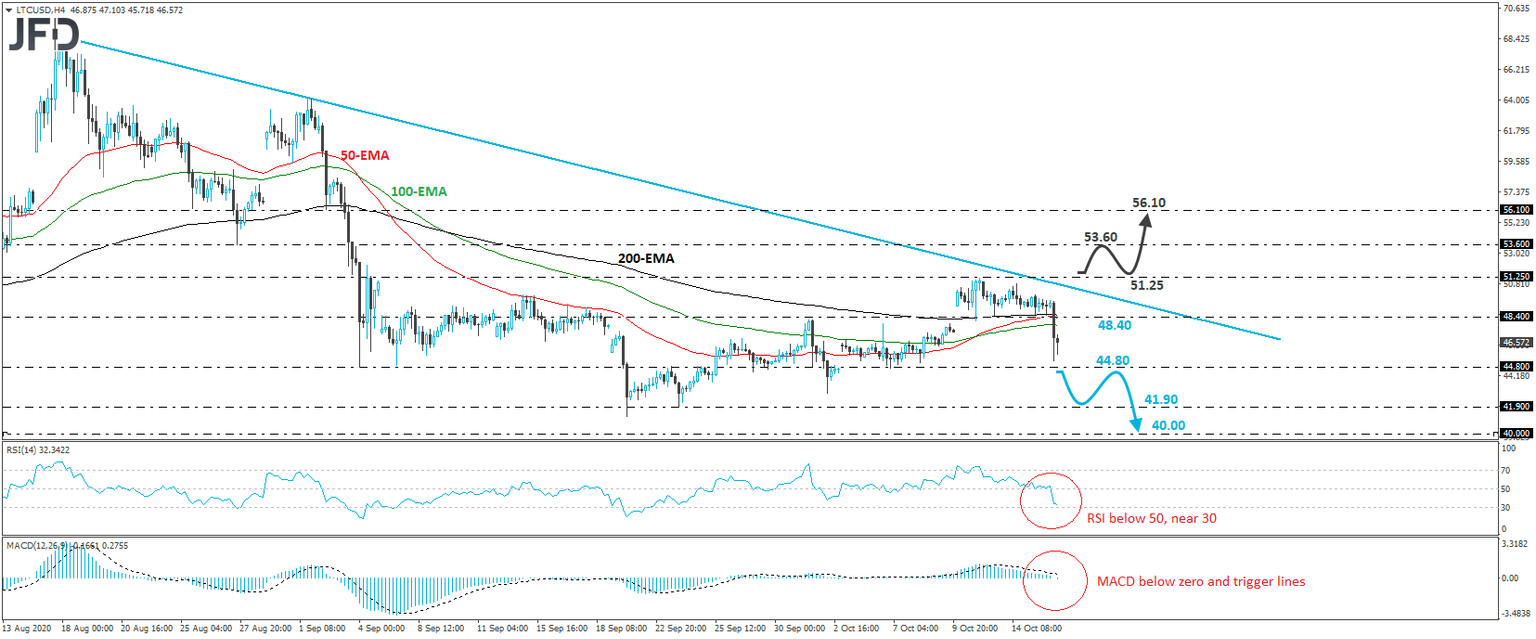

Litecoin falls below 48.40

LTC/USD tumbled on Friday, falling below the 48.40 barrier, which supported the price action since Monday. Overall, the crypto continues to trade below a tentative downside resistance line drawn from the high of August 17th, and thus, we would consider the near-term outlook to be cautiously negative for now.

If the bears are willing to stay in the driver’s seat, we would see them challenging the 44.80 zone soon, which supported the price on October 7th. A clear dip below that zone may invite more sellers into the action, who could push for a test near the 41.90 barrier, marked by the low of September 23rd. Another break, below 41.90 may set the stage for declines towards the psychological round figure of 40.00, which prevented the crypto from drifting lower between June 28th and July 5th.

Shifting attention to our short-term oscillators, we see that the RSI lies below 50 and is now approaching its 30 line, while the MACD lies fractionally below both its zero and trigger lines, pointing down. Both indicators detect downside speed which supports the notion for further declines in this cryptocurrency.

In order to abandon the bearish case and start examining a bullish reversal, we would like to see a clear rebound above the peak of October 12th, at 51.25. The price would already be above the aforementioned downside line and thus, the bulls may decide to initially aim for the inside swing low of August 27th, at 53.60. If that level is not able to halt the advance, the next stop may be at 56.10, marked by the inside swing low of September 2nd.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD