OKEx lists Synthetix, SNX/USDT consolidates in a triangle formation

- OKEx derivatives exchange has recently listed SNX - the native token of Synthetix.

- SNX token deposits and spot trading against BTC and USDT have recently gone live on the exchange.

- Synthetix is one of the largest DeFi apps on Ethereum in terms of locked positions and is valued at around $456 million.

OKEx derivatives exchange has recently listed SNX - the native token of Synthetix, a derivatives liquidity protocol for issuance and trading of synthetic assets. SNX token deposits and spot trading against BTC and USDT have recently gone live on the exchange.

Synthetix lets users trade multiple real-world financial instruments, including cryptocurrencies and stocks, over the blockchain as synthetic assets using ERC-20 tokens. The tokens linked with each synthetic asset track the price of the external assets to make such transactions possible.

By adding support for SNX, OKEx said that it is fulfilling its long-standing vision of being a prime mover in the DeFi sector. Synthetix is one of the largest DeFi applications on Ethereum in terms of locked positions and its value is calculated to be around $456 million.

OKEx CEO Jay Hao said:

OKEx believes that DeFi holds some of the most potential in the cryptocurrency space. We are glad to see so many high-quality DeFi applications like Synthetix standing out in 2020 and have long been paying attention to and promoting the development of DeFi. We’re also expanding our own footprint in this area with products like our C2C Loan that generates passive income for our users and the development of OKChain that will be used to support a thriving DeFi infrastructure.

Hao added that while listing a new token, the project’s utility, user expectations, project’s compliance and other conventional aspects are considered. He said that SNX has qualified all these requirements and that OKEx is happy to support projects like it.

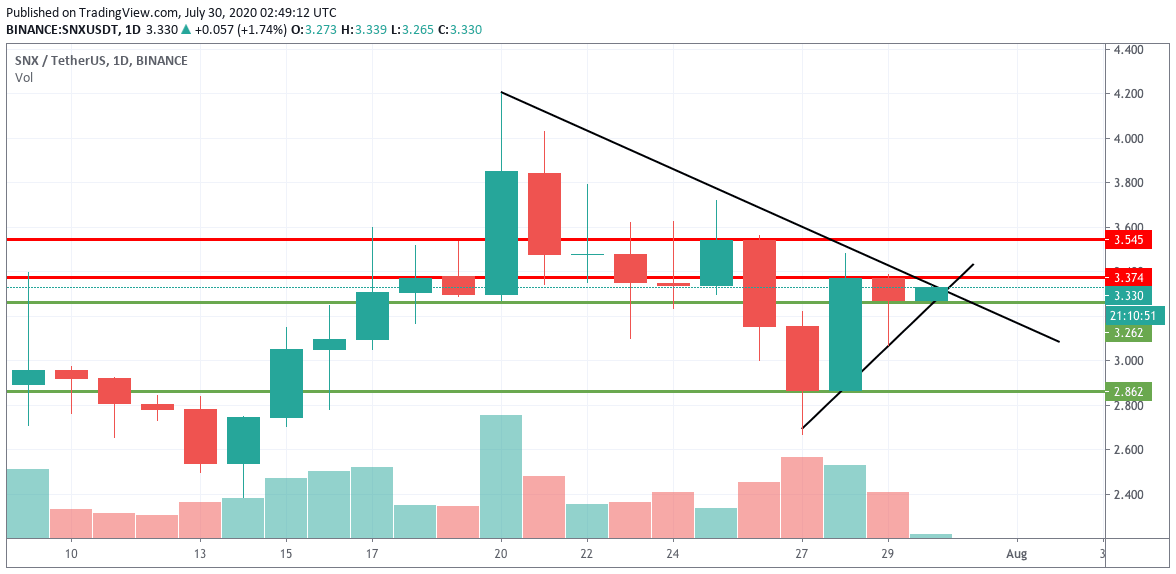

SNX/USDT daily chart

SNX/USDT bulls started the day strong, by taking the price up from 3.262 to 3.33. The price chart shows strong resistance at 3.374 and 3.545. On the downside, SNX/USDT has healthy support at 3.262 and 2.862.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.