Monero Price Prediction: XMR defends crucial level and aims for $180

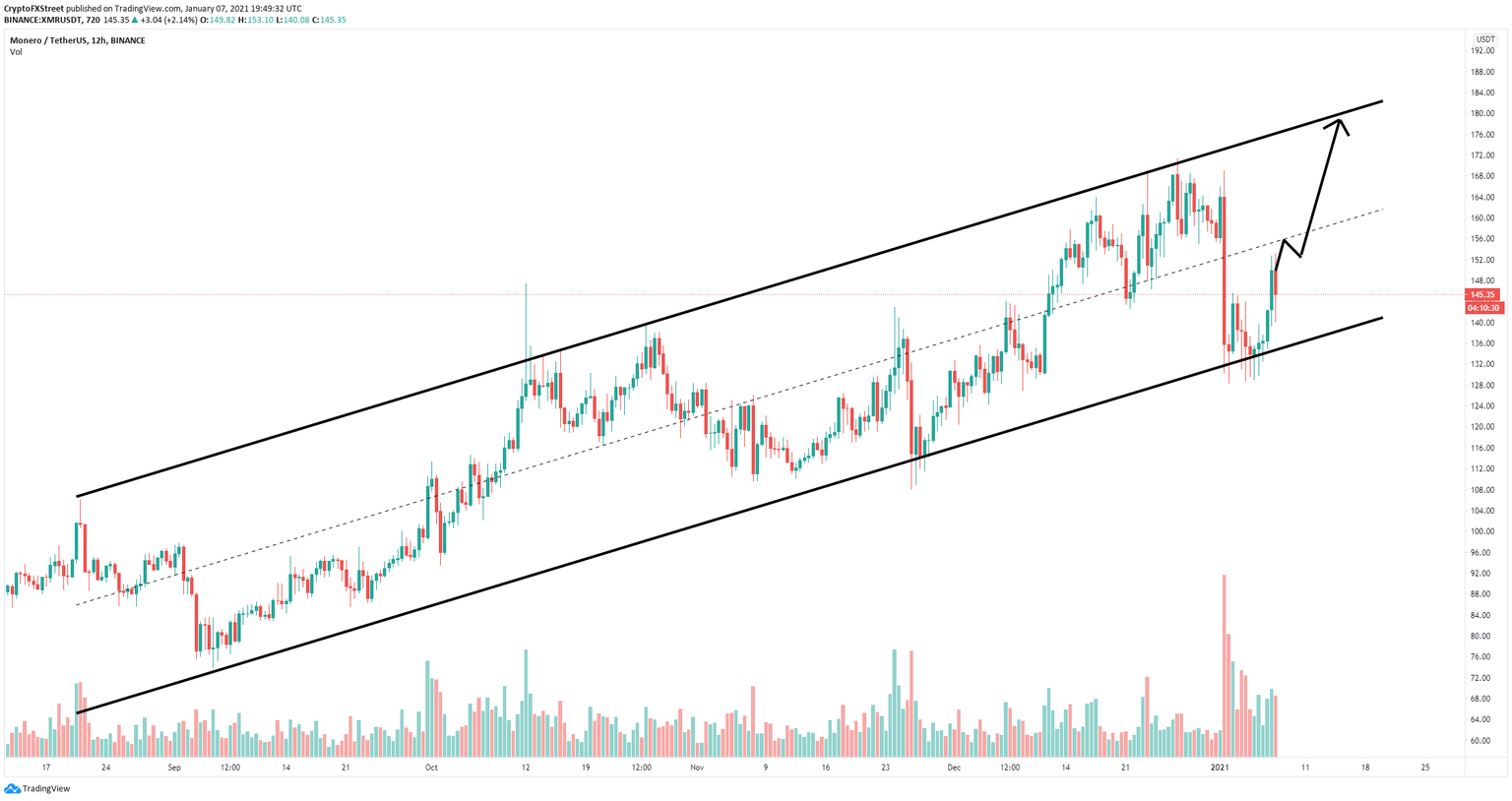

- XMR has established a long-term ascending parallel channel on the 12-hour chart since August 2020.

- XMR bulls have just defended the lower trendline of the pattern and are ready for a rebound.

XMR has been trading inside an ascending parallel channel since August 2020 and has just rebounded from the lower trendline at $135. The digital asset is currently trading at $145 aiming to hit the top of the pattern at $180.

XMR price can hit $180 but it might need to retrace first

On the 12-hour chart, XMR has established a strong ascending parallel channel since August 2020 and has rebounded from the lower boundary towards the middle of the pattern. If the bullish momentum continues, XMR price can quickly jump towards the top of the channel at $180.

XMR/USD 12-hour chart

On January 1, the social volume of XMR spiked significantly and its price plummeted down to $130 from a high of $167. XMR social volume has dropped significantly even though its price climbed toward $150 which indicates its at no risk of another correction.

XMR Social Volume chart

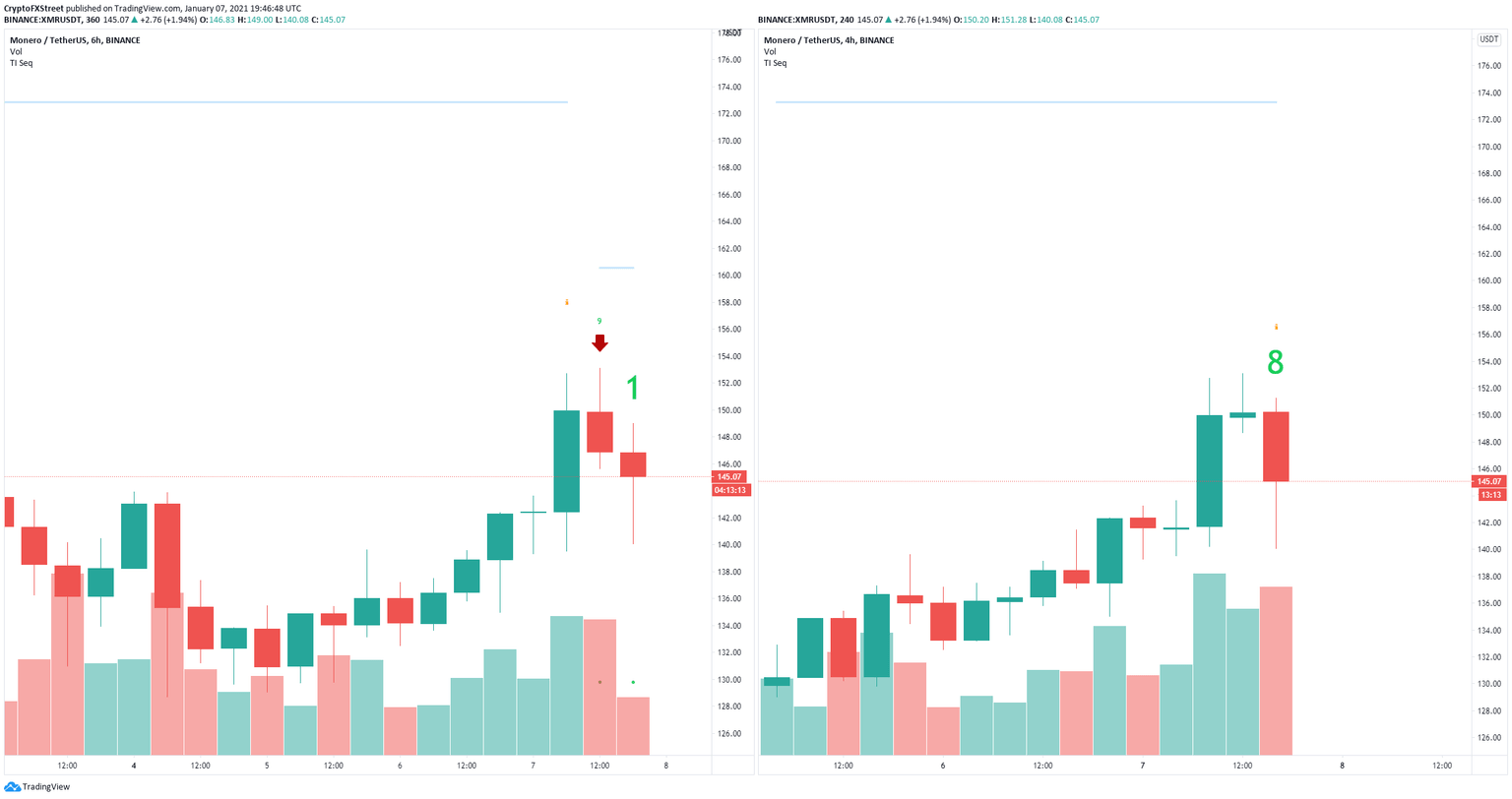

However, there are some concerning signs for XMR bulls. For instance, after the rebound towards $152, the digital asset got rejected significantly and dropped to $140 which is lower than the bulls would hope for.

XMR Sell Signals charts

Additionally, on the 6-hour chart, the TD Sequential indicator has just presented a sell signal and it’s about to do the same on the 4-hour chart. If both calls are confirmed, XMR price could drop towards the lower boundary of the channel at $135 again.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B20.58.49%2C%252007%2520Jan%2C%25202021%5D-637456463343750284.png&w=1536&q=95)