Injective could extend gains with 99% approval on upgrade proposal to reduce inflation

- Injective tokenomics upgrade proposal receives 99% approval ahead of the end of the voting on Tuesday.

- The Injective 3.0 proposal aims to reduce the token’s inflation to make its native token INJ “one of the most deflationary assets to date.”

- INJ price rises nearly 1% on Monday, adding to nearly 10% gains in the past week.

Injective (INJ), a layer-one blockchain that hosts several decentralized finance (DeFi) applications on its chain, looks set to proceed with a major upgrade that aims to reduce the token's inflation rate. INJ price is up nearly 1% on Monday, building on recent gains, as the proposed upgrade is getting the support of 99% of stakers and validators just a few hours before the voting ends.

Injective proposal to reduce inflation receives 99% approval

Injective’s tokenomics proposal aims to make INJ deflationary by including a plan to reduce the on-chain parameters for new token minting. Since its launch, Injective has introduced several measures to reduce inflation of its native token INJ such as token burn auctions on the mainnet launch. These auctions were then expanded to decentralized applications (DApps) in the network.

The proposal's expected outcome is to make INJ deflationary. “Injective aims to emulate and eventually surpass the disinflationary characteristics of Bitcoin to become the most deflationary crypto asset,” the text reads.

As with fiat currencies, a token's inflation rate is a key aspect of its long-term price trend. If a crypto asset is subject to high inflation, it means that its value will decrease over time once more supply becomes available. Some other cryptos are rather deflationary, meaning that there are strict controls over their total supply. Mechanisms such as token burns, halvings or hard caps are some of the tools used to control the supply-demand equilibrium.

The Injective proposal focuses on a controlled reduction in the inflation rate by balancing participation incentives and token scarcity, attracting new traders and early adopters to its blockchain network. The inflation rate change parameter, once increased to 0.5, will allow Injective to react swiftly to fluctuations in staking and ensure that the protocol is resilient, the proposal said.

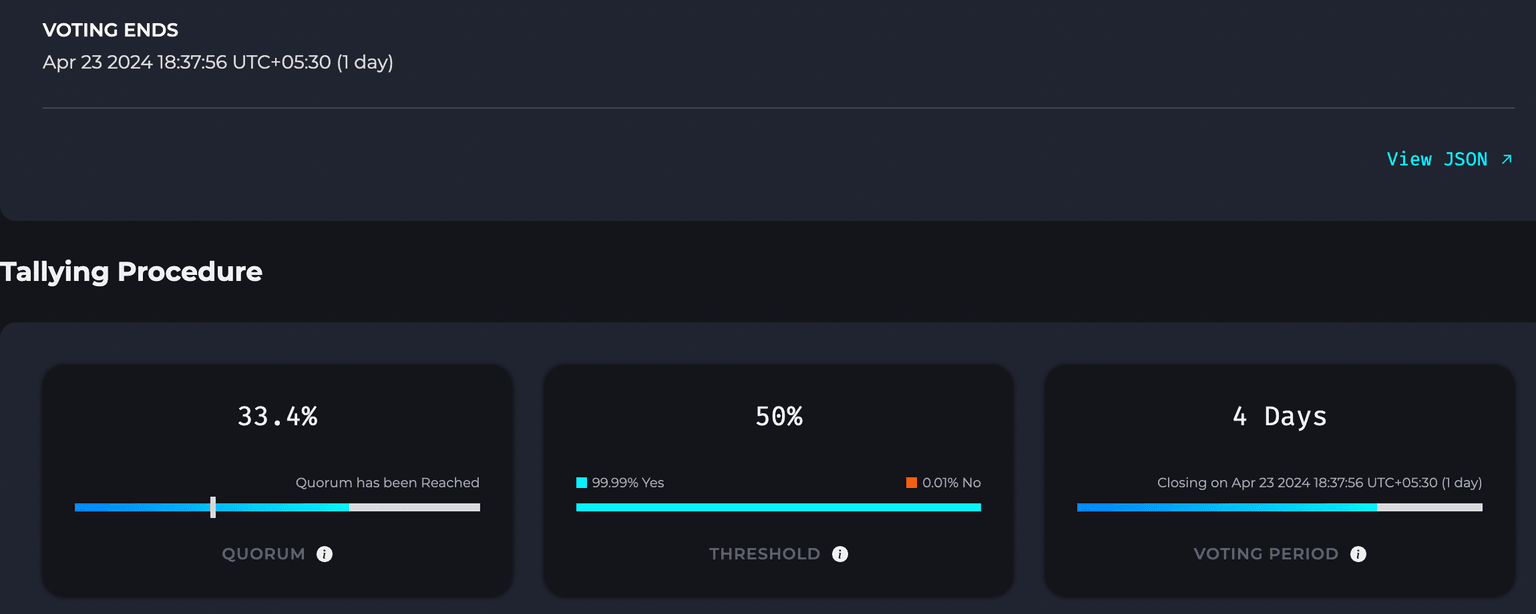

The new proposal is open to vote until April 23.

INJ voting

The portal shows that 99.99% of voters have voted in favor of the proposal, according to the forum.

Reminder to all $INJ stakers and validators:

— Injective (@injective) April 22, 2024

The IIP-392 governance proposal which is set to make $INJ one of the most deflationary tokens ever is live!

Voting ends on April 23rd ️ https://t.co/VkECpBTjAz

INJ trades at $28.50 on Monday, up by nearly 10% in the past week.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.