Litecoin Price Prediction: LTC kickstarts a 65% bull rally

- Litecoin price shows a massive spike in buying pressure, pushing it closer to pre-crash levels.

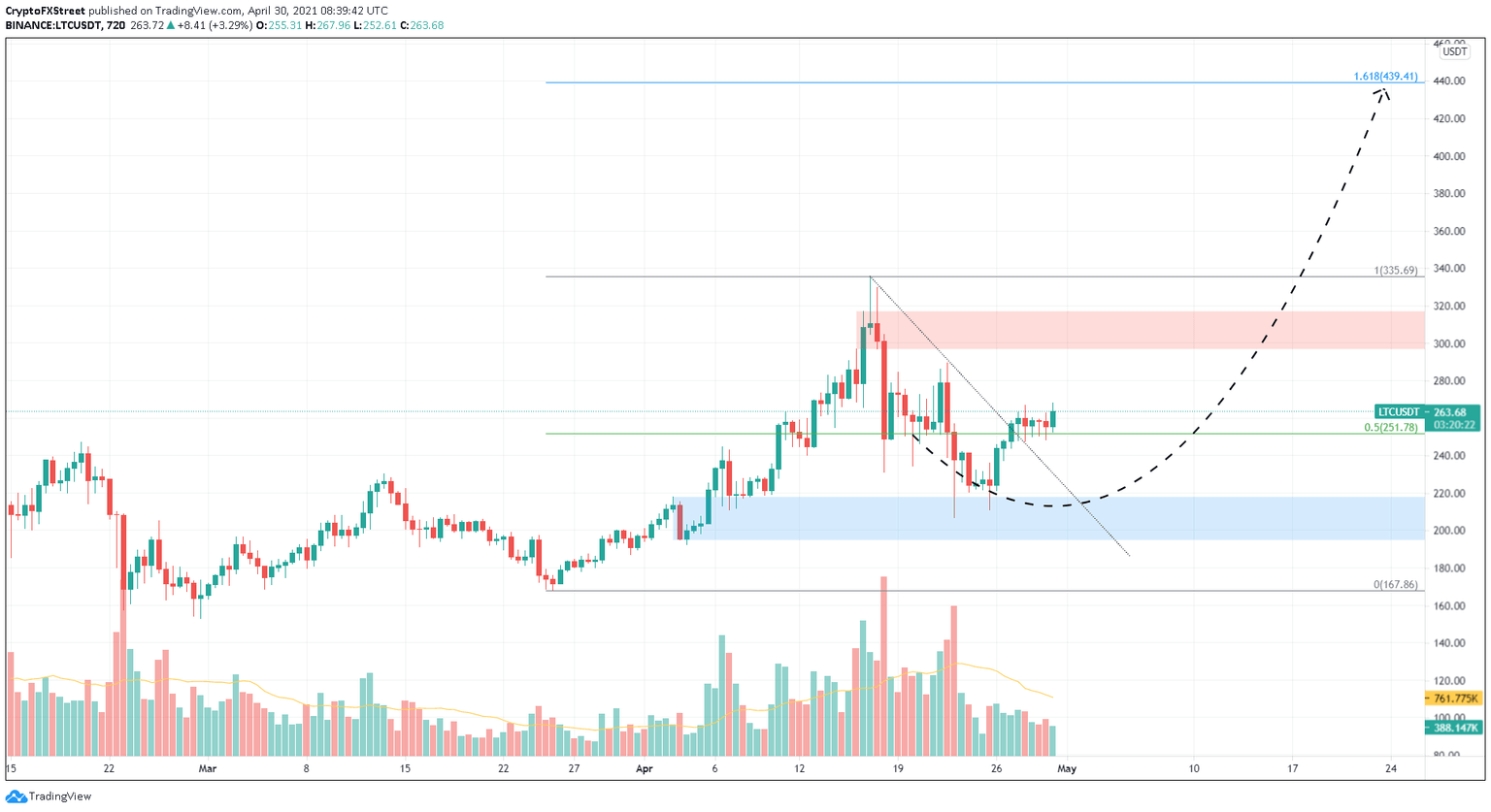

- The supply barrier extending from $296.75 to $317.09 is the only hurdle preventing LTC’s 65% upswing to $439.41.

- A breakdown of the demand zone’s upper trend line at $217.97 will invalidate the bullish outlook.

Litecoin price shows a resurgence of buyers, which has pushed it past some resistance levels. A continuation of this bullish momentum could see LTC retest a critical barrier.

Litecoin price primed for upswing

On the 12-hour chart, Litecoin price has sliced through a sloping resistance level indicating the start of a new uptrend. If the buyers continue to maintain their momentum, LTC could surge 12% to retest the immediate supply zone that stretches from $297.06 to $317.09.

A potential spike in bullish pressure that slices through the upper layer of this resistance area will trigger a retest of the local top at $335.69 and a potential swing to the 161.8% Fibonacci retracement level at $439.41.

LTC/USDT 12-hour chart

Regardless of the bullish momentum, if Litecoin price slices through the 50% Fibonacci retracement level at $251.78, it would question the upswing narrative mentioned above.

Sustained trading below this area could lead to bullish exhaustion pushing LTC to the demand zone’s upper boundary at $217.97

If the sellers manage to pierce this barrier, it will invalidate the optimistic scenario and invoke sideways movement or correction.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.