IOTA launches the first phase of its IOTA 1.5 upgrade as IOT/USD breaks above $0.40-level

- IOTA has released the first phase of the IOTA 1.5 upgrade on its mainnet.

- The upgrade aims to boost performance, usability and reliability of the network.

- The second phase of IOTA 1.5 is expected to release later this year.

The IOTA team has recently announced that the first phase of the IOTA 1.5 network upgrade (Chrysalis), is now live on the mainnet. IOTA 1.5 is the first step that will build a launching pad for a seamless transition into IOTA 2.0 (Coordicide).

The upgrade to #Chrysalis (IOTA 1.5) Phase 1 has finished. Restart Hornet 0.5.0 with the --overwriteCooAddress command once. Make sure to update your Trinity Desktop version. A Trinity Mobile update is also required but we are still awaiting reviews from Apple and Google. #IOTA

— IOTA Engineering (@iota_dev) August 19, 2020

The new upgrade intends to boost the IOTA network's performance, usability, and reliability as it transitions to a completely decentralized platform. The first set of IOTA 1.5 features includes a new tip selection algorithm called URTS, milestone selection improvement and autopeering, simplifying the process of setting up new nodes.

IOTA 1.5 can process more than 1000 transactions per second (TPS). This is a significant improvement from the previous version, which could only handle 40 TPS. The network also offers a 10-second confirmation speed. Various changes concerning the APIs of the Hornet nodes are also included in the upgrade. Hence, Trinity desktop wallet holders and node operators must upgrade their applications to access the network smoothly.

The team is also working on the second phase of IOTA 1.5 and is expected to release it later this year. This upgrade will introduce functionalities such as UTXO, atomic transitions, reusable addresses and a transition to a binary transaction layout.

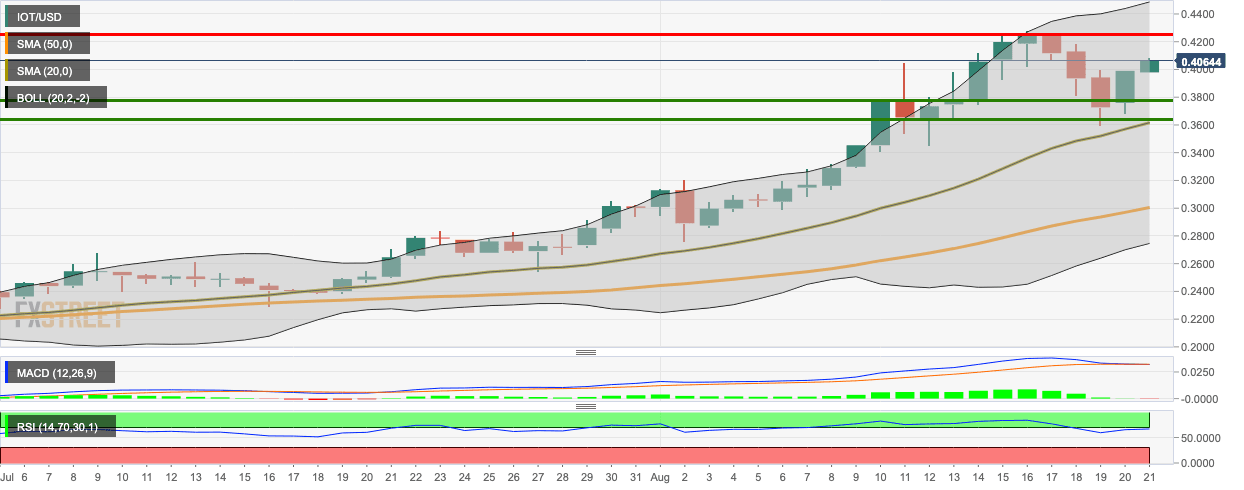

IOT/USD daily chart

IOT/USD rose from $0.297 to $0.406 in the early hours of Friday as the buyers remained for the second straight day. The MACD shows that market momentum has reversed from bullish to bearish, while the RSI is creeping along at the edge of the overbought zone.

IOT/USD has strong resistance at $0.424. On the downside, it has healthy support and $0.378, $0.265 (SMA 20).

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.