset’s price.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin, which showed strength last week, has slipped into a short-term consolidation. However, a shift in momentum could soon bring forth a momentary rally for BTC and altcoins.

XRP slides to $0.50 as ETHgate controversy resurfaces, Ripple CTO debates impact on litigation

Ripple (XRP) loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission (SEC) filing of opposition brief to Ripple’s motion to strike expert testimony.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.