Polygon holders’ presence falls to 11-month low as MATIC price crashes by 17% to form new 2023 low

- MATIC price slid to $0.56 after crashing by almost 17% in the past seven days following Bitcoin’s lead.

- The sudden market crash significantly spooked investors to the point where MATIC holders’ weekly average presence sits at September 2022 lows.

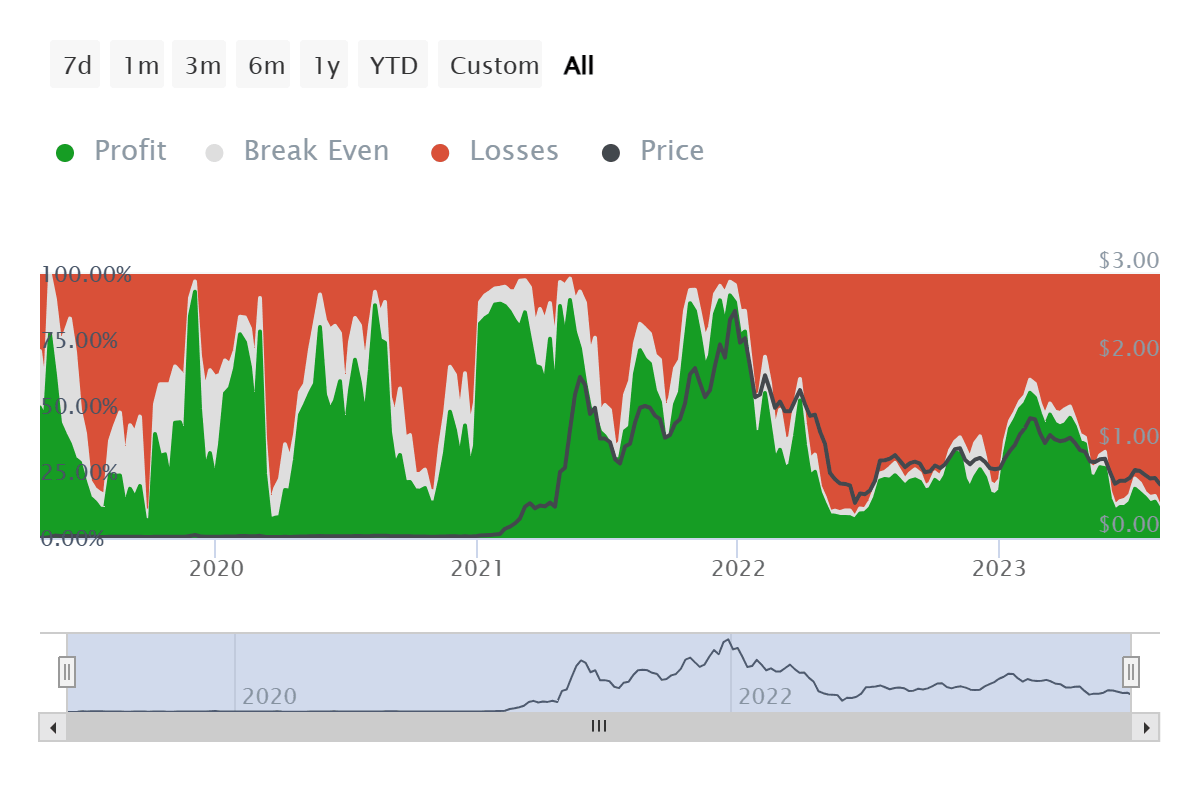

- At the moment, Polygon investors suffer the most losses, with over 88% addresses underwater, suggesting a delay in recovery.

MATIC price depended on the market to observe a recovery, but the dependency backfired as the bearishness got to the altcoin before bullishness could. With the entire crypto market crashing in the past week, Polygon’s native token took a hit, too, and the effect is visible on the investors whose losses continue to balloon.

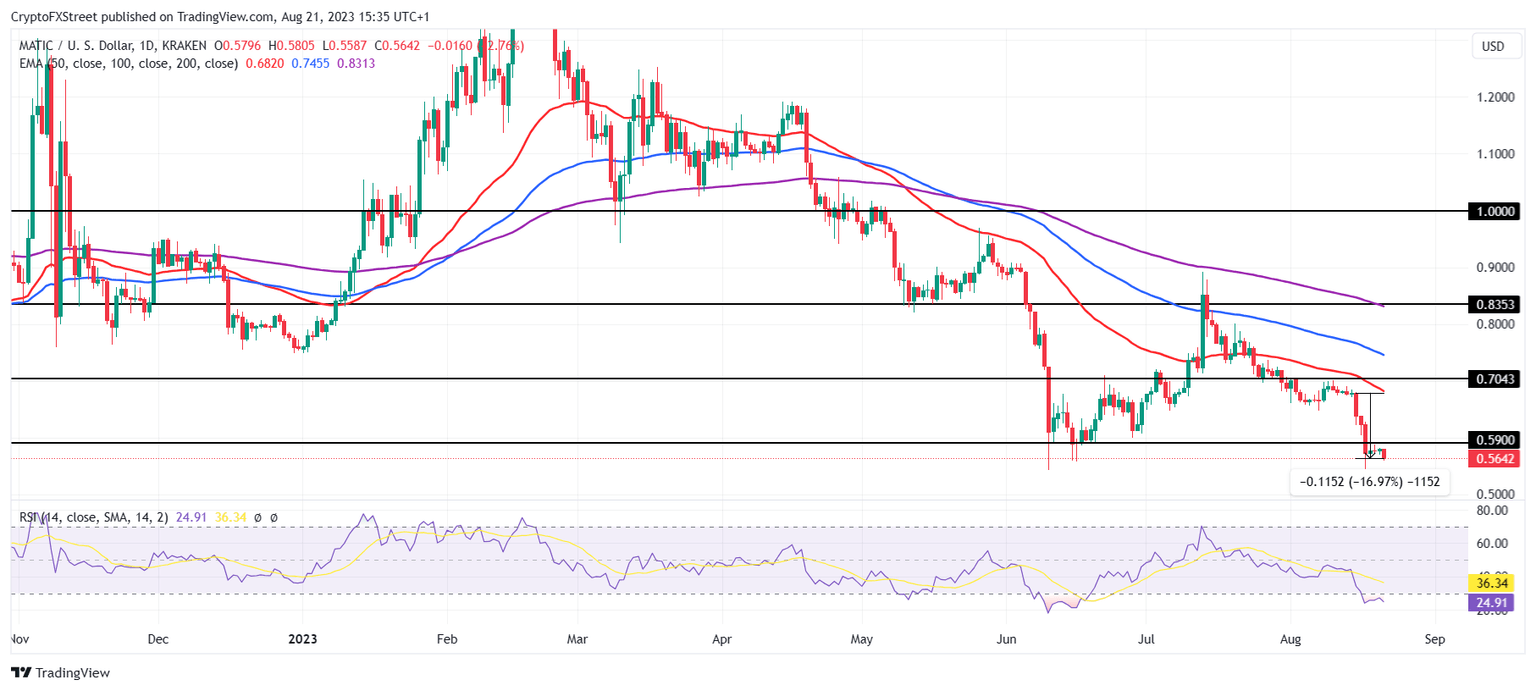

MATIC price marks new 2023 low

MATIC price trading at $0.56 is currently observing the lowest point it has been at since the beginning of this year. The year-to-date lows are just below the June lows of $0.59, thanks to the 17% decline the altcoin noted in the past seven days. The price dip resulted from the crypto market crash in which nearly $2 billion worth of liquidations were observed as Bitcoin fell to $26,000.

MATIC/USD 1-day chart

Naturally, this had a bearish impact on MATIC price, which was already suffering for weeks now. The altcoin holders have yet to indicate much enthusiasm in the last few days, which quickly turned into pessimism over the weekend. The number of investors that conducted a transaction on the chain in the previous 24 hours fell to around 135k on a weekly average. This is the lowest witnessed by Polygon since September 2022, marking an 11-month low.

MATIC active addresses

The digital asset is oversold, with the Relative Strength Index (RSI) sitting below the 30.0 line. Generally, this indicates investors potentially holding back on selling and a reversal in the momentum occurring soon, resulting in recovery.

This is crucial for MATIC holders since, at the moment, these people are some of the most hard-hit investors in the crypto market. With over 88% of all addresses currently underwater, motivation to be active in the market is pretty bleak, and without recovery, it would not be easy to entice new investors too.

MATIC investors at a loss

Thus, those looking to jump into MATIC must first wait for the altcoin to recover some recent losses before it can begin a rally.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B20.05.01%2C%252021%2520Aug%2C%25202023%5D-638282442111280681.png&w=1536&q=95)