Ripple executive slams SEC for its forever crypto ground war, XRP price eyes recovery

- Ripple’s Chief Legal Officer Stuart Alderoty shared his views on the merits of the Terraform case ruling.

- Judge Rakoff sided with the US Securities and Exchange Commission in the lawsuit against Terraform Labs.

- XRP price eyes recovery to $0.70 as BTC sustains above $42,000.

Ripple’s Chief Legal Officer, Stuart Alderoty, highlighted that the Judge presiding over the Terraform case did not criticize or even cite Judge Torres’ Ripple ruling. Alderoty called out the SEC for its “forever” crypto ground war.

XRP price traded sideways below $0.65.

Ripple CLO comments on Terraform ruling

On December 28, a US Federal Judge ruled that Do Kwon and Terraform Labs have violated US law by failing to register two digital currencies, LUNA and UST. These two assets imploded in 2022.

Judge Jed Rakoff sided with the Securities and Exchange Commission (SEC) in its ruling and noted that cryptocurrency assets of Terraform Labs were unregistered securities because they qualified as “investment contracts.”

Ripple’s CLO, Alderoty claimed that he had no firm view on the merits of the case and shared facts of the ruling in a recent tweet. The executive noted that Judge Jed Rakoff did not criticize or even cite Judge Torres’ Ripple ruling. Alderoty observed that the SEC’s “forever” crypto ground war is on and the US financial regulator is fighting token by token, in a lengthy litigation process.

Alderoty condemns the SEC’s fight against cryptocurrency firms and tokens.

I have no firm view on the merits of the Terraform case, but here are a couple of thoughts on yesterday’s ruling. 1. Facts matter. 2. Judge Rakoff does not criticize, let alone even cite, Judge Torres’ Ripple ruling; 3. The SEC’s “forever” crypto ground war, fighting token by…

— Stuart Alderoty (@s_alderoty) December 29, 2023

XRP price eyes recovery

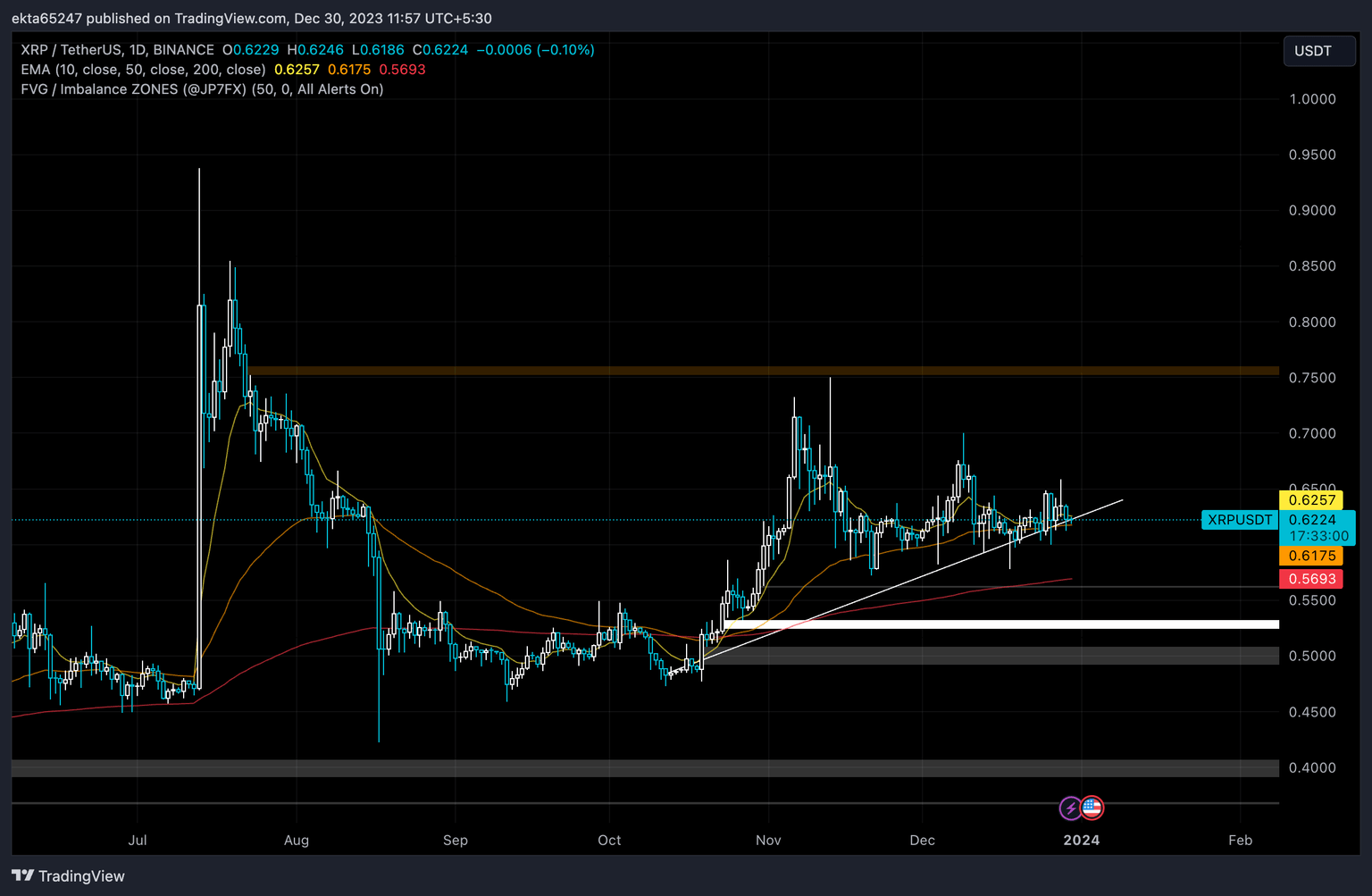

At the time of writing, XRP price is $0.6200. The altcoin sustained above the psychological barrier at $0.60. The altcoin sustained the uptrend that started in October 2023, XRP price is likely to make a comeback to its November local peak of $0.7499.

XRP price is above its 200-day Exponential Moving Average (EMA) at $0.5693. XRP price is largely unchanged in the past week.

XRP/USDT 1-day chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.