Network bridges questioned following 4,323 Ethereum loot in Optimism network's DeFi lender, Exactly, attack

- Hackers have hit Exactly, the DeFi lender for the Optimism network, making away with more than 4,000 ETH.

- Venus Protocol has been compelled to liquidate up to $62.5 million in a wallet linked to the BNB Chain bridge hack last year.

- Up to $1.7 million in ETH was recently stuck on the Shibarium cross-chain bridge amid the Ethereum L2 network mainnet launch.

- With multiple instances of unsuccessful bridge uses, their reliability has come into question

Network bridges have come into question following several unsuccessful stories of either exploiters commandeering bridges or the funds getting stuck. These distress calls have made network users second-guess the validity of bridges as solutions. Citing one user in a post on Crypto X:

Are there any bridges that don’t get hacked???? At this point, using bridges sounds like gambling at best and throwing your crypto out the window at worst

Also Read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC closes the week below crucial support

Multiple unsuccessful stories around bridges

There have been multiple stories of lack of success in using network bridges, going back years. In a case going back to 2022, Venus Protocol has been compelled to liquidate a wallet linked to a 2022 bridge exploit.

#PeckShieldAlert #BNBBridge Exploiter has been liquidated ~5.6M $vBNB (worth ~$52.3M) https://t.co/pDzlhOK3mE pic.twitter.com/IaGlXCvzy8

— PeckShieldAlert (@PeckShieldAlert) August 18, 2023

The bad actor had invaded the BNB chain bridge in 2022, before depositing his loot (900,000 BNB tokens) to the Venus lending protocol as collateral to borrow stablecoins worth $150 million. The loan position, which had remained imbalanced, was liquidated today.

Following today’s market movement, the BNB Bridge exploiter account was made healthy as promised by @BNBCHAIN using whitelisted liquidation without any resulting shortfall or further impact to $bnb https://t.co/TGZ7nbiDPN

— Venus Protocol (@VenusProtocol) August 18, 2023

Besides the above case of bridge exploit, the market was recently treated to another crisis when up to $1.7 million was stuck on the Shibarium bridge. It happened on an important day for dog-themed meme coins, preventing the expected rally for Shiba Inu, Bone ShibaSwap, Treat, and Leash.

#PeckShieldAlert #Shibariumbridge https://t.co/8VyzqRug0G

— PeckShieldAlert (@PeckShieldAlert) August 17, 2023

While Shiba Inu official Shytoshi Kusama quelled the FUD saying that "user funds were safu," this did not alter the outcome for SHIB, BONE, LEASH, and TREAT, as the tokens incurred losses in percentages of double digits.

It is also impossible to overlook the Ronin Bridge that links the NFT sidechain of Axie Infinity to the Ethereum blockchain. This attack marked one of the highest attacks in the history of crypto. When the bridge was attacked, up to 173,600 ETH (worth approximately $622 million at the time) to be stolen.

There has been a security breach on the Ronin Network.https://t.co/ktAp9w5qpP

— Ronin (@Ronin_Network) March 29, 2022

The Wormhole exploit is another case worth mentioning after the bridge attack saw up to $326 million worth of wrapped Ether (WETH).

‼️ The wormhole network is down for maintenance as we look into a potential exploit.

— Wormhole (@wormholecrypto) February 2, 2022

We will provide updates here as soon as we have them.

Thank you for your patience.

Optimism network's Exactly TVL drops by $26 million following bridge attack

In the latest news relating to bridge exploits, over 4,300 Ethereum tokens were stolen during an August 18 hack, with the bad actors taking advantage of a vulnerability in the Optimism network decentralized finance (DeFi) lender, Exactly.

Update: After a thorough review of the Exactly Protocol Hack, we have concluded that the total of stolen amount up to date is ~$7.2M (4323.6 $ETH)

— De.Fi ️ Web3 Antivirus (@DeDotFiSecurity) August 18, 2023

Eventually, they bridged ~1490 $ETH, using Across Protocol, and 2,832.92 $ETH to Ethereum via Optimism Bridge:… https://t.co/s61ai1OEMd

The attack, which was detected by PeckShield, and confirmed by De.Fi Web3 antivirus saw exploiters steal 4,323.6 ETH, worth approximately $7.2 million at present rates. After the attack, the hacker used the Across Protocol to move approximately 1,490 Ether, and the 2,832.92 Ether moved through the Optimism Bridge.

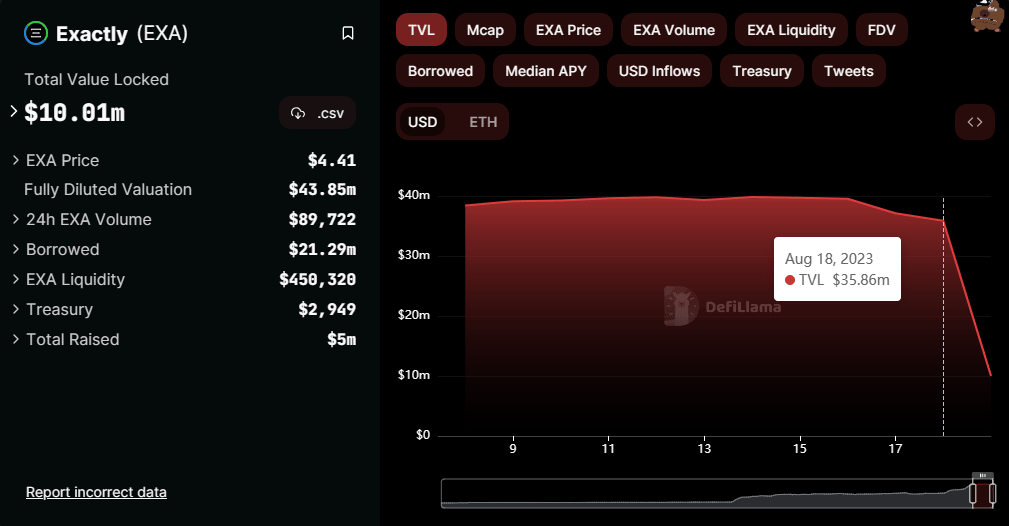

As a consequence of the attack, the total value locked (TVL) of Exactly has fallen by over 72%, losing around $26 million by moving from $35.86 million to the current $10.01 million.

Exactly TVL

The typical pattern among the three cases, among others, is that these bad actors take advantage of bridges during their early stages of market debut. By commandeering their "experimental" premieres, the exploiters interrupt transactions moving tokens between two blockchains.

In their nascent stages, the bridges have limited liquidity,tokens get locked in smart contracts as a balance between the tokens locked and unlocked on either side of the transaction chain. With this, hackers establish a vector to execute their attack.

Users must therefore be wary of bridges, particularly in their early stages, to avoid falling victim of such attacks.

Ethereum development FAQs

What is the next big Ethereum software update?

After the Merge, the Ethereum community is looking at the Sharding upgrade next, which has been slated for sometime later in the year. The development can be summarized in four words, “scalability through more efficient data storage.” The software update will increase the capacity of the blockchain, widening the amount of data that can be stored or accessed. At the same time, all services running atop the Ethereum blockchain will enjoy significantly reduced transaction fees.

What is the difference between hard fork and soft fork?

A fork is the splitting of a blockchain after developers agree and proceed to implement upgrades. The decision comes after these developers reach a consensus for a software upgrade. The ensuing part will see one part continue with the status as is, while the other one will proceed with new features combined with the former ones. A hard fork basically entails permanent divergence of a new side chain from the original one, while a soft fork is doing the same, only difference being that it is temporary.

What is EIP-4844?

EIP-4844 is an improvement proposal for the Ethereum network. The upgrade promises reduced gas fees, which is a valuable offering considering the high transaction cost that continues to daunt crypto players. It has been a long-standing concern for the Ethereum network. The proposal is also referred to as “proto-Danksharding,” with an unmatched ability to increase the speed of transactions on the Ethereum blockchain. At the same time, it helps to reduce the transaction cost as everything becomes decentralized.

What is gas in the context of Ethereum?

Gas token is a new, innovative Ethereum contract where users can tokenize gas on the Ethereum network. This means they can store gas when it is cheap and start to deploy the gas once the market has shifted to the north. The use of Gas token helps to subsidize high gas prices on transactions, meaning investors can do everything from arbitraging decentralized exchanges to buying into initial coin offerings (ICOs) early.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.