Lido TVL pares recent gains as ETH, MATIC, SOL price rally wanes

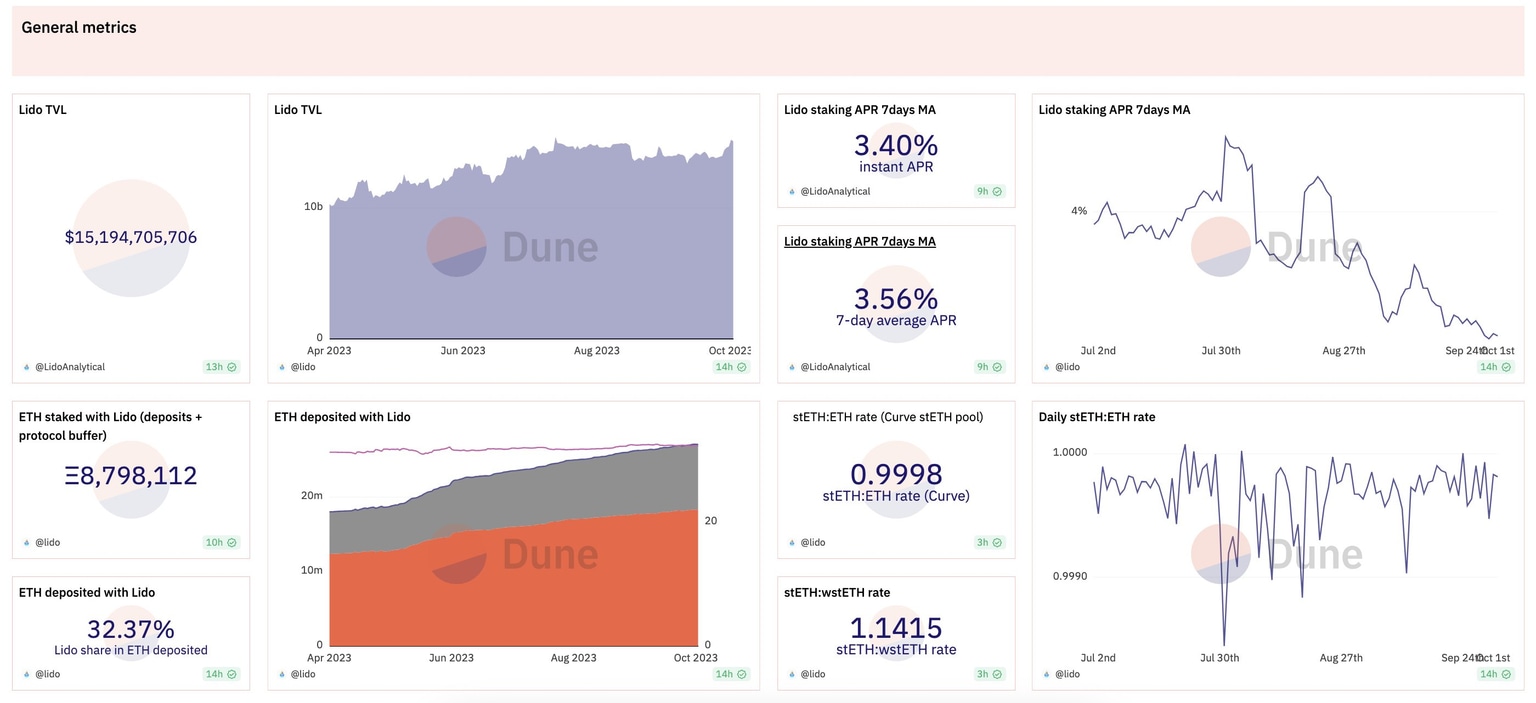

- Lido's Total Value Locked surged to $15.37 billion in the week to October 2 before undergoing a slight dip.

- Ethereum Futures ETF launch fell short of expectations, hitting prices

- stETH APR experienced a slight decline, according to seven-day moving average figures.

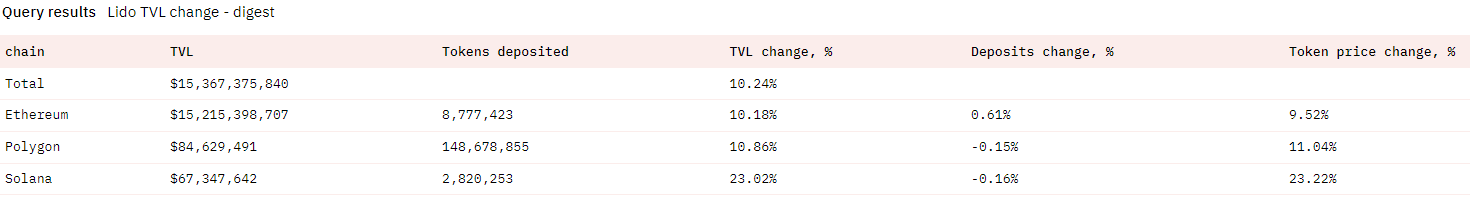

Lido Finance Total Value Locked (TVL), the value of all crypto assets held in the protocol, reached $15.37 billion in the week to October 2, the highest level since August. The 10.24% weekly surge was largely fueled by Ethereum (ETH) price gains, although the lukewarm launch of Ethereum Futures ETFs has pulled down Lido's TVL.

Lido's 10% TVL surge tapers after ETF launch

Lido Finance, an Ethereum staking player, witnessed a surge in its TVL to $15.37 billion between September 25 and October 2, or a 10.24% increase, according to data published Monday by the protocol in its official X account. Lido notes that the major factor that led to this surge was a 9.52% rise in Ethereum (ETH). During the period, Lido ranked second in net new deposits to the Ethereum Beacon Chain, attracting a substantial 40,768 ETH in just seven days.

Additionally, altcoins like MATIC and SOL also contributed to the gains with an 11.04% and 23.22% price rise, respectively.

Lido market markers

However, Lido's TVL growth tapered off on Tuesday below the $15 billion mark. This could be largely attributed to the market's tepid response to Ethereum's Exchange-Traded Funds (ETFs).

Drivers of Lido TVL

Staked Ethereum APR declines

Lido underlined that the staked Ethereum (stETH) APR, the annual percentage rate that stakers can expect to earn, experienced a slight decline in the last week. The seven-day moving average settled at 3.56%. However, the total amount of wrapped stETH deposited into DeFi pools increased by 0.92%, concluding the week at 3.09 million stETH. The share of wrapped stETH in DeFi also increased marginally, from 35.16% to 35.25%.

Meanwhile, based on CoinShares figures, Ethereum witnessed its seventh consecutive week of outflows, amounting to $1.5 million. If the altcoin market remains lukewarm, Lido TVL could further take a hit in the coming week.

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.