Privacy Coins Price Prediction: Zcash, Monero, and Dash primed to kick start new bull rally

- Some of the top privacy-centric cryptocurrencies in the market are looking bullish despite the extreme levels of greed among investors.

- Zcash, Monero, and Dash could be about to start a new leg up after recovering from the recent crypto market-wide correction.

Zcash, Monero, and Dash took a mild hit after making significant gains over the past few weeks. Although these privacy-centric coins seem to have entered a stagnation period, momentum appears to be building for another leg up.

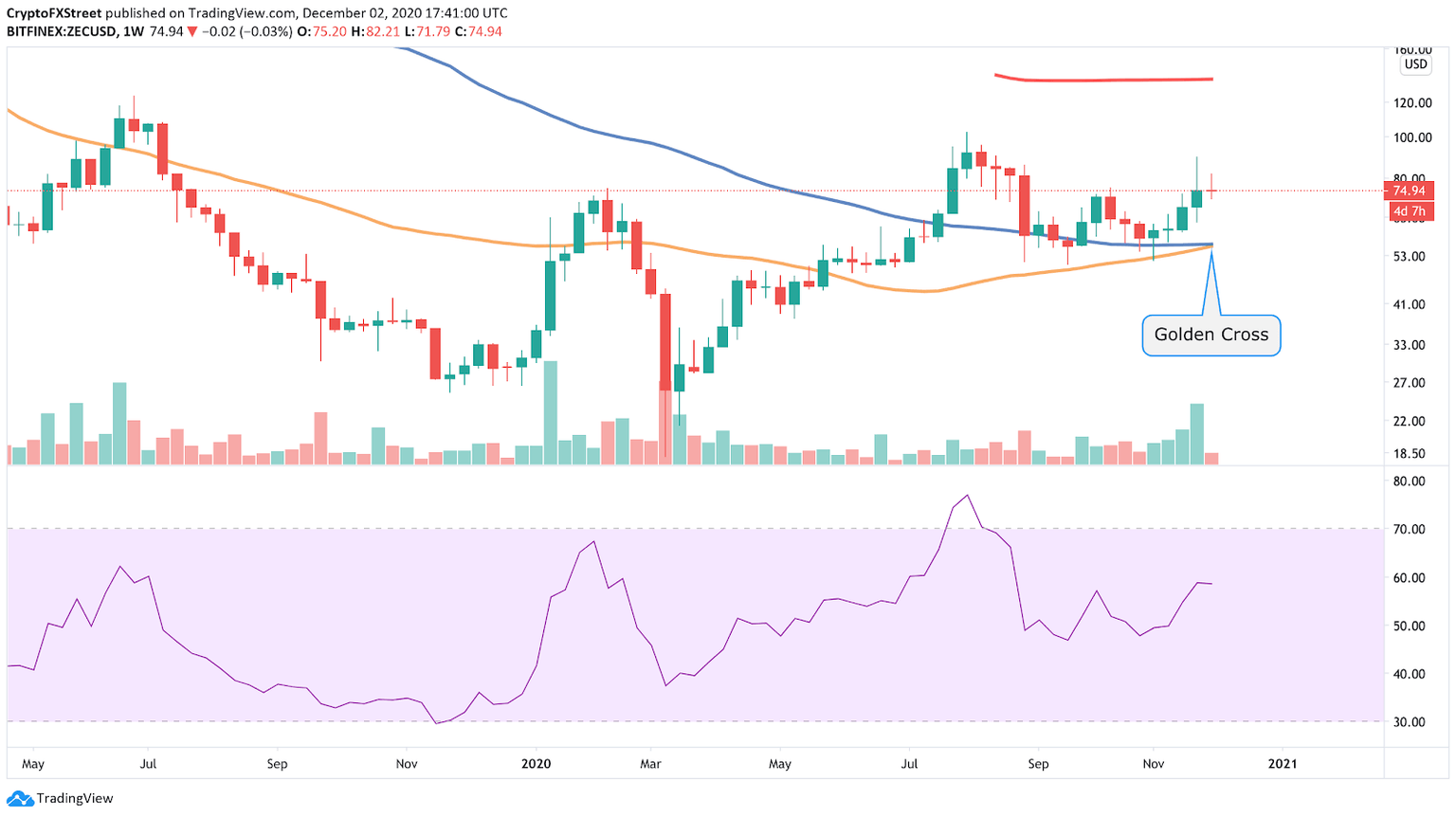

Zcash to resume uptrend after taking a breather

Zcash has been recovering slowly after prices tumbled to hit a low of $63.5, as previously discussed. While the privacy coin has yet to make another higher high, the bigger time frames, such as the weekly chart, show signs of further consolidation.

The buying pressure behind ZEC seems to be just enough to maintain its current price, preventing any major decline.

ZEC/USD weekly chart

Regardless, it appears that the bulls are gearing up to cover even more grounds. As the 50-week SMA moves on top of the 100-week SMA, a golden cross may form. Many investors see this pattern as one of the most definitive and strong buy signals that could start a long-term bull market.

If validated, Zcash could rise and test the 200-week SMA, currently hovering around $135.

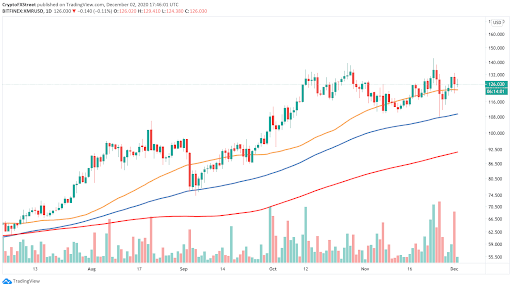

Monero bulls hold to critical support as prices continue to recover

Since filing two patents for Monero tracing technology by blockchain analytics and intelligence company Cipher, it has failed to regain its previous position above $130. Indeed, XMR is currently exchanging hands just around $126 as it continues to recover from the 24% nosedive it took on November 24.

XMR/USD daily chart

As long as Monero continues holding above the 50-day SMA, its trend may remain bullish. A further spike in buying pressure could see it surge towards $150. But if prices breach the underlying support, it will signal another retracement to the 100- or 200-day SMA.

These critical support levels sit at $110 and $92, respectively.

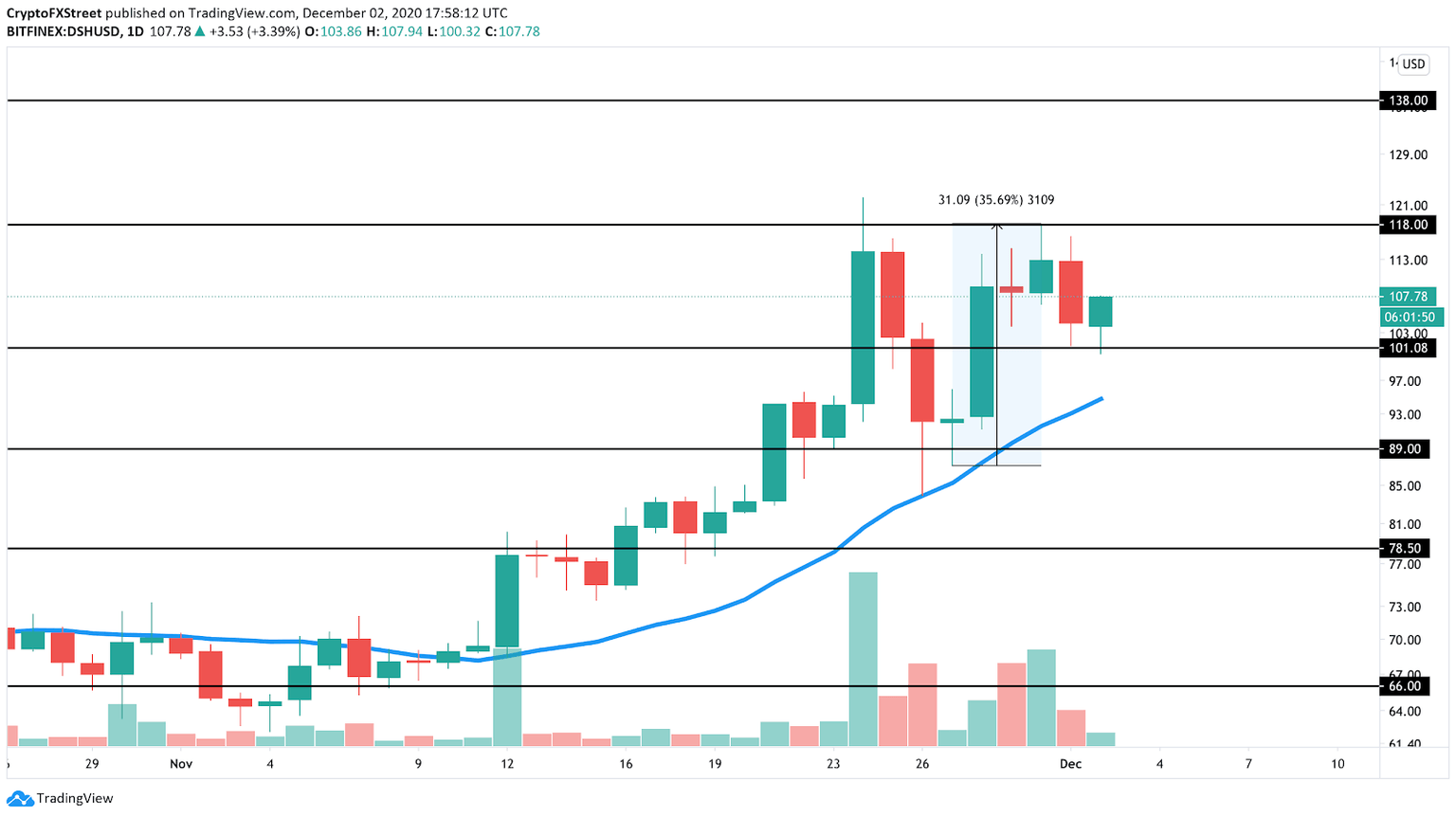

Dash’s rise to $140 dependents on a crucial hurdle

Since late November, Dash has enjoyed significant gains. Its price shot up more than 35% to hit a high of over $118. However, this resistance region rejected the bullish impulse, causing DASH to retrace to the $100 zone, where it is currently trading at.

DASH/USD daily chart

Given the increasing amount of money flowing into the cryptocurrency market, another rebound towards the $118 resistance barrier may be underway. If Dash can turn this hurdle into support, it will clear the path for a further advance to $140.

Author

FXStreet Team

FXStreet