Not Bitcoin, Ethereum or Cardano, but these crypto assets hold the potential for a bull run

- Sistine Research highlighted Monero, Solana and Tron to be the altcoins that are close to a rally.

- Tron price has seen some significant growth since its bull run began in November 2022, rising by over 80% to date.

- All three assets share a high correlation with Bitcoin, suggesting their movement will be influenced by BTC.

When it comes to cryptocurrencies, most investors only focus on a few of the top assets, such as Bitcoin, Ethereum, Cardano, and, sadly, meme coins. However, there are other altcoins that can likely eclipse these assets and initiate a bull run very soon.

Solana and two other altcoins to watch out for

Research firm Sistine Research highlighted three assets that are close to initiating another leg of rally, provided they can manage to break out of their critical resistance levels. These assets were Monero (XMR), Solana (SOL), and Tron (TRX).

According to their tweet, XMR price against Bitcoin is very close to the critical barrier that has kept the altcoin trading under it since the beginning of May. If Monero manages to break the resistance, which stands at 0.005757 BTC, an uptrend is on the cards. However, a failed breakout and invalidation of 0.005577 BTC could lead to a decline.

Some potentially bullish charts for you.

— Sistine Research (@sistineresearch) October 12, 2023

XMR/BTC

SOL/BTC

SOL/USD

TRX/USD pic.twitter.com/Ml5fPu2Xdi

Similarly, in the case of Solana price, the breakout zone lies around $40, which marks the pre-FTX collapse double top. In order to do that, the altcoin would first have to reclaim the support at $25. However, the failure to do so could result in an invalidation of the ongoing uptrend and crash to $16.

The third asset, TRX, has been in an uptrend since November 2022, rising by more than 81%. However, the breakout zone for the altcoin lies at $0.125, far above its current trading price of $0.084. Furthermore, if the cryptocurrency loses the support of its uptrend line, the bullish thesis would be invalidated.

Bitcoin holds the key to their rallies

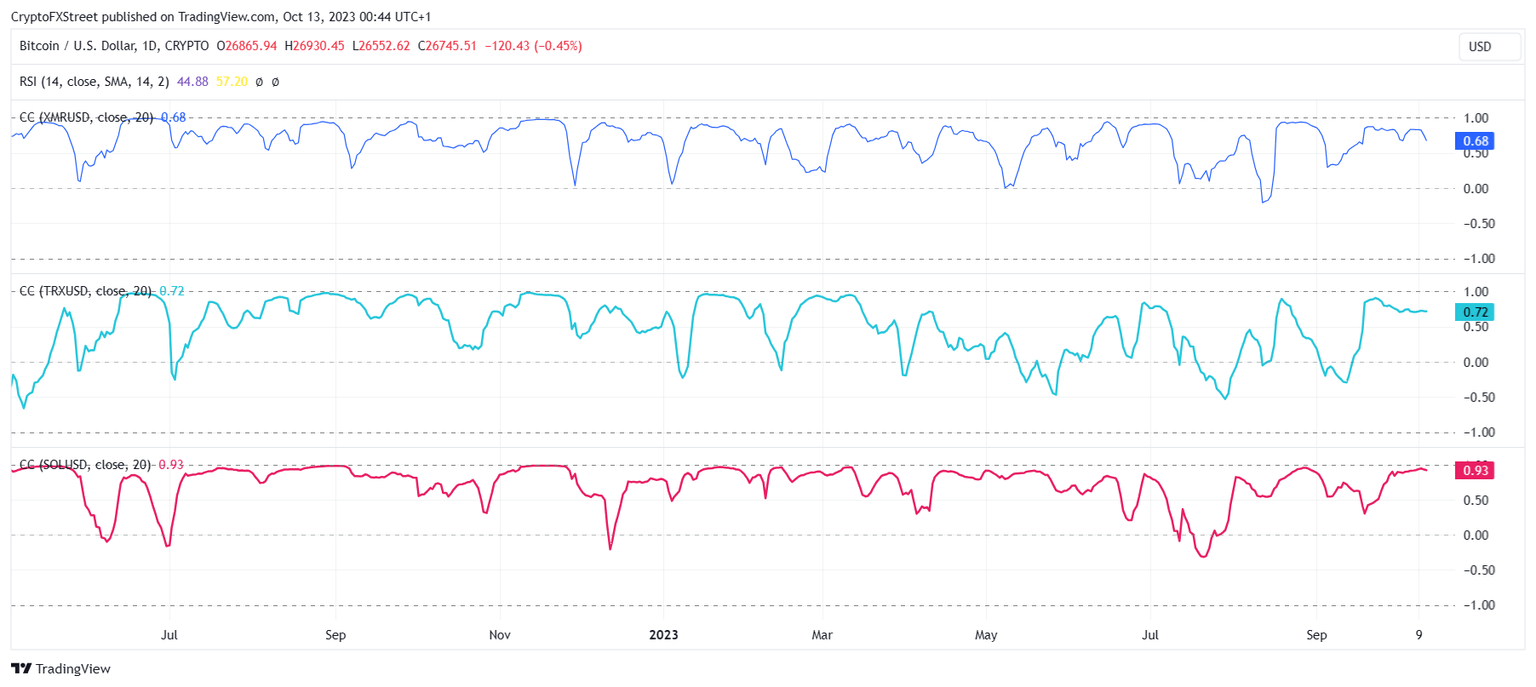

Even though these assets are bullish in nature at the moment, considering their price action, they are still dependent on Bitcoin for their movement going forward. The reason behind this is the high correlation they share with BTC. The correlation of Monero stands at 0.68, that of Tron is around 0.72, and Solana has the highest correlation of 0.93.

Correlation of Bitcoin with aforementioned altcoins

Thus, if Bitcoin price recovers, the chances of these altcoin rallies improve significantly. Similarly, the vulnerability of a crash for XMR, SOL and TRX will also intensify should BTC decline in the future.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.