Neo partners with Ontology and Switcheo to launch cross-chain interoperability protocol

- Neo, Ontology and Switcheo partner to launch an interoperability protocol alliance - Poly Network.

- Devs can now build dapps to run on multiple blockchains without compromise.

- Poly Network’s core function will include swapping digital currencies for other tokenized assets.

Neo (NEO), Ontology (ONT) and Switcheo have recently joined forces to unveil the “heterogeneous interoperability” protocol alliance - Poly Network. Additionally, the NEAR project has rolled out the Rainbow Bridge, connecting NEAR and Ethereum.

Ontology co-founder, Andy Ji, said:

Cross-chain interoperability is becoming increasingly important as we focus on moving away from a siloed way of working.

Maksym Zavershynskyi, NEAR engineering manager, explained that their new protocol will help devs as they don’t have to choose between blockchains or solutions that are not compatible. Ji noted that Ontology was already connected to Ethereum via cross-chain functionality.

Now, through Poly Network, an enterprise leveraging the Ontology blockchain will be able to seamlessly interact with an enterprise leveraging Ethereum, Cosmos, or Neo, helping these platforms overcome challenges to scalability, mainstream adoption, and collaboration.

Ji added that swapping digital currencies for other tokenized assets is one of the Poly Network's primary functions, which will soon add support for the Bitcoin blockchain. NEAR co-founder, Alex Skidanov, said that devs could avoid paying excess fees on Ethereum by transferring “performance or gas-fee critical parts to NEAR while keeping their Ethereum-native user base.” Currently, the bridge is running in a test environment.

Several other projects are also trying to solve the interoperability issue. Earlier in 2020, the Tether (USDT) stablecoin was moved onto the OMG network to ease the gas burden on Ethereum.

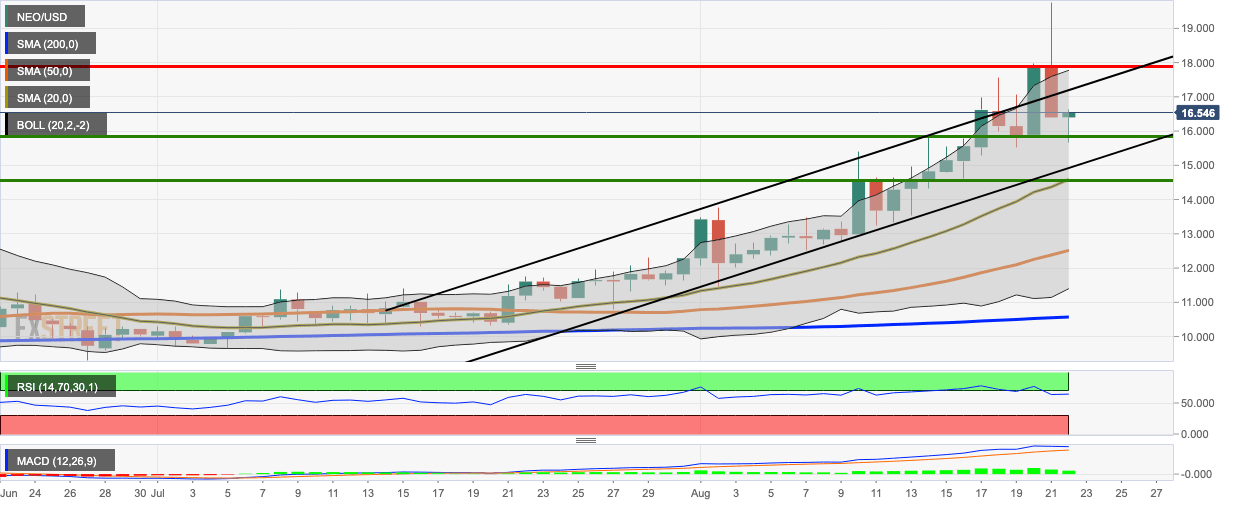

NEO/USD daily chart

NEO/USD bulls re-entered the market following a bearish Friday as the price went up from $16.39 to $16.49. This Friday, the price faced bearish correction since NEO/USD was trending above the 20-day Bollinger Band, indicating that it was overvalued. The MACD shows sustained bullish momentum, while the RSI is trending next to the overbought zone around 66.10.

NEO/USD has one strong resistance level at $17.90. On the downside, we have healthy support levels at $15.87, $14.573 (SMA 20) and $12.55.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.