Ethereum Price Forecast: BitMine treasury crosses 4 million ETH, but Fundstrat suggests caution

Ethereum price today: $3,020

- Ethereum treasury firm BitMine acquired 98,852 ETH last week, growing its stash to 4.06 million ETH.

- Fundstrat's cautious outlook of $1,800-$2,000 per ETH in H1 2026 contradicts Thomas Lee's bullish predictions.

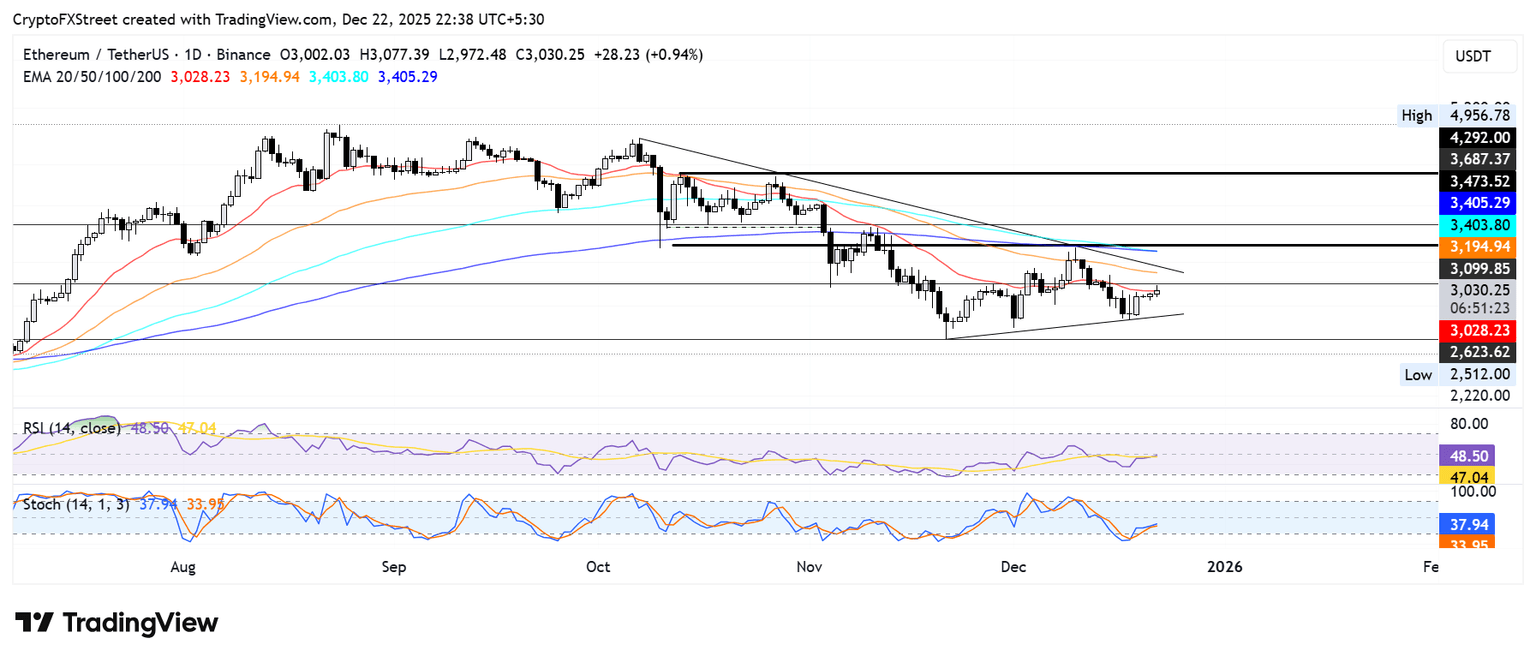

- ETH must overcome resistance near $3,100 to test the upper boundary of a symmetrical triangle.

Ethereum (ETH) treasury company BitMine Immersion (BMNR) has grown its digital asset stash above the 4 million ETH threshold, according to a Monday statement.

The Nevada-based firm acquired 98,852 ETH since its last update, pushing its holdings to 4.06 million ETH, about 3.37% of the top altcoin's circulating supply.

"This is a tremendous milestone achieved after just 5.5 months," said BitMine chairman Thomas Lee. "We are making rapid progress towards the 'alchemy of 5%' and we are already seeing the synergies borne from our substantial ETH holdings," Lee added.

Since transitioning to an Ethereum treasury strategy in July, BitMine has grown to become the largest corporate holder of ETH, ahead of SharpLink Gaming (SBET) and The Ether Machine (ETHM).

Lee, who also doubles as head of research at Fundstrat, has come under fire following the research firm's cautious outlook on ETH for H1 2026.

Fundstrat says ETH could drop to $2,000 in H1 2026

In an internal report published last week by Fundstrat's head of digital asset strategy, Sean Farrell, the firm predicts the crypto market could experience a meaningful drawdown in H1 2026, with ETH falling toward the $1,800-$2,000 range before rallying in H2.

The prediction contrasts with Lee's recent bullish remarks at the Binance Blockchain Week of ETH being "severely undervalued" at $3,000. He also predicted the top altcoin to set a new all-time high in January 2026.

Farrell clarified in a Saturday X post that the differing views are due to several independent analysts' frameworks attending to different clients and time horizons.

"My objective is to help clients and subscribers with meaningful crypto allocations (think ~20%+ of a portfolio) outperform across cycles through active rebalancing," wrote Farrell. "[...] Tom's work caters to big money managers and investors who allocate 1-5% of their portfolio to BTC & ETH. This requires disciplined, long-term thinking about secular trends to outperform over time."

Ethereum Price Forecast: ETH faces resistance at $3,100

Ethereum saw $58.4 million in liquidations over the past 24 hours, driven by $41.8 million in short liquidations, per Coinglass data.

ETH is facing resistance near the $3,100 key level as it attempts to establish a rise above the 20-day Exponential Moving Average (EMA). A rise above $3,100 and the 50-day EMA could push ETH to test the upper boundary of the symmetrical triangle before tackling the critical resistance near $3,470.

On the downside, ETH could find support at the triangle's lower boundary line if it sees a firm rejection at $3,100.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are approaching their respective neutral levels. A firm cross above will accelerate bullish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi