Polkadot price needs a breather before a 30% rally

- Polkadot price sweeps range high at $19.58, suggesting a potential retracement to $16.81.

- This pullback is necessary for DOT to trigger a 30% rally to $22.

- A four-hour candlestick close below $14.04 will invalidate the bullish thesis.

Polkadot price is showing signs of exhaustion after taking out a previously formed swing high. Investors can expect DOT to retrace lower before catalyzing a new leg-up.

Polkadot price prepares for next move

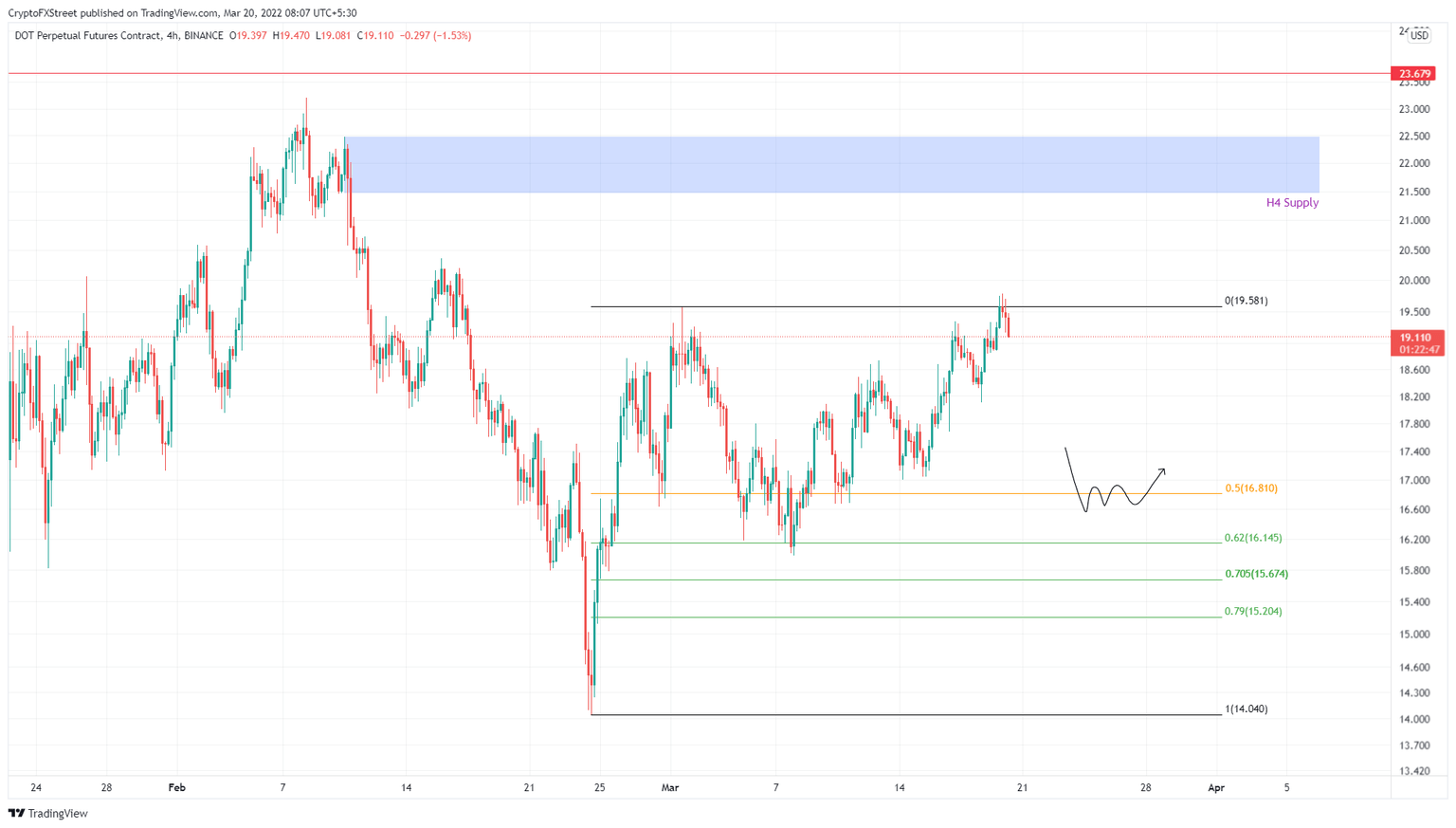

Polkadot price set a range extending from $14.04 to $19.58 after rallying roughly 40% in less than a week. This move set a boundary within which DOT would move in the coming weeks.

The down move plowed through the 50% retracement level at $16.81 and tagged the 62% retracement barrier at $16.15 twice before triggering a leg-up. This uptrend caused Polkadot price to sweep the range high at $19.58, suggesting that a retracement is likely.

Going forward, investors can expect Polkadot price to correct to the 50% retracement level at $16.81. While it is conservative to expect the pullback to halt around $16.81, investors should be prepared for a dip up to $15.20 aka the 79% retracement level.

Regardless, the uptrend that originates between the 50% and 79% retracement levels is likely to shatter through the range high at $19.58 and make a run at the four-hour demand zone, extending from $21.47 to $22.47.

This move would constitute a 30% ascent from $16.81 and $40% from $15.20 and is likely where the upside is capped for DOT.

DOT/USDT 4-hour chart

Regardless of optimism, if Polkadot price shatters through the 79% retracement level at $15.20 without a quick recovery, it wil indicate a weakness or unwillingness on the buyers’ part. In such a case, a four-hour candlestick close below $14.04 will invalidate the bullish thesis for the Polkadot price. This development will open the path for DOT to explore a stable support level at $12.60.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.