ImmutableX price could crash 10% as sell signals multiply

- ImmutableX price looks heavy as its range tightens below the 2.33 hurdle.

- Declining RSI combined with liquidity runs could trigger a quick 11% correction to $1.99.

- In a worst-case scenario, IMX could trigger a 26% crash to the low-volume node at $1.66.

- Invalidation of the bearish thesis will occur on the successful flip of the daily breaker level of $2.40 into a support floor.

ImmutableX (IMX) price rally in the past nine days has been impressive, but the recent slowdown prompts questions of a potential correction. The momentum indicators are showing a steady decline in bullish momentum, which adds to the bearish outlook of IMX.

Also read: NFT platform Immutablex's IMX token surges 35% with upbit leading volume growth

ImmutableX price loses steam

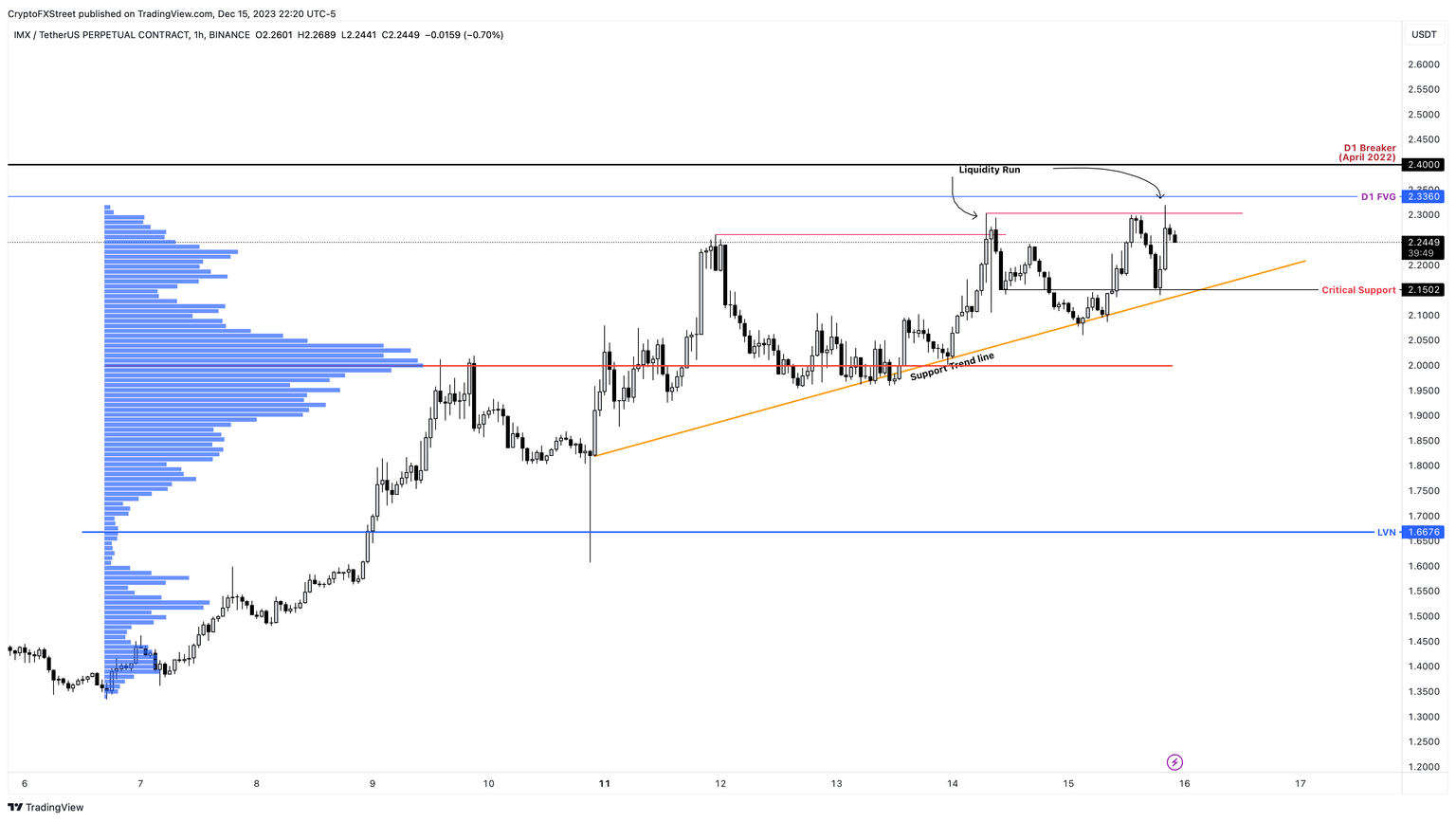

ImmutableX price surged 73% in the last nine days and currently trades at $2.26. The one-hour chart shows clear signs of top formation, which include a slowdown in the uptrend, followed by liquidity run above previous highs that lead to swing failure patterns.

Not only does IMX show all these signs, but it also has produced higher highs, while the Relative Strength Index (RSI) and Awesome Oscillator (AO) have produced lower highs. This non-conformity is termed a bearish divergence and often results in a small pullback or a steep correction.

A short-term 5% correction will send ImmutableX price to the $2.15 support level. A breakdown of this barrier will break the bullish market structure for IMX and kickstart a steep correction phase. In such a case, the altcoin could tag a high-volume node at $1.99. This move would constitute an 11% crash from the current position.

In a dire case, ImmutableX price could slide as low as $1.66, which is the low-volume node of the price action between December 6 and 15.

IMX/USDT 1-hour chart

While it is tempting to open a short position here, investors need to consider the possibility of ImmutableX price stretching higher to tag the $2.40 hurdle as another liquidity run. This move would force early bears to close at a loss and lure greedy bulls. Hence, a local top formation here could be ideal for opening a swing short position with $1.66 as the take-profit level.

However, if ImmutableX price flips the $2.40 hurdle into a support floor, it would invalidate the bearish thesis. In such a case, IMX could eye a retest of $2.5 and a potential revisit of the $3 psychological level.

Also Read: Tether to fight illicit use of stablecoins and help expand dollar hegemony globally

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.