Lido DAO price stands safe from falling below $1.500 solely due to its investors’ HODLing

- Lido DAO price, despite observing a near 14% crash, is still standing above the multi-month support of $1.647.

- LDO holders have been standing strong since May, with the supply among mid-term holders rising by 16%.

- This HODLing has resulted in the network observing minimal realized losses since May and could also support recovery if this behavior continues.

Lido DAO price has noted a macro sideways movement since May, with the current value of the asset sitting only 4% above its worth from two months ago. While the volatility in the market brought losses and profits to many, the most consistent investors that stood throughout the turmoil happened to LDO holders.

Lido DAO price slips on the charts

Lido DAO price, trading at $1.940 at the time of writing, declined by 13.71% in three days. Even though the fall did not take away much from the second half of the June rally, it did bring the altcoin closer to the five-month-old support level of $1.647. This altcoin has kept above this line, bouncing off of it since January this year and will continue to do so with the help of its investors.

LDO/USD 1-day chart

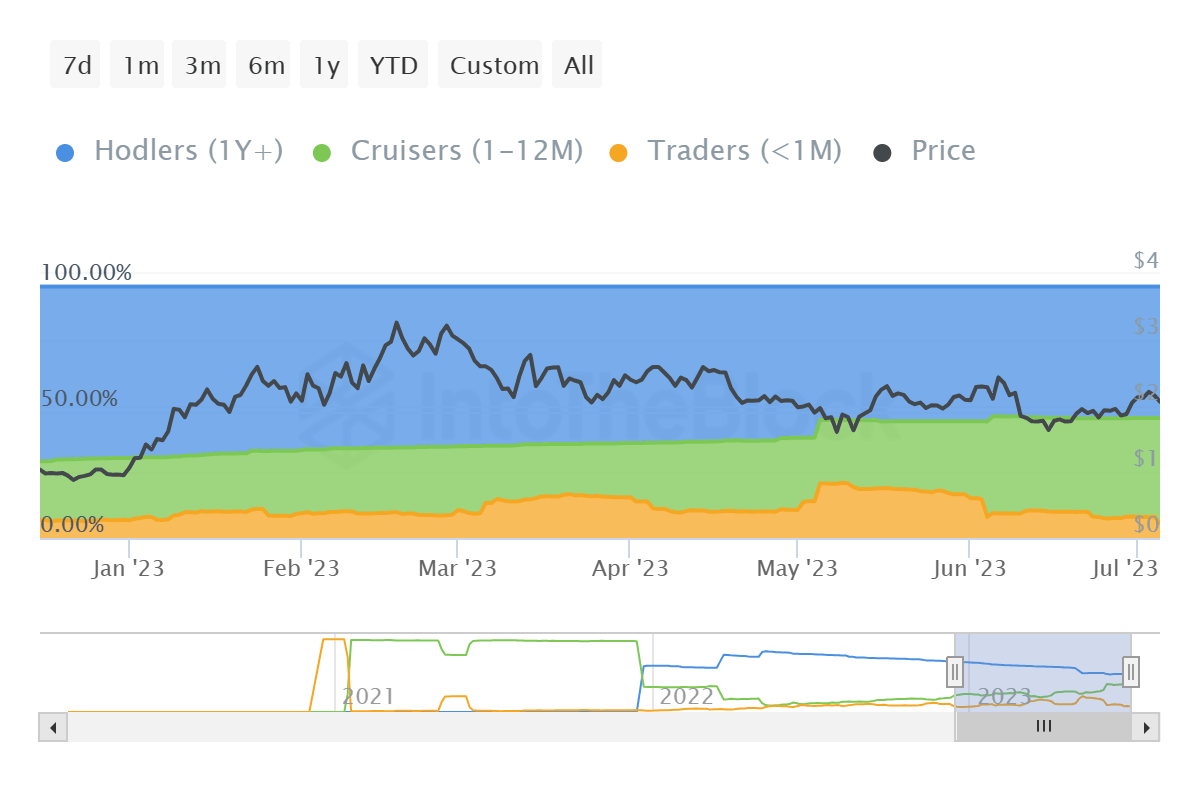

While most of the crypto asset investors resorted to either offloading their holdings or making profits at the earliest, LDO holders chose to hold on to their assets. This is visible in the transfer of supply from short-term holders (STH) to mid-term holders (MTH).

The former constitute the addresses that only hold on to their tokens for less than a month. The mid-term holders, on the other hand, tend to keep their supply intact for more than a month but less than a year.

Back in May, the share of both these cohorts was pretty much equal, with STH holding 21% of the entire circulating supply while MTH held about 25% of the supply. Over the course of the next two months and come July, STH now holds only 4% of all LDO, while MTH now commands more than 41% of the entire supply.

Lido DAO supply distribution

This is proof that investors held on to their LDO throughout the recent turmoil in hopes of a solid recovery in the future. This paid off as Lido DAO price stood safe from excessive decline and realized losses also remained at a low.

Lido DAO network realized losses/profits

Going forward, LDO holders need to maintain this attitude as HODLing through the bear market historically has resulted in solid gains. However, should Lido DAO price lose the five-month-old support line and slip below $1.500, these holders might change their stance to offset their losses.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.03.47%2C%252007%2520Jul%2C%25202023%5D-638242862076774314.png&w=1536&q=95)