Is Crypto.com price poised for a 14% rally following the exchange’s release of Proof of Reserves?

- Crypto.com joined Binance and other major cryptocurrency exchanges in publishing its reserves.

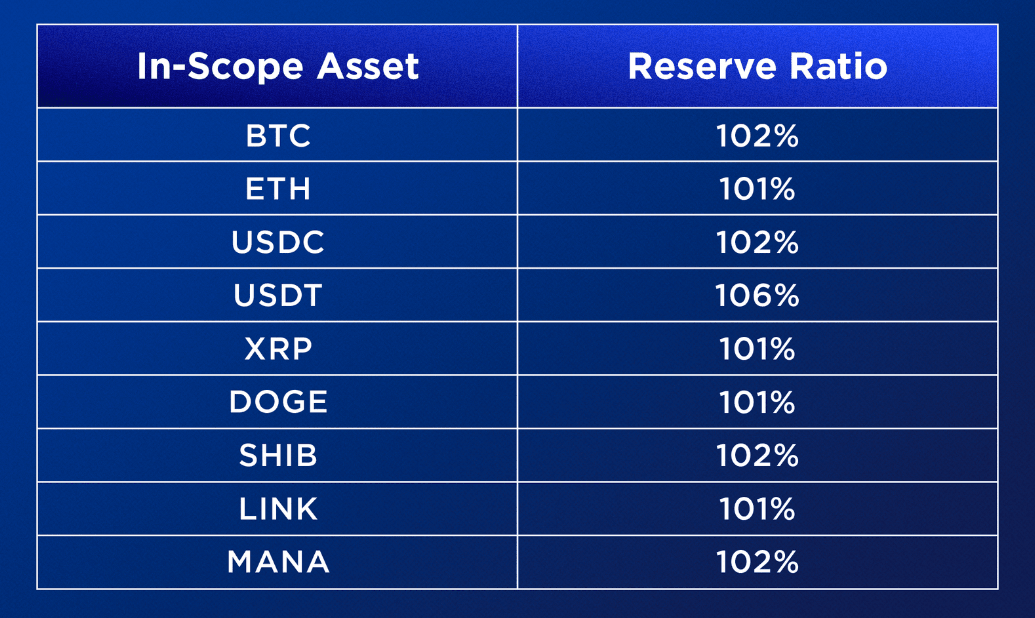

- Crypto.com produced the reserves for nine assets, with USDT’s Reserve Ratio climbing to 106%

- Crypto.com price needs some buying pressure to breach its resistance level at $0.0676.

Crypto.com is one of the best-known crypto exchanges in the world thanks to its multiple sports partnerships, including a deal with FIFA World Cup Qatar 2022. However, at the end of the day, the stuff that matters is how much users have faith in the exchange, especially since the FTX collapse.

Crypto.com proves its mettle

Crypto.com followed in the footsteps of Binance, which urged other exchanges to join this movement back in November. Following the downfall of FTX, Binance suggested other crypto exchanges release their reserves in order to reassure investors that their funds are safe from an FTX event.

Soon after Binance, exchanges like OKX, Bitfinex and Huobi came forward to post their Proof of Reserves. Crypto.com became another addition to the list. Unlike Binance, which only posted its Bitcoin reserves of 101%, Crypto.com put up its reserves for all nine major crypto assets. While Bitcoin has a reserve ratio of 102%, USDT (Tether) has a ratio of 106% on the exchange.

Crypto.com reserves

Regardless, at the least, all the assets have a 1:1 reserve of its customer assets. Commenting on the Proof of Reserves report, Kris Marszalek, the CEO of Crypto.com, stated,

“Providing audited Proof of Reserves is an important step for the entire industry to increase transparency and begin the process of restoring trust.”

Is Crypto.com price setting itself up for a rise?

Generally, entities making moves in the positive direction are considered bullish triggers for their tokens. But given the current condition of the market, Crypto.com price will need a lot more than just positive development to recover from its present level.

Trading at $0.0641, Crypto.com price would be on its way toward marking a recovery if it finds some buyers to push the demand. This would set CRO on the path of breaching the $0.0676 resistance level. Thereon the altcoin will need to tag $0.0733, and flipping it into support would mark a 14% rise as well as a kick-start recovery.

CRO/USD 4-hour chart

However, if the selling pressure takes precedence and the Crypto.com price falls, the altcoin could end up at its immediate support level at $0.0618. Losing this support would send it slipping toward $0.0591. A daily candlestick close below this level would invalidate the bullish thesis, setting Crypto.com price on the way to tag $0.0564.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.