- Polkadot price up more than 22% from the December 20 low.

- Near-term resistance ahead near the $31 value area.

- Insanely bullish reversal pattern now present on the Point and Figure Chart

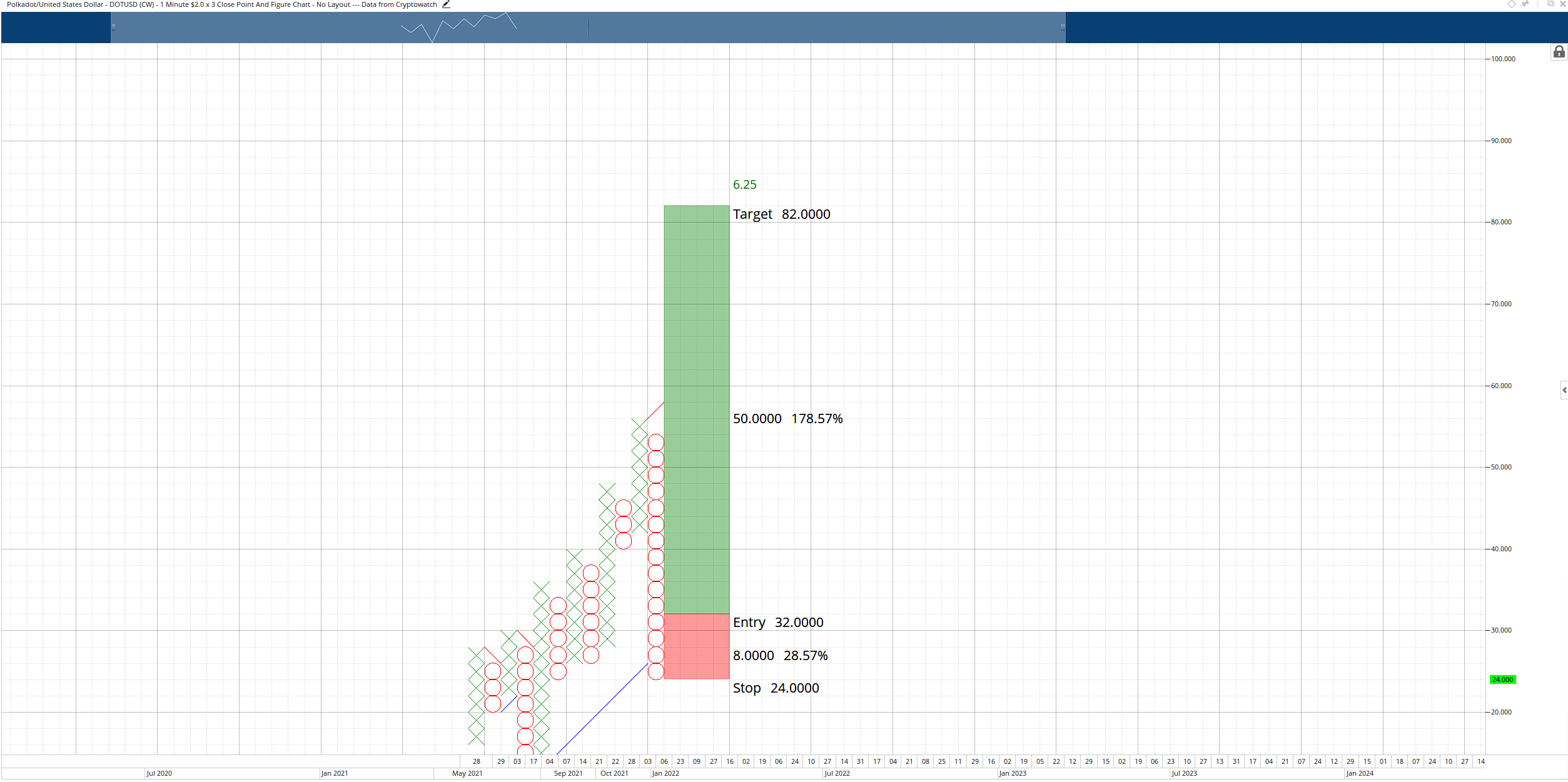

Polkadot price could experience an unprecedented spike over the next week and extend into late January 2022. The setup on the $2.00/3-box reversal Point and Figure chart indicates a more than 300% move higher from the present value area.

Polkadot price poised to move to $82

Polkadot price has a strong bullish reversal Point and Figure chart pattern developing. That pattern is known as a Spike Pattern. A Spike Pattern is any columns of Xs or Os with fifteen or more boxes.

Polkadot completed the Spike Pattern when it hit its most recent swing low near the $24 value area. The entry off of a Spike Pattern is always the three-box reversal. This gives bulls an outstanding opportunity to enter at the bottom of a swing.

The hypothetical long setup off the Spike Pattern is a buy stop order at the 3-box reversal (currently $32), a stop loss of 4-boxes (currently at $24), and a profit target at $82. The profit target is derived from the Vertal Profit Target Method in Point and Figure Analysis.

The long trade idea provides a 6.25:1 reward for the risk trade setup. In addition, a two to three-box trailing stop would help protect any implied profits post entry.

DOT/USDT $2.00/3-box Reversal Point and Figure Chart

There is no current invalidation point for the entry because as Polkadot price moves lower, so does the entry.

Traders should watch the daily Ichimoku chart near the entry level at $32. There is considerable resistance at $31 to $32, and it is very likely buyers may have a tough time moving above that price range on the first test.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

CAKE price bottoms out as PancakeSwap announces $25 million burn

PancakeSwap’s price increased nearly 3% on Monday after the decentralized exchange platform on the Binance Smart Chain announced a token burn of more than 8.9 million CAKE tokens, collected from trading fees across Automated Market Makers Version 2 and 3 of the platform.

Ripple lawsuit to see SEC response on Monday, XRP nears 4.5 million mark in liquidity pools

Ripple closed above $0.52 on Sunday and resumed its climb on Monday, May 6. Sentiment among market participants is positive as traders await Securities and Exchange Commission response filing and XRP locked in Automated Market Maker liquidity pools crosses 4.31 million.

Crypto AI tokens post near double-digit gains amidst launches from NVIDIA, OpenAI and Amazon

AI-based cryptocurrencies have experienced nearly double-digit or higher gains on Monday, well above the price increases seen among the main crypto assets, likely fuelled by recent announcements of new developments from AI and tech giants in the US.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin’s consolidation crosses the two-month mark but shows no signs of a breakout or a directional move. Investors waiting with bated breath for a volatile move remain confused about whether to buy the dips or keep some cash reserves for a rainy day.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.