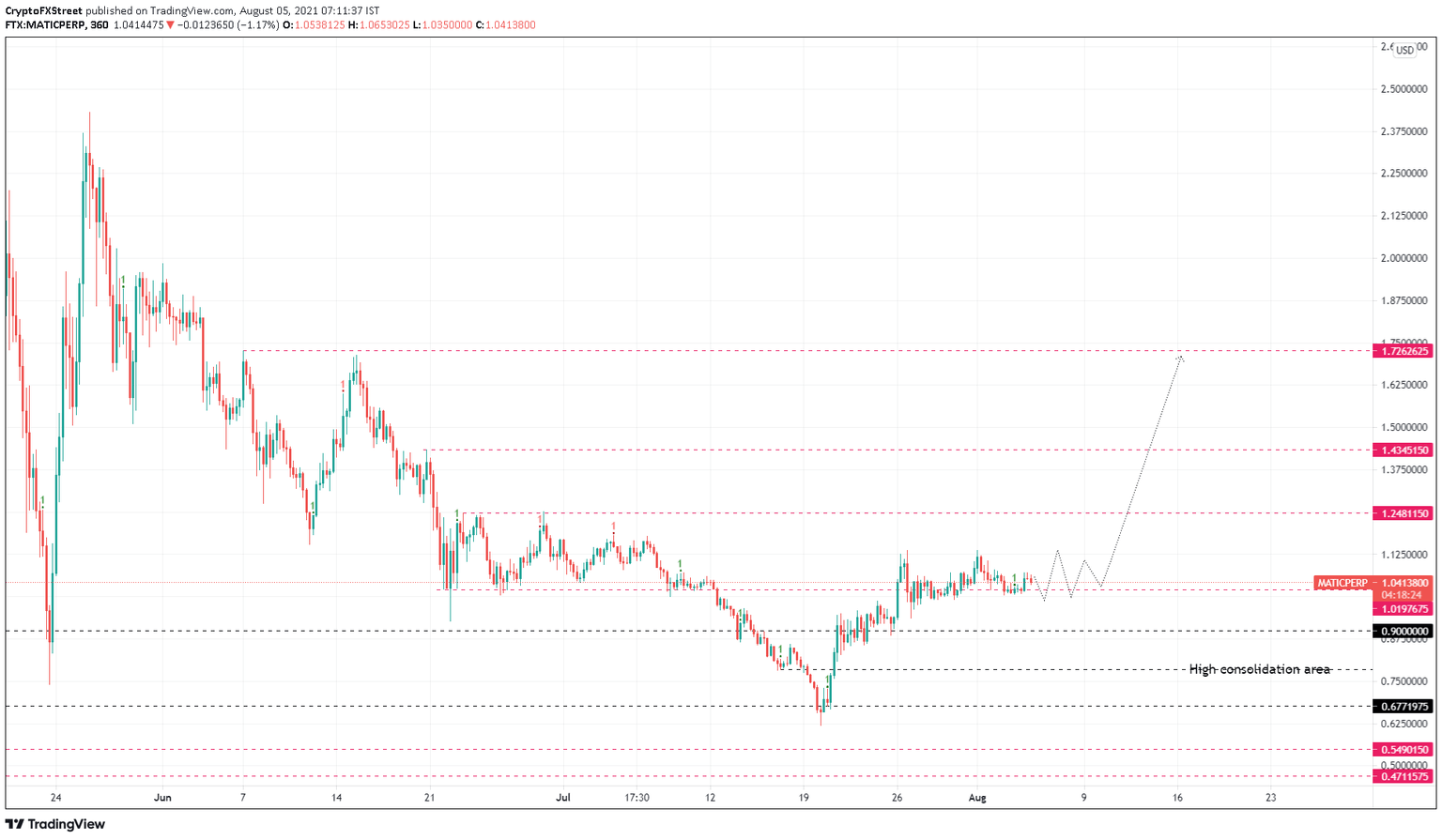

MATIC Price Prediction: Polygon awaits a trigger that could propel it up 68%

- MATIC price is currently trading extremely close to a support level at $1.019.

- The consolidation around $1.019 could be a precursor to a massive upswing.

- A breakdown of the $0.90 demand barrier will invalidate the bullish thesis.

MATIC price has stayed lull after the July 26 swing high at $1.137. The sideways movement indicates a build-up of pressure, which could lead to a massive move in either direction.

MATIC price searches for a catalyst

MATIC price rose roughly 83% from $0.621 to $1.137 between July 20 and July 26. However, this uptrend left the bulls exhausted, which has resulted in a sideways movement since then.

Although the Momentum Reversal Indicator has flashed a buy signal in the form of a green ‘one’ candlestick, things have not taken a turn.

However, a potential spike in buying pressure that triggers this uptrend will first encounter the $1.019 resistance level after a 19% climb. Following this, the $1.435 and $1.726 supply barriers are likely to be retested. All in all, this move from $1.019 to $1.726 would indicate a 68% ascent.

Considering the consolidation after July 6, investors can assume this climb to be explosive in nature. It is possible that MATIC price might blast through $1.019 and $1.435 before seeing any meaningful correction.

MATIC/USDT 6-hour chart

While the uptrend scenario is mainly due to the general structure of the market, there is a chance MATIC price might head lower.

Such a move could be seen after the immediate support barrier at $1.019 is breached. This development, while non-threatening, could turn things to the worse if the subsequent foothold at $0.90 is shattered.

This breach will invalidate the bullish outlook and might potentially trigger further selling pressure, leading to a 25% downswing to $0.677.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.