MATIC price eyes retest of $1.95 as Polygon forms a bottom reversal pattern

- MATIC price set up a triple bottom pattern, suggesting a reversal is likely.

- Investors can expect Polygon to pierce through the breaker and tag the weekly resistance barrier at $1.95.

- A breakdown of the daily support level at $1.44 will invalidate the bullish thesis.

MATIC price managed to stay above a crucial foothold despite the recent bearish retracements. As a result, Polygon has set up a bullish formation that forecasts a reversal.

MATIC price sets sight on recovery

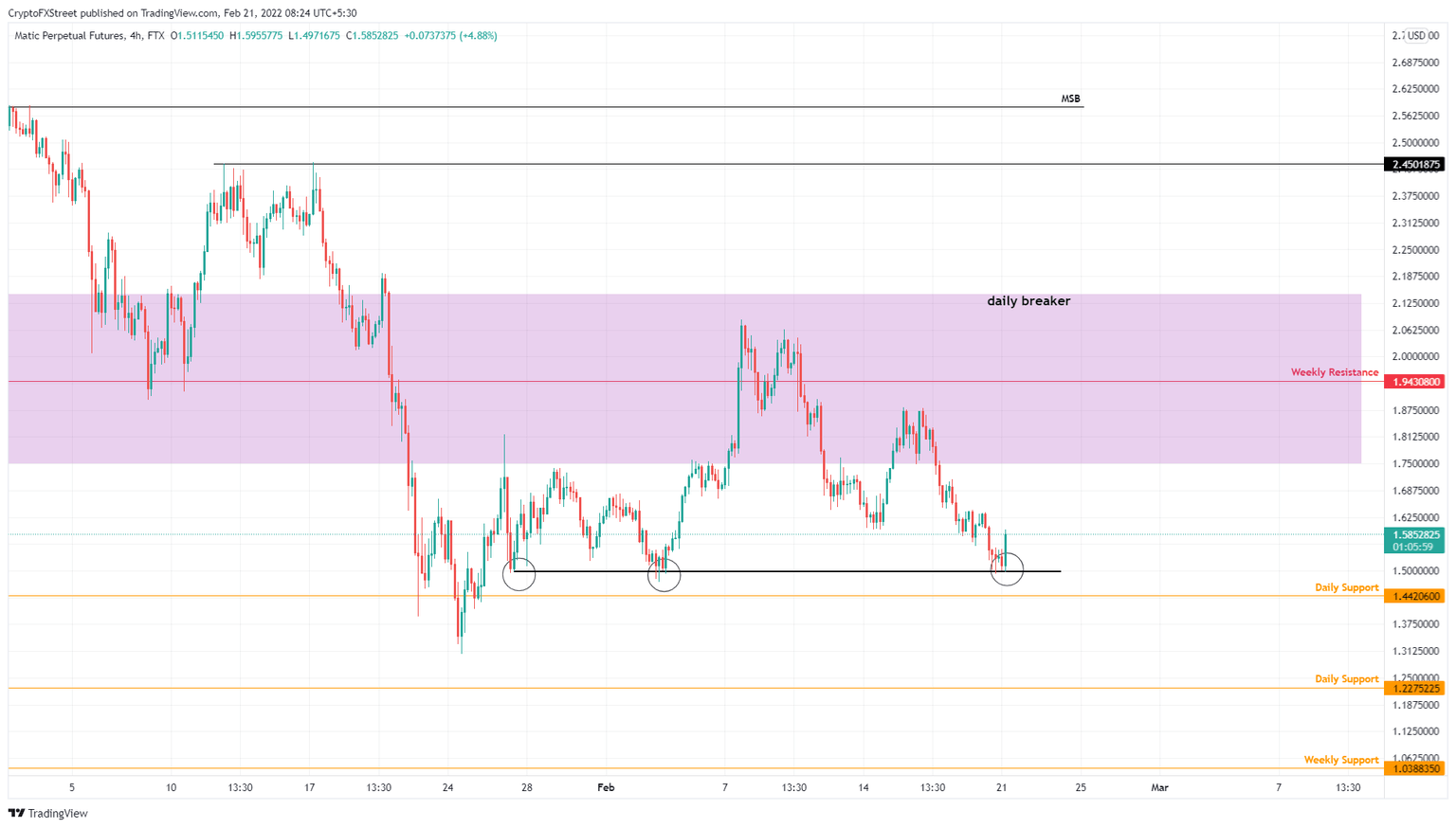

MATIC price broke the daily support level at $1.44 on January 24 but recovered quickly and set up a higher low at $1.50. The recovery since then created two more lows around $1.50, giving rise to a triple bottom.

This technical formation is a bottom reversal setup, so investors can expect Polygon to make a run for the immediate hurdle. The bearish breaker extending from $1.75 to $2.15 was a significant hurdle, but multiple retests seem to have weakened it enough to allow bulls to pierce through it.

Therefore, MATIC price will likely retest the weekly resistance barrier at $1.95 as it bounces off the $1.50 support. In some cases, the altcoin might extend to a whole number - $2 before contemplating retracement or bulls facing exhaustion. Regardless, MATIC price is due for volatility favoring the bulls.

MATIC/USDT 4-hour chart

While things are looking up for MATIC price, a potential spike in selling pressure that pushes the altcoin to produce a four-hour candlestick close below the immediate support level at $1.44 will create a lower low.

This development will skew the odds in the bears’ favor and invalidate the bullish thesis. In this case, MATIC price may crash 15% and revisit the $1.23 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.