Litecoin Price Forecast: LTC aims for a new leg up but whales are selling

- Litecoin price had a breakout from a descending wedge pattern on the 4-hour chart.

- The digital asset aims for a price target of $300 in the near term.

- The number of LTC whales has significantly decreased in the past week.

Litecoin price has been trading sideways for the past 24 hours after a breakout from a key pattern formed on the 4-hour chart. However, the number of large holders of LTC has significantly decreased over the last week, indicating that whales are taking profits from their positions.

Litecoin price eying up $300 but faces selling pressure ahead

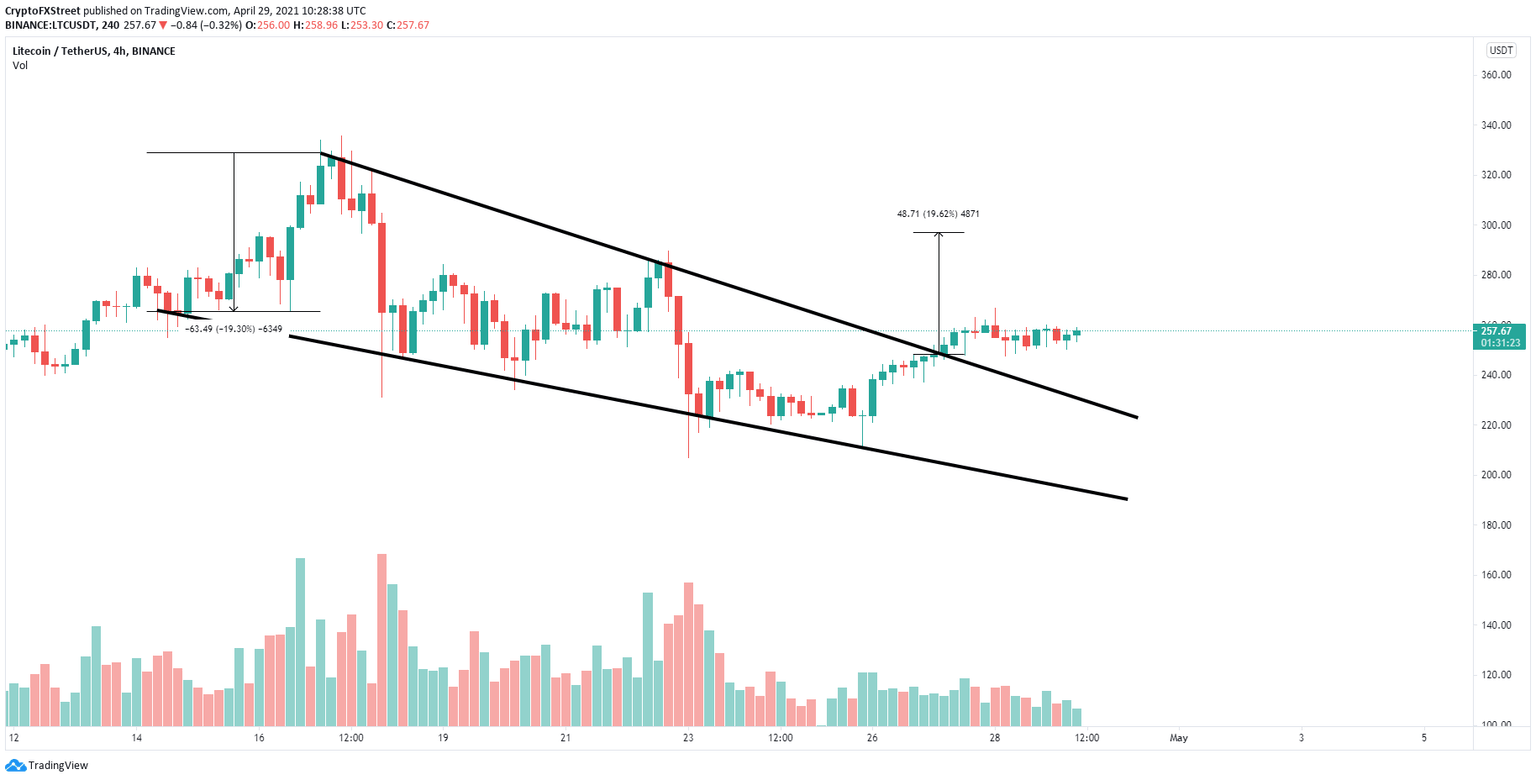

Litecoin formed a descending wedge pattern on the 4-hour chart which can be drawn by connecting the lower highs and lower lows with two converging trend lines. The price target of this breakout is $300 and has not been reached yet.

LTC/USD 4-hour chart

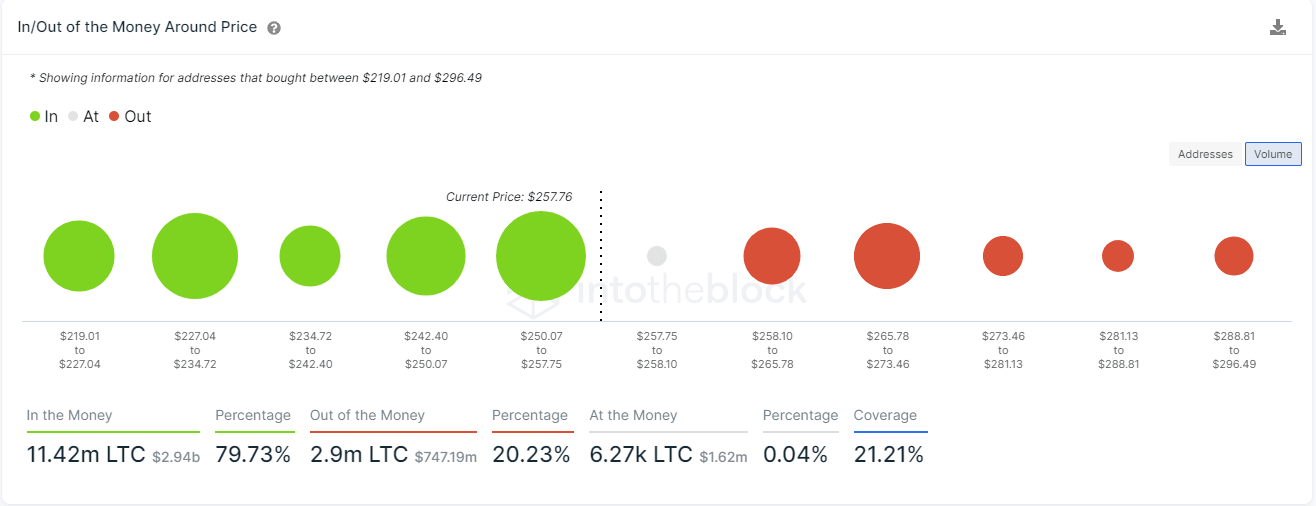

The In/Out of the Money Around Price (IOMAP) chart shows only one significant resistance area between $265 and $273 where 50,000 addresses purchased 1.4 million LTC. A breakout above this point should push Litecoin price toward the $300 target.

LTC IOMAP chart

On the other hand, it seems that large holders of LTC are losing their faith in the digital asset, a bearish sign. The number of whales with 100,000 to 1,000,000 LTC has greatly decreased in April from a high of 118 to a current low of 106.

LTC Supply Distribution

The IOMAP model indicates that the area between $257 and $242 is a critical support range. A breakdown below this area could drive Litecoin price toward the next important support point at $227.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B14.09.30%2C%252029%2520Apr%2C%25202021%5D-637552909098233607.png&w=1536&q=95)