ImmutableX price rallies by 40% in 24 hours, but whale activity remains weak

- ImmutableX price rose to $0.771, breaching many crucial barriers, including key Exponential Moving Averages (EMA).

- The recent hype surrounding layer-2 solutions might have contributed to the rise.

- IMX whales are not active enough to influence price despite holding 87% of the circulating supply.

ImmutableX price rise astonished the market as the altcoin led the crypto market rally on Tuesday. The altcoin hit a 45-day high and, in the process, managed to flip many of the resistance levels into support floors. The reason behind the rally, however, is presently unknown, but the whales seem to be active once again.

ImmutableX price takes the crypto market by surprise

ImmutableX price shot up by nearly 40% during the intra-day trading hours, with the altcoin exchanging hands at $0.771 at the time of writing. Marking the second-highest single-day rise of the year, IMX managed to breach all three Exponential Moving Averages (EMAs). A retest of these lines would support the rally enough to sustain the rise.

This is crucial in bringing the altcoin to break through the barrier at $0.802. This resistance level was last breached back in June and last tested as a support line six months ago in March. A retest of this line would serve as the basis for a rally beyond $0.864.

IMX/USD 1-day chart

However, as per the Relative Strength Index (RSI), the crypto asset is overbought at the moment. This means that as the overheated market cools down, IMX might note some corrections.

However, excessive drawdown must be looked out for, as, in such an event, a fall back the support at $0.579 is likely. Falling through this level would send ImmutableX price to the monthly low of $0.475, invalidating the bullish thesis.

Lack of whale movement might result in corrections

Whales are the most important cohort of investors for IMX, as they command nearly 87% of the entire circulating supply. Their movement impacts the market considerably, and conversely, the lack thereof can cause losses to the investors.

This was visible over the past couple of weeks, when the large transactions (transactions worth more than $100,000) remained at a low $7 million on average, with a minor spike once in a few days. Even in the past 24 hours, the whale transactions only amounted to $22.6 million.

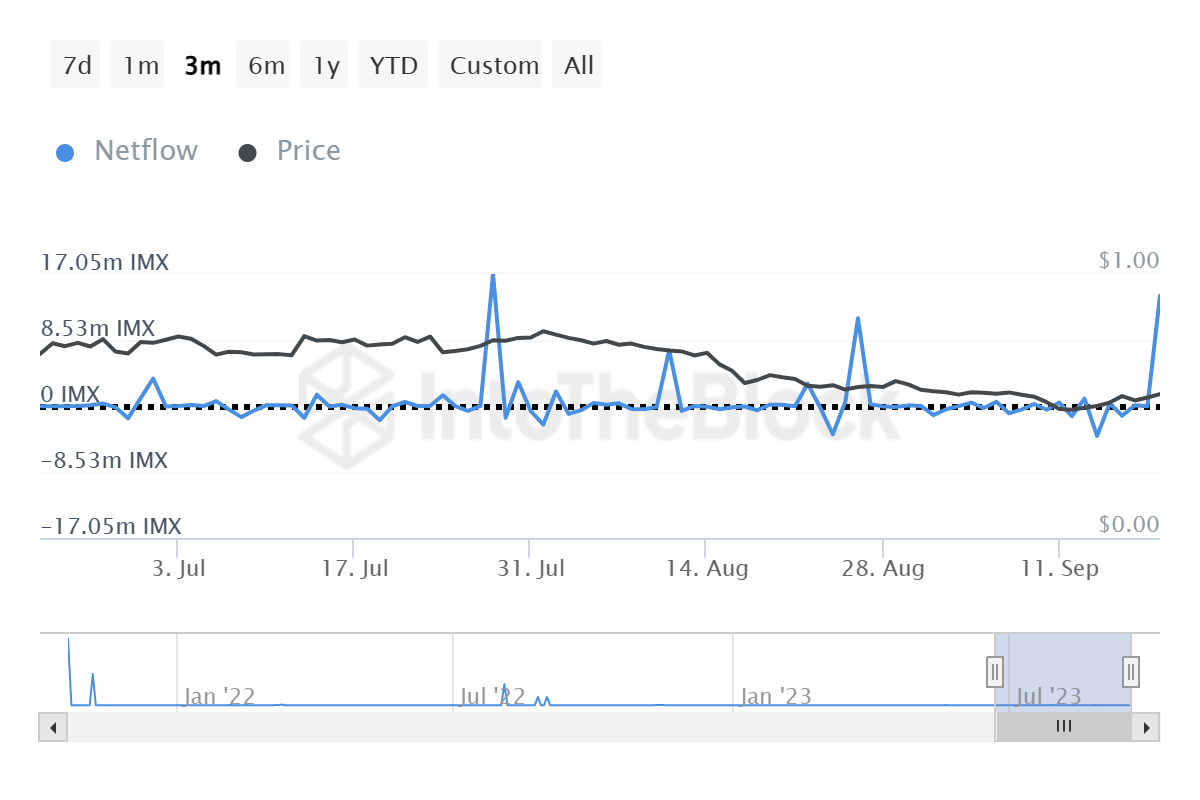

However, one difference this time around was the reduced outflows in comparison to the past instances. This kept the netflow of whales and large wallet holders positive, hitting a three-week high of 14.24 million IMX worth around $10.9 million.

ImmutableX whale netflows

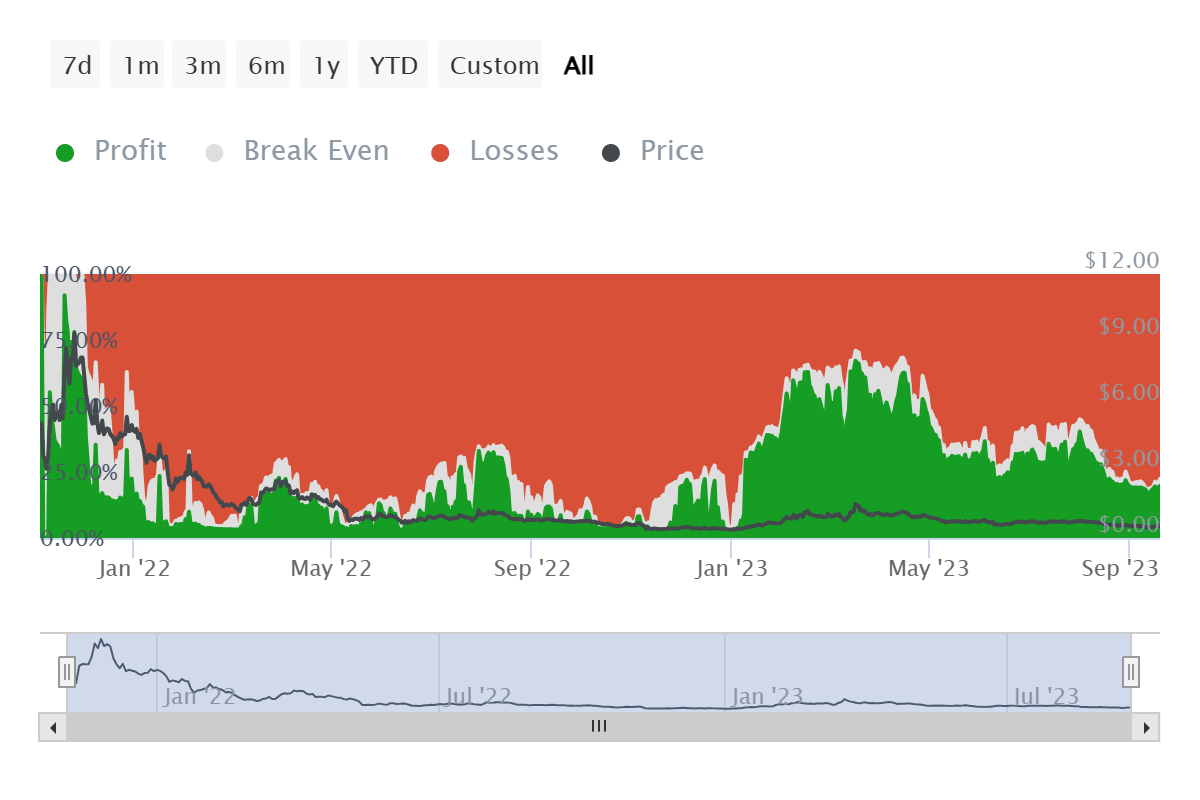

However, the frequency of inflows is still low, which, in the long run, might prove harmful for the altcoin. As is about 77% of the addresses are at a loss at the moment, which makes the incentive for being active on the chain rather bleak.

ImmutableX investors at a loss

This might impact the sustainability of the rally and could even lead to a decline in ImmutableX price.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.