Nvidia’s big drop ushers correction in AI tokens, NVDA wipes out $220 billion in market capitalization

- Nvidia wiped out $220 billion in market cap on Friday, the chipmaker dropped to third most valuable firm behind Microsoft and Apple.

- The correction in the tech giant’s stock was followed by AI tokens extending their losses, NEAR, FET, RNDR, GRT, TAO were hit.

- Fetch.ai, Render, The Graph holders realized losses during the recent correction in AI tokens.

Chipmaking Artificial Intelligence (AI) giant Nvidia took a hit on its valuation on Friday. The tech firm was dethroned by Microsoft and Apple as it wiped out nearly $220 billion in market capitalization.

Nvidia’s decline coincides with AI tokens extending their losses on Friday and Saturday, June 22. The seven-day return on most AI tokens is negative, per CoinGecko data.

Developments in AI and tech giants have directly impacted AI token prices in the past several weeks.

AI tokens extend losses: NEAR, FET, RNDR, GRT, TAO

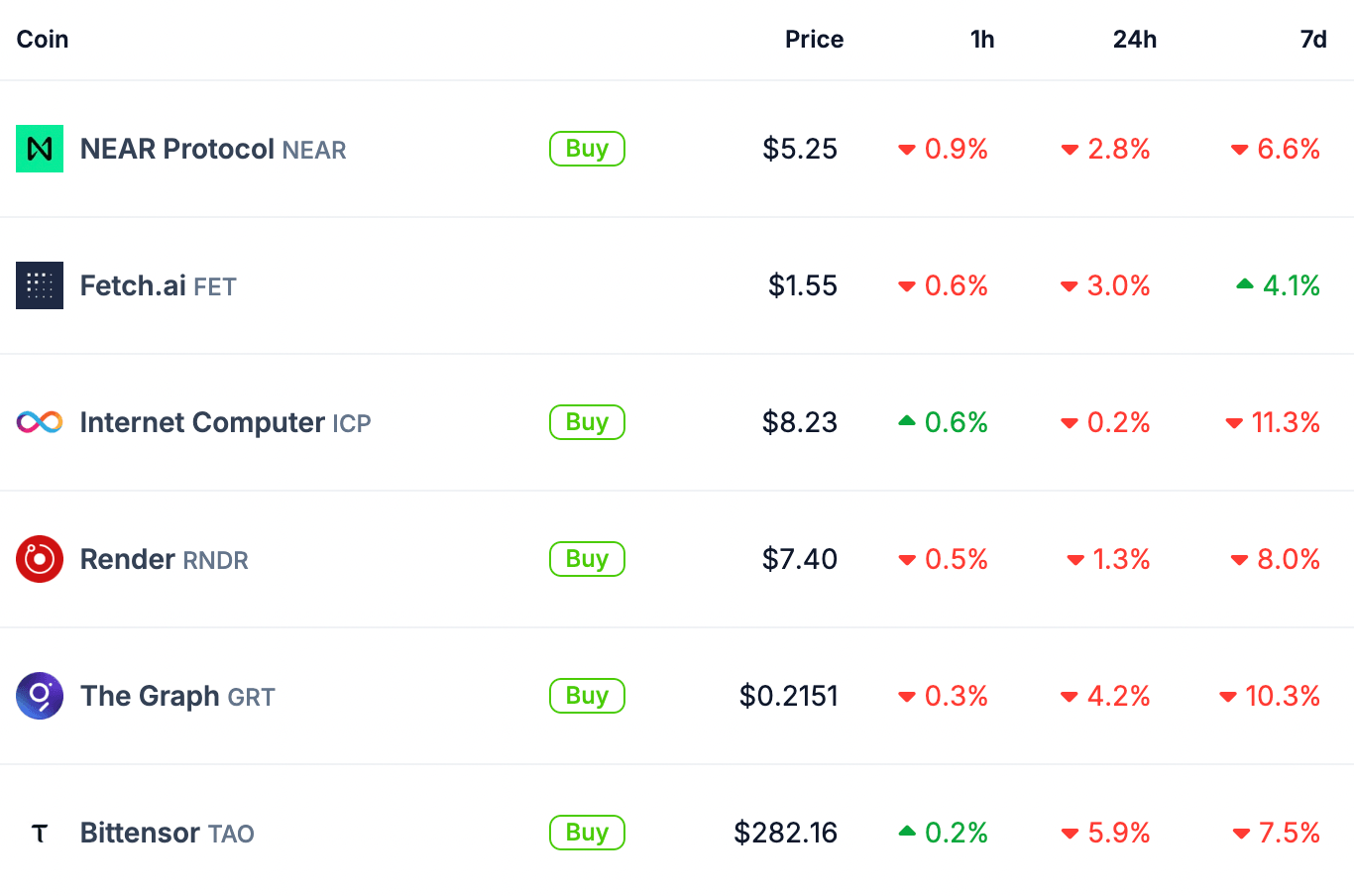

AI tokens NEAR Protocol (NEAR), Fetch.ai (FET), Render (RNDR), The Graph (GRT) and Bittensor (TAO) extended their losses in the past 24 hours. The prices of the AI tokens dipped in the past seven days, amidst a market-wide correction in Bitcoin and altcoins.

The market capitalization of the sector declined 1.7%, down to $28.295 billion, as seen on CoinGecko.

AI token prices in the past 24 hours and 7 days on CoinGecko

The drop in chipmaker Nvidia’s market capitalization is likely the market mover that influenced AI tokens. Other developments include the upcoming merger of the Fetch.ai, Ocean Protocol and SingularityNET, into ASI token (on July 15).

News of technology giant Apple’s decision to hold off AI tech in the European Union countries, citing regulatory concerns, is another notable development.

Is the AI narrative dethroned?

Crypto influencer behind the X handle @CredibleCrypto notes that the narrative of the “AI supercycle” could end soon. While the narrative is strong, their consistent profit taking can push prices down, it won’t last forever.

In this space, a lot of people think strength now or for a number of months = strength always.

— CrediBULL Crypto (@CredibleCrypto) June 21, 2024

It's why we start hearing things like "Bitcoin supercycle" and "meme-coin supercycle" and "AI supercycle".

Newsflash- strength NOW almost always means weakness later.

Why?…

FET, RNDR, GRT holders take losses during the dip

Data from crypto intelligence tracker Santiment shows that FET, RNDR and GRT holders have consistently realized losses on their holdings during the recent correction. As holders shed their assets at a loss, it is likely that they expect the tokens to extend their decline and plummet lower.

The Network Realized Profit/Loss metric identifies the net profit/loss of all holders on a given day and shows negative spikes, meaning holders are taking losses in all three assets.

FET, RNDR, GRT network

At the time of writing, the three assets are down between 1.3% and 4.2% in the past 24 hours.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B15.35.43%2C%252022%2520Jun%2C%25202024%5D-638546500363374278.png&w=1536&q=95)

%2520%5B15.36.31%2C%252022%2520Jun%2C%25202024%5D-638546500587570173.png&w=1536&q=95)

%2520%5B15.36.11%2C%252022%2520Jun%2C%25202024%5D-638546500825500229.png&w=1536&q=95)