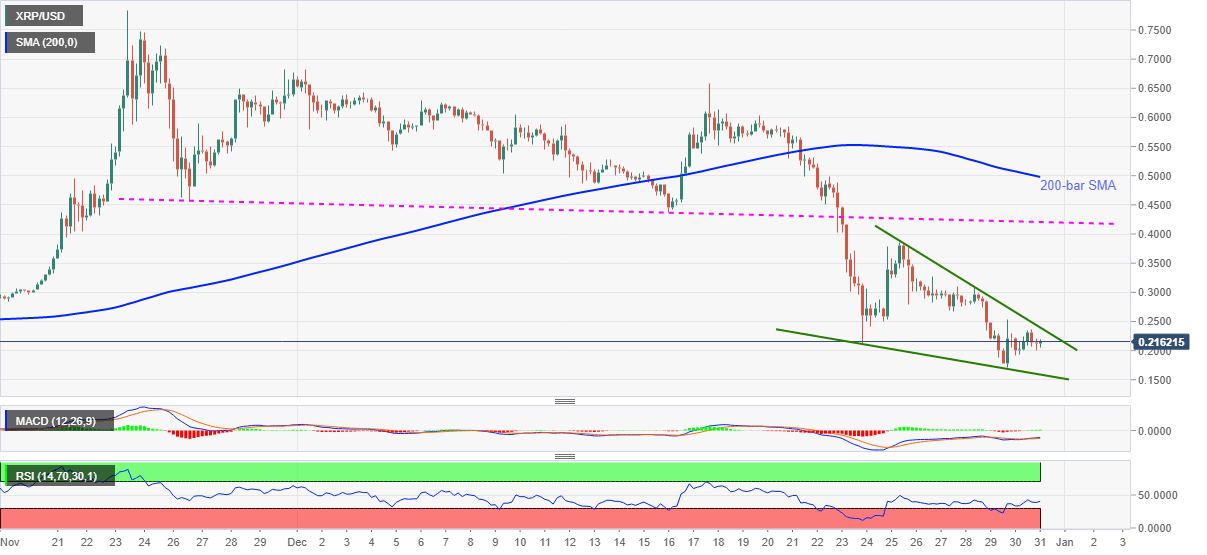

Ripple Price Analysis: Falling wedge near six-month low probes XRP bears below 0.2400

- XRP/USD consolidates recent losses after regaining 0.2000 the previous day.

- Bullish MACD also favors a chart pattern having significance near the bottom.

- 200-bar SMA, one-month-old falling trend line adds to the upside barriers.

Having recently probed the intraday high near 0.2200, XRP/USD takes rounds to 0.2160, up 2.009% on a day, during the early Thursday. The crypto major recently gained bears’ attention as multiple buses shunned XRP trading.

However, sellers seem to catch a breather following its drop to the lowest since June earlier in the week. The resulted retracement portrays a bullish chart pattern on the four-hour (4H) play.

While wedge has an increased strength to boost the prices when they’re low, XRP/USD’s downtrend to the multi-day bottom keeps the short-term buyers hopeful. Also favoring the upside momentum is the bullish MACD signals.

However, a clear upside break of 0.2400 becomes necessary for the XRP buyers to confirm the bullish chart pattern that favors a return of 0.4500 mark on the chart. Also acting as an upside barrier is the previous support line from November 26, at 0.4208 now.

During the quote’s sustained rise past-0.4208, the 200-bar SMA level of 0.4980 will be the key to watch.

Alternatively, the recent low, also the lowest since June 27, near 0.1720, will precede the stated bullish formation’s support line, currently around 0.1588, to challenge the XRP/USD bears.

Should there be a clear downside past-0.1588, the yearly bottom surrounding 0.1130 and the 0.1000 psychological magnet will gain the market’s attention.

XRP/USD four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.