Pyth Network Price Forecast: PYTH bulls eye 10% bounce at key support

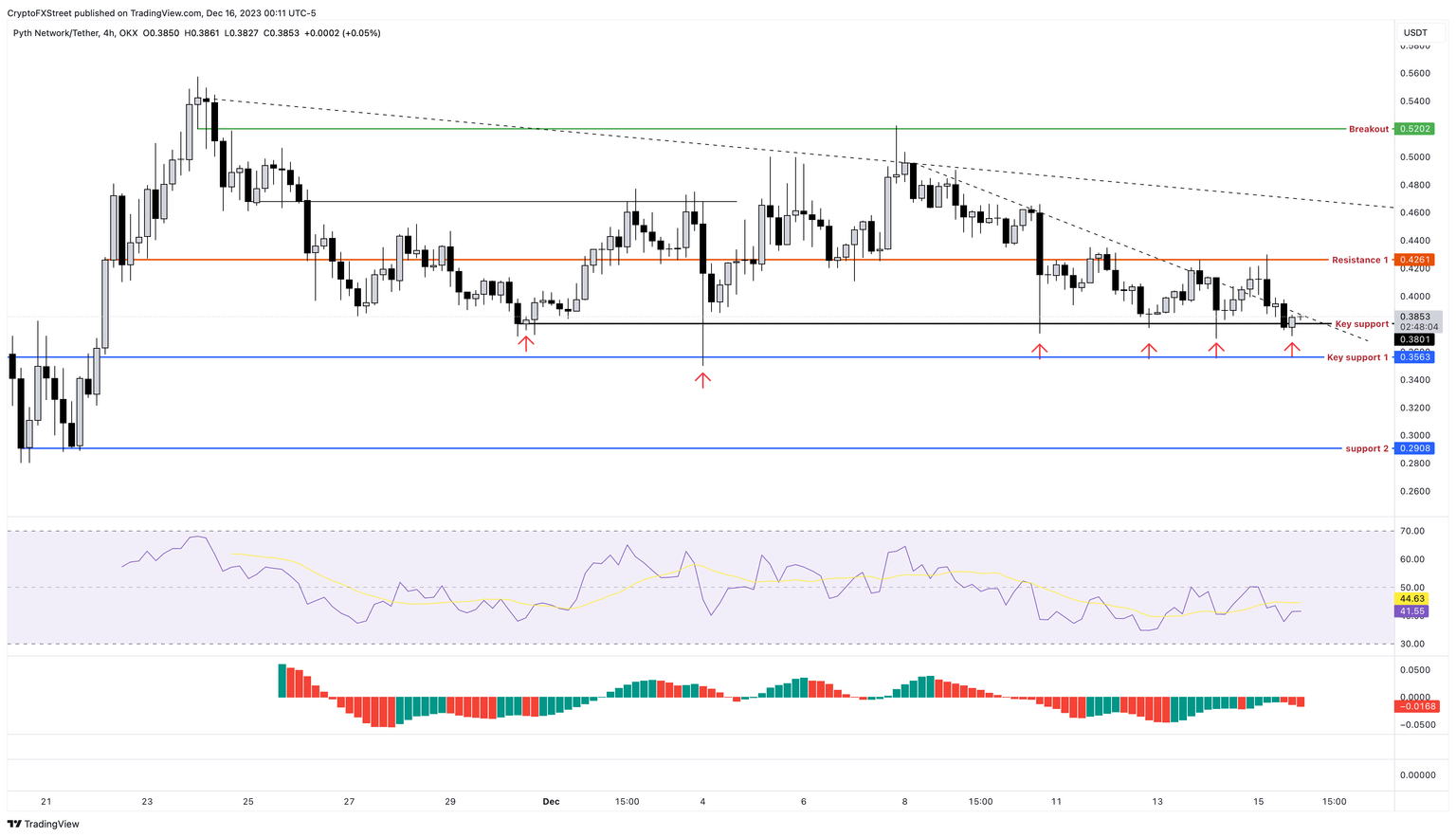

- Pyth Network price trades just above the key support level of $0.380.

- A bounce here could trigger a 10% move to the immediate resistance level of $0.426.

- A decisive flip of this hurdle into a support floor could send PYTH up by 22% to $0.520.

- A four-hour candlestick close that flips $0.356 into a resistance level will invalidate the bullish thesis.

Pyth Network (PYTH) price has been trending lower since December 7, but the recent retest of a key support level opens up the path for a potential bounce.

Also read: Bitcoin Weekly Forecast: BTC cool-off prepares markets for crypto’s final two weeks of 2023

Pyth Network price at critical levels

Pyth Network price set a local top at $0.522 on December 7 and has since shed nearly 30% and formed a local bottom at $0.371. Although PYTH dipped below the $0.380 support level, its recovery now faces a tough decision.

A quick surge in buying pressure will do two things: a breakout above the declining trend line connecting swing highs since December 8 and create a shift in market structure favoring bulls. While this would be promising for bulls, only a 10% upswing is likely in the short term since PYTH will face a key hurdle at $0.426.

A decisive four-hour candlestick close above $0.426 that flips it into a support level will allow Pyth Network price to rally another 22% and tag the $0.520 barrier. In total, this move would constitute a 35% gain from the current price level of $0.385.

While it is unsure if Pyth Network price can overcome this level considering the current market conditions. But if it does, it would allow PYTH to overcome the current all-time high at $0.557 and set up a new one.

Also Read: EOS price presents a good long term buying opportunity

PYTH/USDT 4-hour chart

While the bullish outlook for Pyth Network price makes sense, it is contingent on buyers defending the $0.380 support level. A breakdown of this barrier followed by a four-hour candlestick close that flips $0.356 into a resistance level will invalidate the bullish thesis.

In such a case, Pyth Network price could drop 18% and revisit the $0.290 support level.

Also read: ImmutableX price could crash 10% as sell signals multiply

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.