Profitability of over 1 billion MATIC remains uncertain even after MATIC price rallies by 15%

- MATIC price since June 29 has risen by 15% to breach the $0.700 mark.

- Over $800 million worth of MATIC tokens await another 10% rise to be profitable.

- The cryptocurrency shares a negative correlation with Bitcoin price, making it susceptible to slower recovery.

MATIC price is still hanging around the June lows, noting recovery but not spectacular enough to call it a rally. This is, at the moment, quite necessary for the L2 token since the failure to do so could have a significant impact on the investors. Interestingly, Bitcoin price breaching $31,000 may not be of a lot of help here.

MATIC price rise brings hope to investors

MATIC price at the time of writing could be seen hovering above the $0.700 mark, which had been unbreached since June 10. Now it is important for the Polygon token to also flip into a support floor as that holds the key to recovery as well as profits.

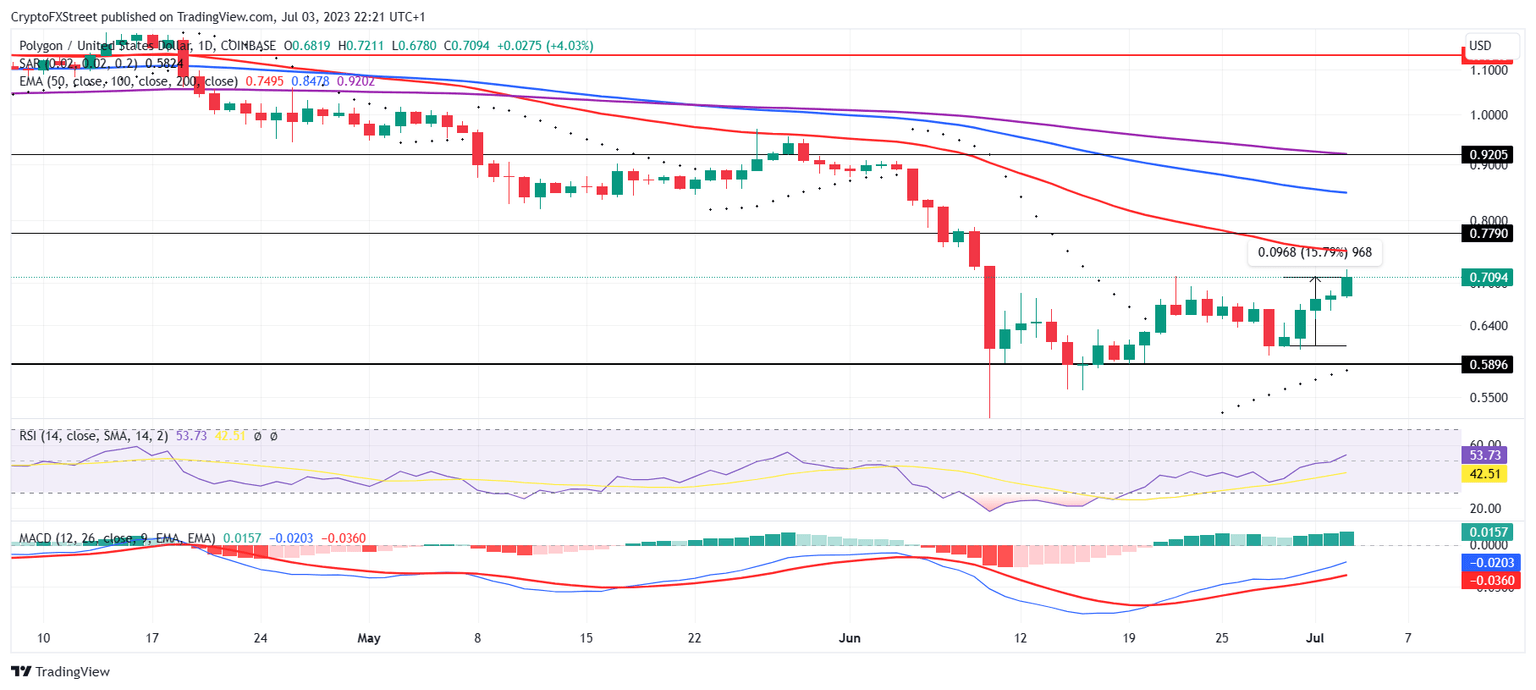

MATIC/USD 1-day chart

Rising above the aforementioned price level triggered potential profits for about 1.15 billion MATIC tokens. These tokens were purchased by more than 47k addresses between $0.703 and $0.819 at an average price of $0.779. In order for this supply to provide profits to its holders, MATIC price still needs to note a 10% rally.

MATIC GIOM

While the broader market cues could prove to be helpful to the altcoin in achieving this, MATIC seems to be in a rather unfavorable situation at the moment. The cryptocurrency seems to be sharing a negative correlation of -0.11 presently with the leader of the crypto market, Bitcoin.

MATIC correlation with Bitcoin

This might be a setback as MATIC price may not follow Bitcoin price’s lead. BTC, over the last 24 hours, has managed to breach the $31,000 mark. However, further rally may or may not be followed by the Polygon token.

Thus the best shot MATIC holders have at gaining profits right now is to remain patient and hold off on any potential selling. Profit-taking could be detrimental to the price and might even lead to the $815 million worth of supply from ever seeing green.

Once these 1.15 billion MATIC tokens churn profits for their holders, it would open the path for a much larger supply of 4.7 billion MATIC tokens worth over $3 billion (at present price) to become profitable. However, this feat calls for a 28% rally from MATIC price, which might be a while for now.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.