Render price crashes by 8% following transition from Ethereum to Solana

- Render price slipped to trade at $2.22 after a nearly 8% decline following the failed breach of $2.55.

- The Render Network successfully completed upgrading its core infrastructure to Solana from Ethereum.

- Render Foundation, in accordance with the upgrade, allocated $2.5 million worth of RNDR as a reward to migrate RNDR tokens to the Solana blockchain.

Render price exhibited a reaction opposite to market expectations after the Render Network achieved a milestone, upgrading from Ethereum to Solana. The network, seeing as to how the transition might affect its users, is assisting by granting subsidies using RNDR tokens.

Read more - Breaking: FTX founder Sam Bankman-Fried found guilty on all counts, including stealing $8 billion from users

Render moves to Solana from Ethereum

Render Network, which is a blockchain and crypto-enabled protocol that enables individuals to contribute unused GPU power to help projects render motion graphics and visual effects, was launched on Ethereum back in 2017. But after six years, the project is moving from the "home of Decentralized Finance (DeFi)" to Solana, also known as the "Ethereum killer".

The move was touted to be a "watershed moment" for Render and seen as an attempt at capitalizing on the benefits of the Solana blockchain. Jules Urbach, the founder and architect of the Render Network, commenting on the transition, stated,

"Solana's incredible transaction speeds, low costs, and commitment to web-scale architecture make it a perfect fit for the Render Network as we continue building a scalable and decentralized metaverse infrastructure.

In the announcement, Render Network noted that the transition of assets from Ethereum to Solana is being facilitated by Wormhole. Furthermore, to ease the transition for its users, Render also stated that it has allocated up to 1.14 million RNDR worth about $2.5 million at the current price in grants.

This would be used to subsidize user transfer fees on Ethereum associated with the upgrade for up to three months.

Interestingly, the market reacted much differently than what was expected out of RNDR.

Render price takes a hit

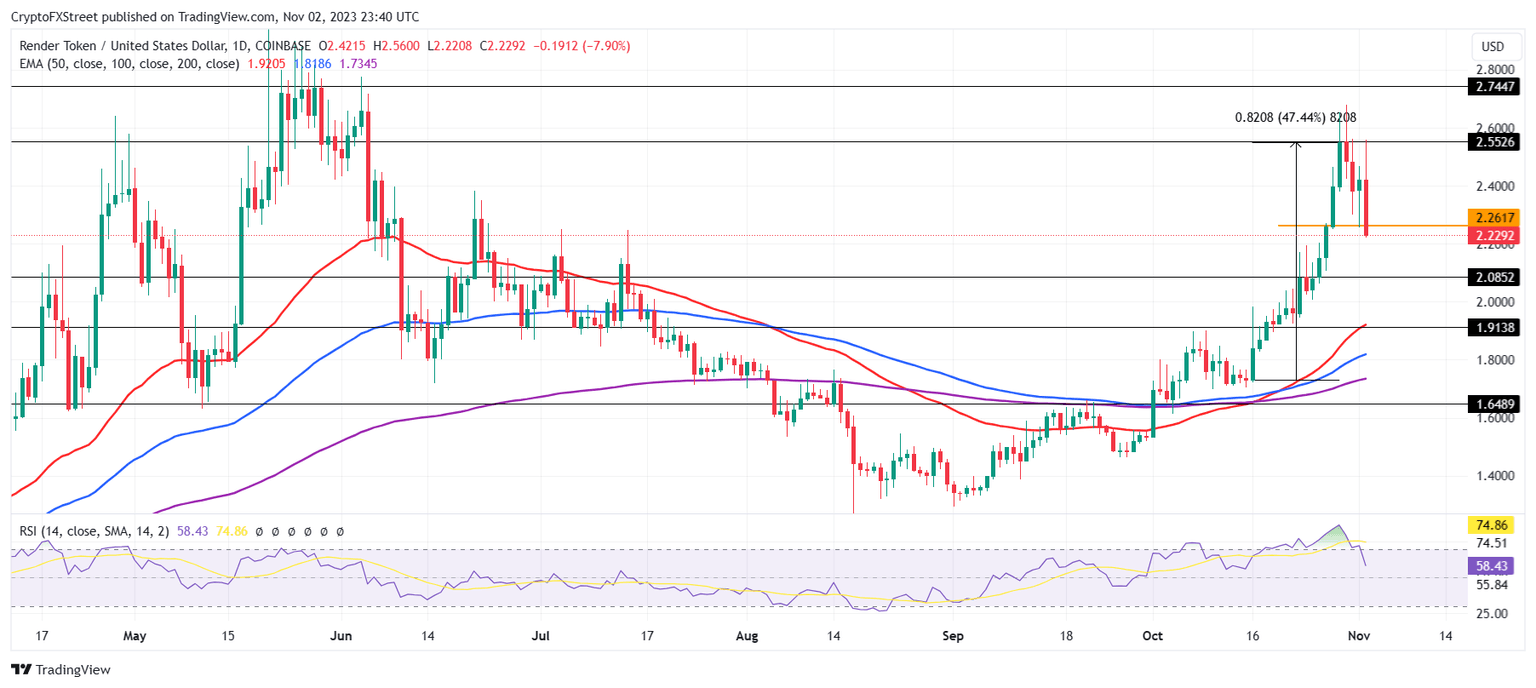

Render price at the time of writing, trading at $2.22, noted a 7.8% decline in the past day despite the historic milestone. The influence of the broader market cues trumped the impact of the network upgrade, resulting in RNDR falling through the support level at $2.26.

The altcoin is still in the bullish zone, as noted on the Relative Strength Index (RSI), albeit observing a downtick. If the investors' sentiment remains negative, a further downfall can be expected, which might bring RNDR down to $2.08 and RSI to test the neutral line at 50.0 as support.

If the broader market cues further push the Render price downward, losing the support of $2.08 is possible, sending the token to tag the support line at $1.91. This level is also coinciding with the 50-day Exponential Moving Average (EMA).

RNDR/USD 1-day chart

However, if the Render price bounces above $2.08, it could invalidate the bearish thesis. The confirmation of the same would be achieved when the RSI bounces off the neutral line. This would enable RNDR to reclaim the support at $2.26.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.