MicroStrategy unveils Decentralized Identity solution on Bitcoin blockchain

- MicroStrategy is working on the launch of MicroStrategy Orange, a Decentralized Identity solution that uses inscriptions.

- The Bitcoin-based identity solution will store and call users’ personal information on the BTC blockchain.

- MicroStrategy is yet to reveal a date for launch.

MicroStrategy, a Business Intelligence company which holds 214,400 Bitcoin, on Thursday, revealed in a presentation that it is working on the launch of a decentralized identity solution. The solution uses the Bitcoin blockchain and it is called MicroStrategy Orange.

Crypto analyst and influencer Dylan LeClair dropped the details in a recent tweet on X after attending a presentation by the firm.

MicroStrategy proposes decentralized identity solution

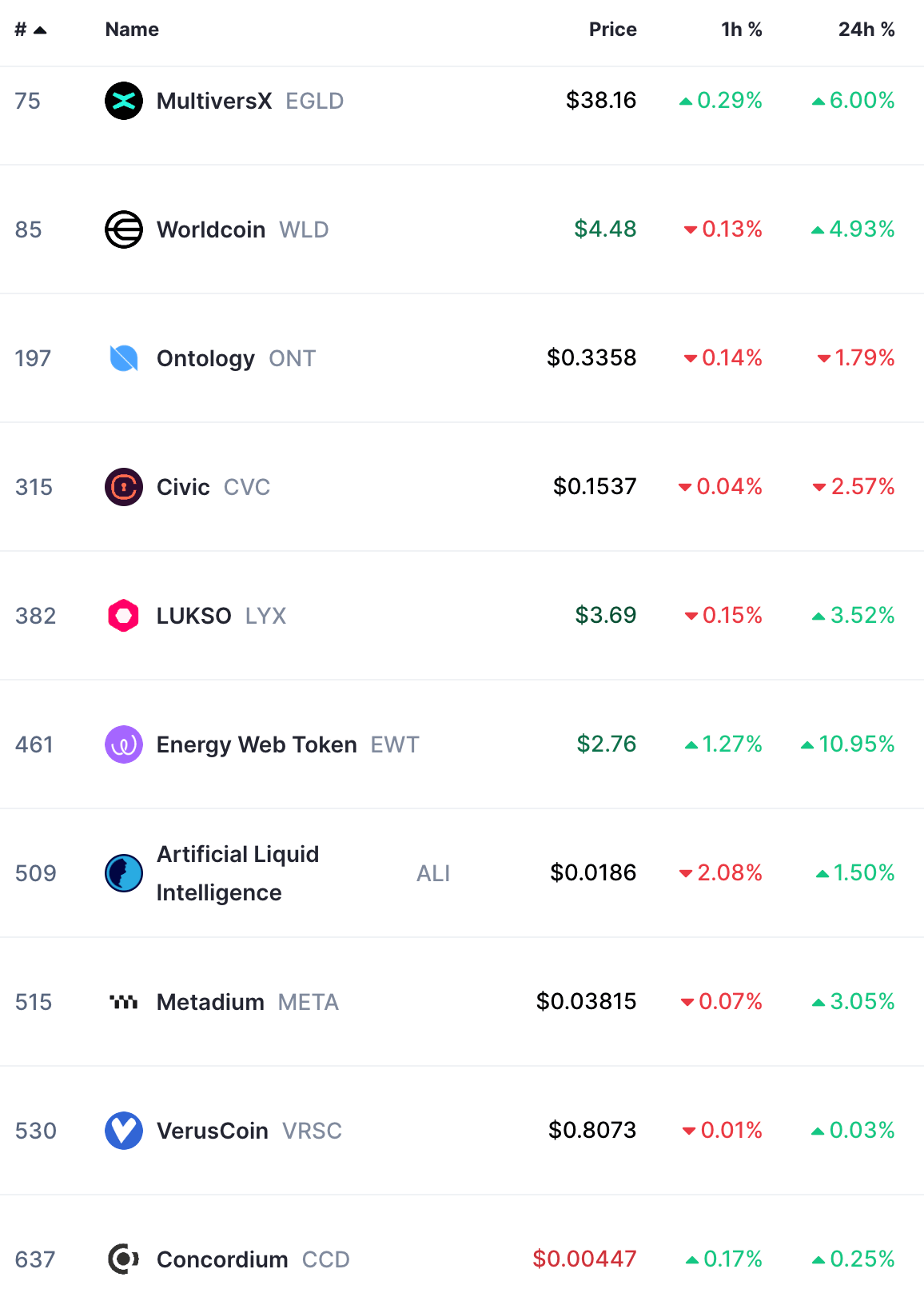

Decentralized identities are focused on offering Web3 users control over their digital personas while keeping their data secure. Several key players like Shiba Inu, Worldcoin, Polygon ID or Ethereum Name Service are targeting a similar problem statement, giving Web3 users more control on how and who their personal information is shared with.

Decentralized identity systems help users determine how and with whom their personal information is shared. The idea is to return control to users and end the reliance on a handful of centralized entities that control market participants’ personal information.

According to Dylan LeClair’s report, MicroStrategy Orange will use Bitcoin Inscriptions. Inscriptions will help users store and manage their identities while Unspent Transaction Output (UTXOs) allow for control of user identities.

$MSTR launching MicroStrategy Orange, a Decentralized Identity solution using the #Bitcoin blockchain.

— Dylan LeClair (@DylanLeClair_) May 1, 2024

The Bitcoin Inscription DID method (did:btc) uses inscriptions in witness data to store and manage DIDs, leveraging UTXOs for DID control.

MicroStrategy is yet to announce an official launch date.

Of the top 10 decentralized identity tokens, eight have noted price gains in the past 24 hours despite the broader correction in the crypto sector, as seen on CoinMarketCap.

Decentralized Identity tokens

Social intelligence company LunarCrush tested market sentiment in response to MicroStrategy’s Decentralized identity solution. The firm observed the sentiment move up since the announcement, noting that 84% of all posts that include “MSTR” (MicroStrategy’s ticker) and MSTRWorld24” were positive.

MSTR Sentiment among market participants

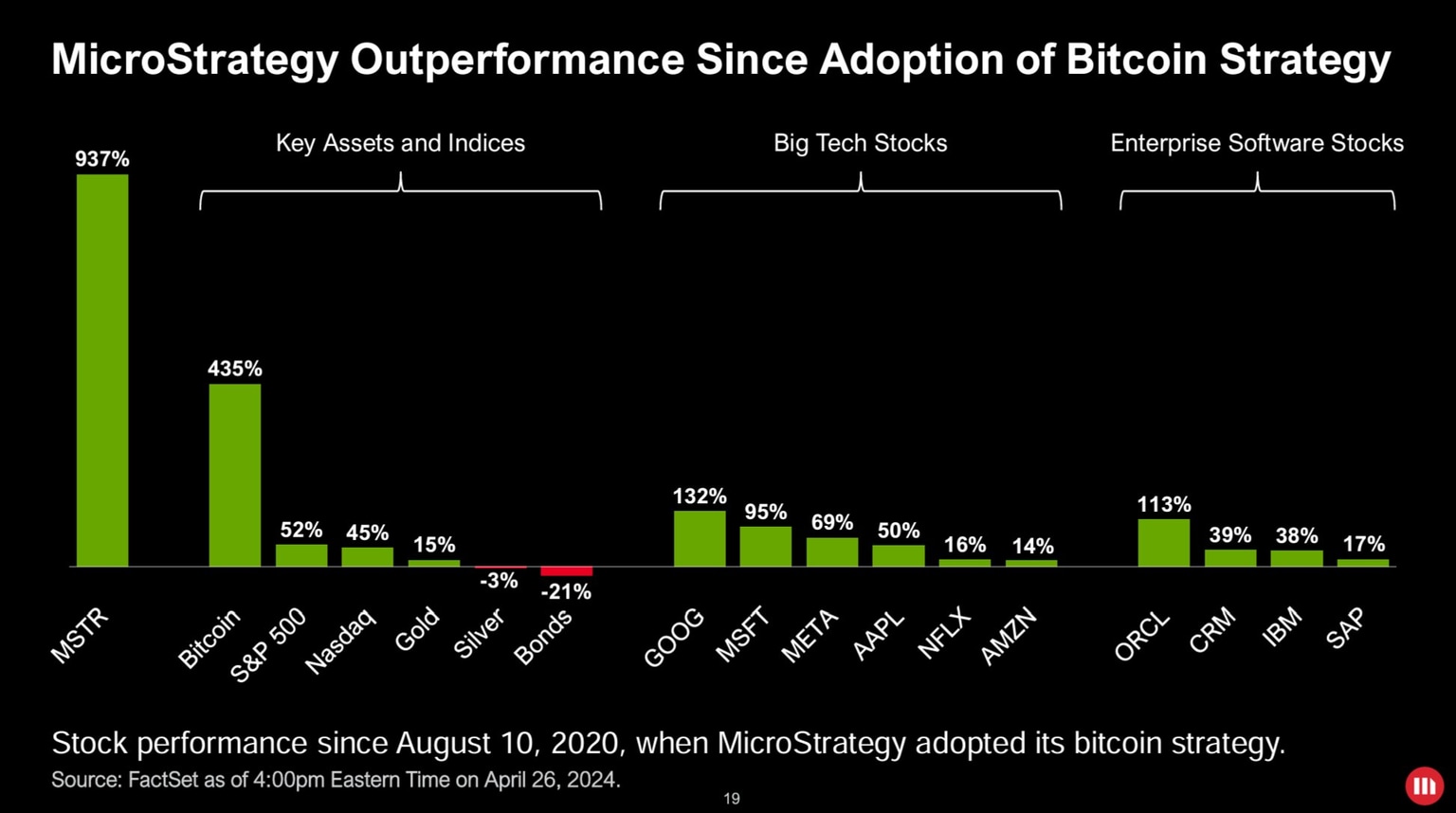

In its recent earnings report, MicroStrategy announced that since the adoption of Bitcoin strategy, the stock has significantly outperformed BTC, S&P 500, Nasdaq, Gold, Silver and top tech indices.

MicroStrategy stock performance against key assets, tech stocks.

In April, the firm added another $7.8 million in Bitcoin (144 BTC) to its holdings. The logical next step for the firm is likely the development of solutions on the Bitcoin blockchain, like MicroStrategy Orange.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.