Ripple Price Analysis: XRP bulls need to crack 200-DMA to extend the recovery

- XRP/USD looks to extend recovery from two-week lows.

- 200-DMA is the level to beat for the XRP bulls.

- Daily RSI edges higher but holds below the midline.

Ripple (XRP/USD) is attempting to build on Friday’s impressive bounce from two-week lows of $0.2400 amid the upbeat sentiment witnessed across the crypto board so far this Saturday.

The no. 5 coin currently trades near $0.2800, adding over 2% on a daily basis. However, it remains on the track to end the week almost unchanged.

The altcoin rose as high as $0.3295 earlier this week following the news of the nomination of Michael Barr, a former US Treasury official and a former key member of Ripple's advisory board, as head of the Office of the Comptroller of the Currency (OCC).

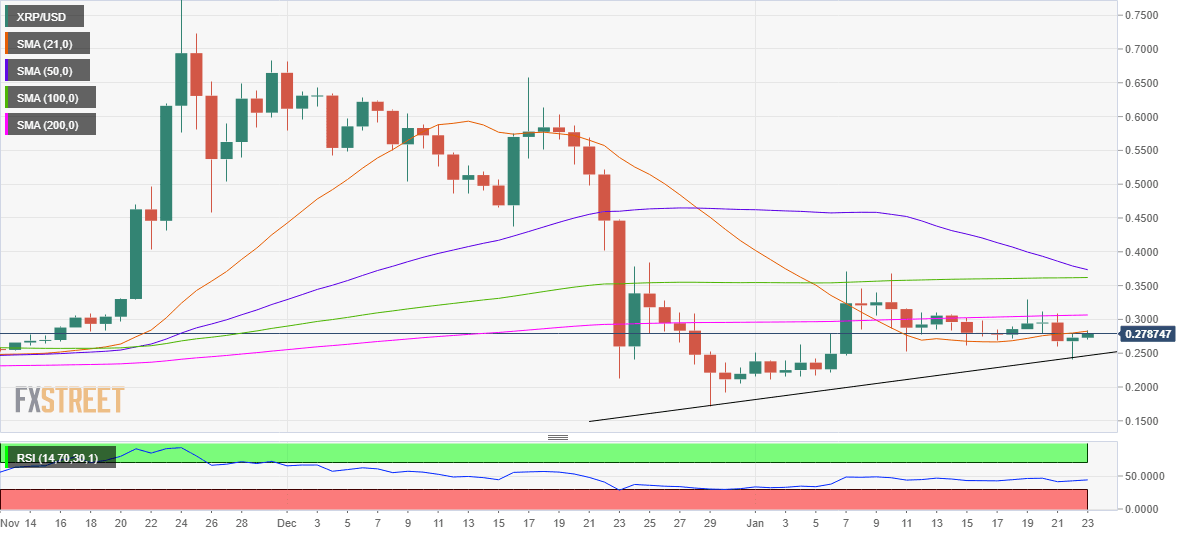

XRP/USD: Battling 21-DMA on the road to recovery

XRP/USD: Daily chart

Ripple’s daily chart shows that the bulls are trying hard to recapture the 21-daily moving average (DMA) at $0.2826, in order to revive the recovery momentum.

However, with the 14-day Relative Strength Index (RSI) still trading within the bearish territory, the XRP bulls lack the conviction for the upside extension.

Acceptance above the 21-DMA could open doors for a test of the critical horizontal 200-DMA at $0.3066, Note that the coin has failed to sustain above the latter since January 10.

A daily close above the 200-DMA barrier is needed to negate the bearish bias.

Alternatively, a rejection at the abovementioned 21-DMA hurdle could expose the three-week-long falling trendline support at $0.2465, below which the two-week troughs will be put to test.

The next best support awaits around $0.2150 while the December 29 low of $0.1719 would be the last line of defense for the bulls.

XRP/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.