Polkadot price could crash 20% amidst Silvergate FUD and crypto market uncertainty

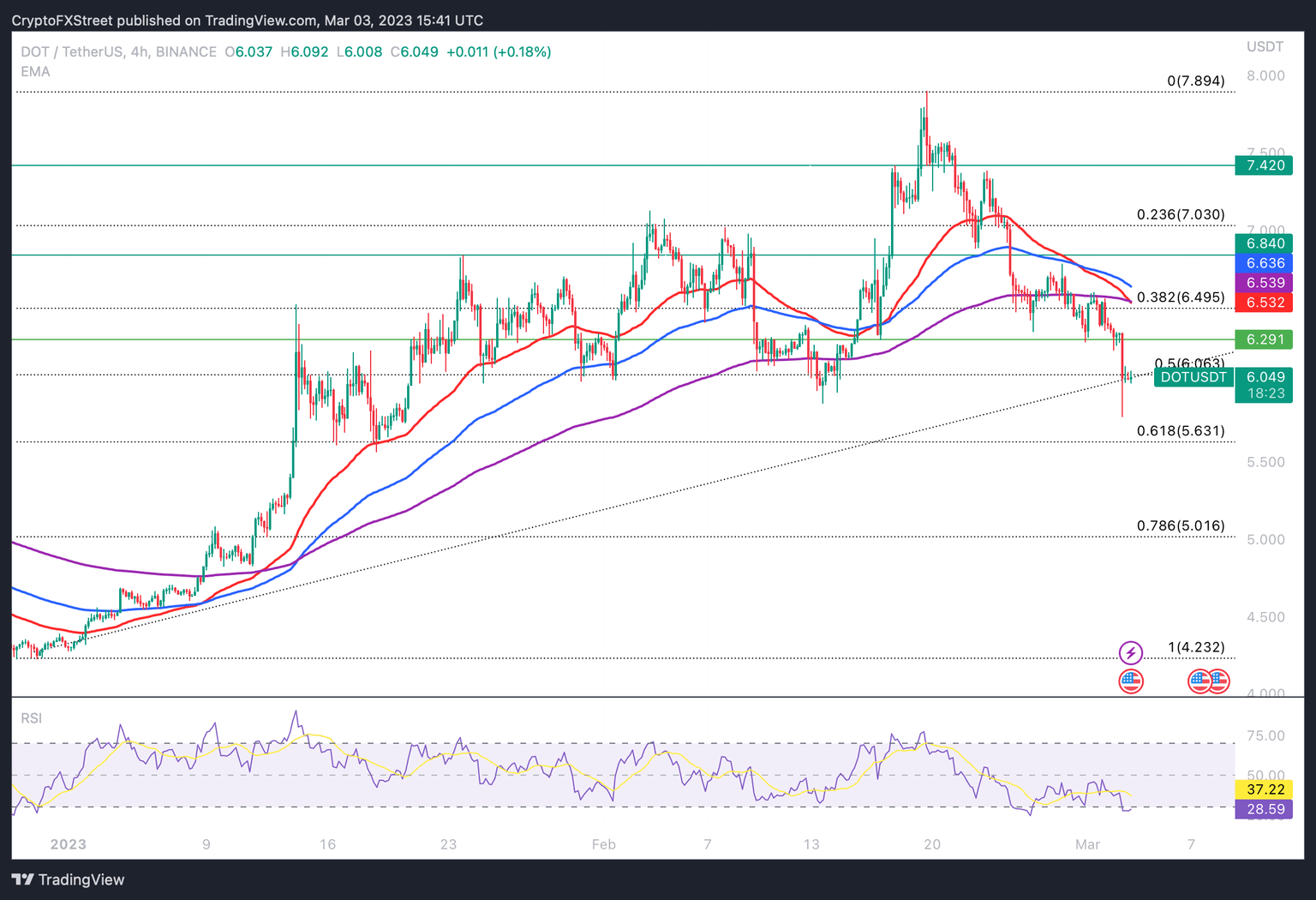

- Polkadot price is hovering around Exponential Moving Averages at $6.36 and $6.17, after shedding nearly 4.5% since March 2.

- The Silvergate FUD has triggered a crash in cryptocurrency prices, Bitcoin and Ethereum shed nearly 5% alongside altcoins.

- If DOT price successsfully rebounds from the trendline, it could invalidate the bearish thesis.

Polkadot (DOT) price dropped in tandem with Bitcoin and Ethereum amidst the rising uncertainty surrounding Silvergate bank. DOT could witness a 20% crash in the short-term, in the absence of a bullish catalyst and in response to the tumultuous events in crypto.

Also read: Is Ripple setting the stage for a win against the SEC: What to expect from XRP price?

Polkadot price is at risk of 20% decline

Polkadot price is currently consolidating, following the short-term uptrend that started in the beginning of January 2023. DOT is trading below its three Exponential Moving Averages (EMAs), 50, 100 and 200-day at $6.36, $6.59 and $6.17.

The Ethereum-alternative made attempts to stay above the trendline, however it remains to be seen whether DOT will rebound from the trendline or close below it. A 20% crash from $6.04 could push Polkadot price back to $4.8, a level previously tested in the first week of January 2023. Within less than 90 days, Polkadot price made bullish strides pushing DOT price to its local peak of $7.89 before beginning its correction.

Depending on Bitcoin’s recovery, DOT could attempt to make a comeback to February's close of $6.36.

DOT/USDT price chart

If the bearish thesis is validated and DOT nosedives, it could wipe out all gains in 2023 and hit the $4.23 level, where it started its uptrend. The Relative Strength Index (RSI) is close to oversold (30), at 32.20. There is room for a recovery in Polkadot. Since mid-February RSI has been in a downtrend, similar to the Polkadot price.

If DOT climbs above its three EMAs and flips resistance at $6.84 into support, it could invalidate the bearish thesis.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.