Litecoin Price Analysis: MimbleWimble launch to push LTC outside the range

- David Burkett announced Litecoin's MimbleWimble launch on a testnet.

- LTC/USD stays locked inside the symmetrical triangle.

Litecoin's MimbleWimble went live on testnet during the weekend, according to the information published on the project's official website.

David Burkett, the creator of the privacy-focused cryptocurrency Grin, has been working on the Litecoin's MimbleWimble project since October 2019, when the Litecoin Foundation published two Litecoin Improvement Proposals that implied MimbleWimble integration to make transactions with LTC more anonymous.

What is MimbleWimble and how it works

Without going deep into details, MimbleWimble is a protocol based on Proof-of-Work (PoW) consensus algorithm with powerful scalability in increased privacy features. The name comes from the Harry Potter series, where MimbleWimble stands for the tongue-tying curse that prevented an enemy from making coherent speech and keeping them from talking about a particular subject. In the cryptocurrency industry, it means that the protocol can hide transaction data.

MimbleWimble does not support scripts, while the protocol's functionality is limited to monetary transactions, making it hard to implement the second-layer solutions like Lightning Network or atomic swaps. Also, in theory, MimbleWimble may be vulnerable to quant computing as it is based on the elliptic curve cryptography (ECC).

Currently, MimbleWimble is used by two projects - Beam and Grin. Litecoin is on the way to join the company.

What's the progress with Litecoin's integration

Now that the protocol is launched on the testnet, the community can explore the functionality and hunt for bugs before the official release.

According to David Burkett, the testnet supports several connected nodes and blocks mining functionality. Now the developer plans to focus on making MimbleWimble more user-friendly for non-tech people.

Burkett also added that the current protocol's version is not perfect as it does not support the checks for extraordinary or emergency scenarios. He expects that the final version will go live in 2021; however, the exact date remains unknown at this stage.

LTC/USD: The technical picture

Litecoin (LTC), now the 10th largest digital asset with the current market value of $3 billion, is changing hands at $46.20. The coin has gained over 1% of its value in the last 24 hours. LTC/USD has been moving within the intraday downside trend since the beginning of Monday amid the sell-off on the cryptocurrency markets.

Litecion has an average daily trading volume of $2.2 billion and is most actively traded on Binance.

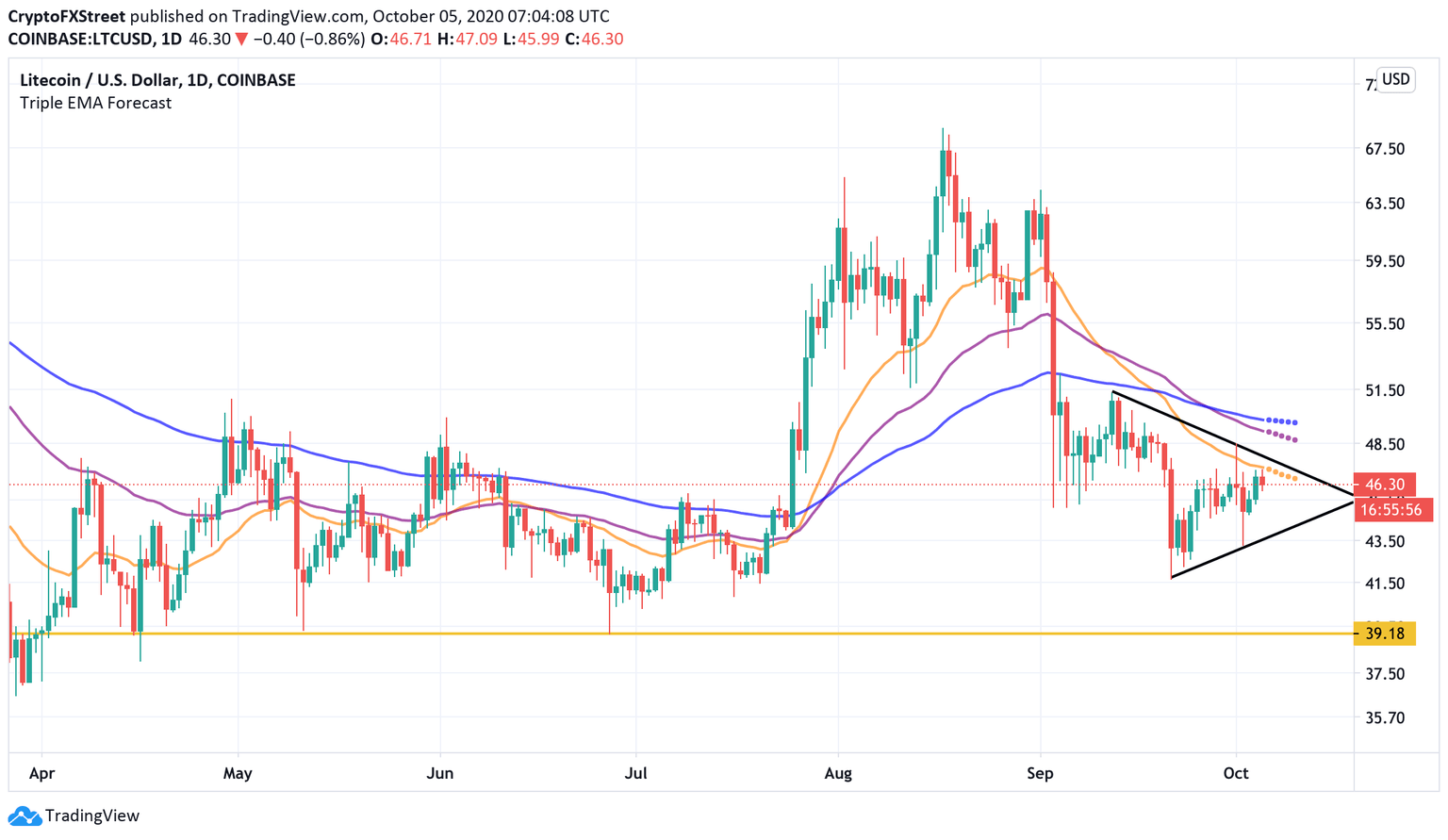

LTC/USD daily chart

On the daily chart, LTC/USD is moving within a symmetrical triangle pattern, which implies that the market is in a state of uncertainty, while the direction of the breakthrough is not clear yet.

On the upside, the recovery is limited by the short-term EMA (exponential moving average) at $47.00, followed by the upper border of the above-mentioned triangle pattern at $47.50. A sustainable move above this area will signal that the price performed a bullish breakthrough with the next aim at $49.65 (the long-term EMA) at $49.65 and psychological $50.00.

On the downside, the initial support comes at $44.00, with the lower line of the triangle located below this level. Once it is out of the way, the sell-off may be extended towards psychological $40.00 and $39.20 that serves as strong support through may til the beginning os July.

Litecoin's In and Out of the Money data

Litecoin's on-chain data shows that the coin has strong support in the area from $46.00 to 44.80, with over 3.6 million coins bough around those prices. This wall of supply has the potential to absorb the bearish pressure and push the price back towards the upside targets of $49.65 and $50.00

Meanwhile, the local resistance is less intense, with 2.3 million LTC sitting in the area of $46.60-$48.00, followed by another cluster of 1.75 million around $49.50.

To conclude: The launch of MimbleWimble tetsnet takes LTC a step closer to the status of a privacy-focused coin. However, the market reaction was muted as LTC/USD continued moving in a tight range.

From the technical point of view, the upside looks like a path of least resistance. A sustainable move above $47.50 will confirm the bullish scenario.

On the other hand, a sell-off below $44.00 will invalidate the positive outlook and bring $40.00 into focus.

Author

Tanya Abrosimova

Independent Analyst