If Tether falls the whole cryptocurrency market could go down with it

- USDT issuer Tether struggles with legal issues.

- The cryptocurrency market may be in trouble if the stablecoin goes bust.

Tether, the biggest and the most widely used stablecoin in the market, may prove to be too big to fail. What will happen to the cryptocurrency market if Tether goes broke or gets banned by authorities? How will Tether's problems affect the bigger market, or will they pass unnoticed as long as Bitcoin is rock solid?

Tether, or USDT, was born to bring more stability to the cryptocurrency market. It is pegged to the US dollar, where one USDT represents one USD. The stablecoin is issued by Hong Kong-based homonymous company Tether, which claims to maintain reserves equal to the number of USDT in circulation.

Tether, Bitfinex and US authorities

Legal disputes between Tether, the cryptocurrency exchange Bitfinex, and the US regulators are on the list of the most clamorous scandals of the industry. In April 2019, the New York attorney accused Bitfinex of covering up the loss of $850 million of users' funds with stablecoins issued by Tether. The authorities claimed that the cryptocurrency exchange operator, iFinex Inc, was also involved in creative accounting. Moreover, the companies deliberately misled the customers by failing to inform them of the incident.

The investigators concluded that Bitfinex transferred $850 million worth of users' assets to the account of the Panama-based payment service provider Crypto Capital Corp and replaced them with USDT.

The regulators prohibited iFinex from providing services to New York citizens and restricted iFinex and Bitfinex access to Tether assets.

Bitfinex confirmed the loss of $850 million; however, they claimed that the money was seized from Crypto Capital Corp. They also confirmed that they loaned $700 from Tether; the rest was covered by other assets.

In May 2019, the New York Attorney General (NYAG) demanded Bitfinex to provide the documents tied to Tether and reveal the details of their cooperation. The company attempted to claim that USDT was neither commodity nor security, meaning that NYAG had no jurisdiction over the companies involved. However, the New York Supreme Court's Appellate Division ruled that NYAG and the Attorney General Letitia James can continue investigations into entities behind USDT.

Tether rules the market

The problem with USDT is that it is no longer backed by USD as Tether initially claimed it. The company has silently changed the peg; now, it consists of a basket of assets, cash equivalents, and some vague assets received by Tether from loans to third parties. In other words, Tether reserves may include virtually anything. USDT may be backed by dollars, or bitcoins, or loans, or even thin air.

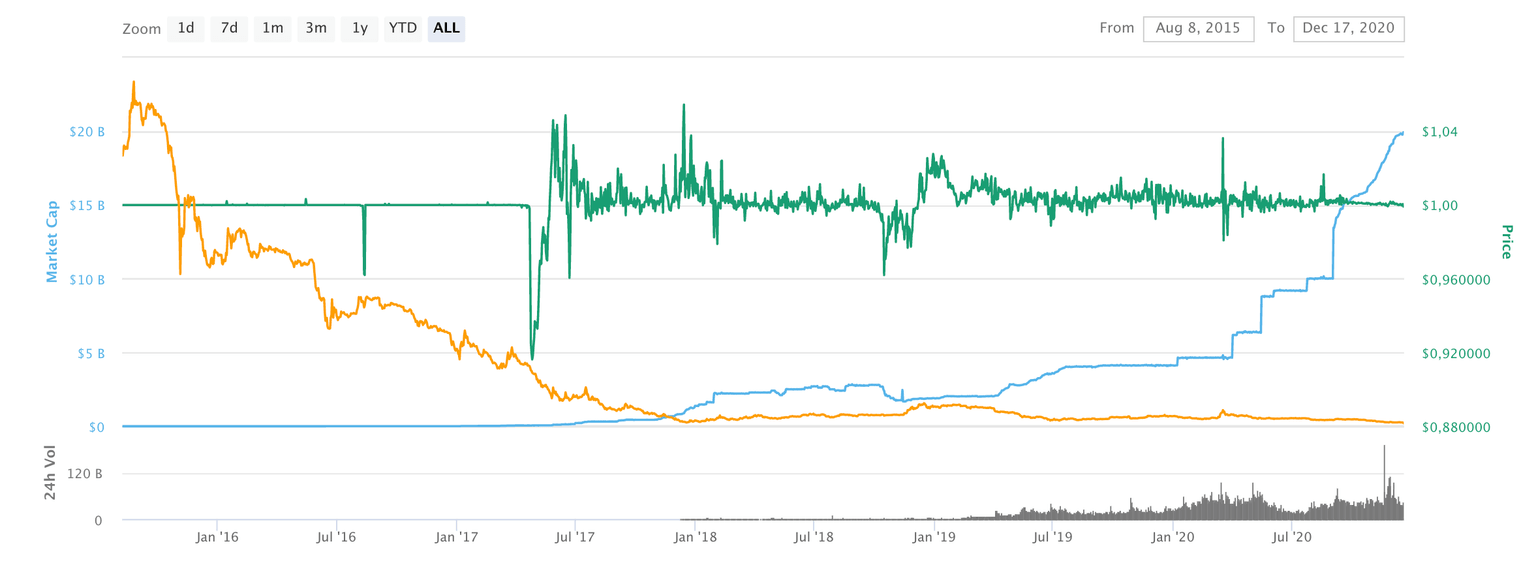

Tether seems to have become a digital version of fiat that can be printed by the issuer at will. Since the beginning of 2020, USDT market capitalization increased nearly fivefold, from $4 billion to $19 billion by the time of writing, meaning that over 15 billion coins were injected into the cryptocurrency system in less than 12 months.

USDT, market capitalization

Also, USDT is the most actively traded coins with an average daily trading volume of nearly a staggering $1 trillion; Bitcoin falls behind with only $66 billion. As many cryptocurrency exchanges do not accept fiat, USDT serves as a handy substitute.

Tether and Bitcoin correlation

A research study performed by TokenAnalyst in 2019 showed that in 70% of cases, Bitcoin growth coincided with USDT minting.

Over the course of 2019, there has been a net total of $1.5B worth of Tether minted on both Omni (USDT Omni) and on Ethereum (USDT ERC2O).

— TokenAnalyst (@thetokenanalyst) October 3, 2019

We took a look at the relationship between $BTC price and $USDT supply over the course of history.

THREAD pic.twitter.com/Y8ED62bkTI

The situation has hardly changed in 2020. Over $ 4 billion worth of USDT were pumped into the system in the past three months. The injection coincided with a strong Bitcoin price increase, meaning that the $4 billion invested into USDT were used to purchase Bitcoin.

As the market collapsed in March, big cryptocurrency exchanges and whales poured money into USDT to keep the system afloat. Issuers of stablecoins effectively assumed the banks' role and acted as a rescuer of last resort for the cryptocurrency market.

On Tether life support

The industry has become too dependant on Tether and USDT. While Bitcoin price fluctuations certainly have something to do with USDT minting, other coins and cryptocurrency-related services also need USDT to stay afloat.

All the cryptocurrency sub-industries, including the hilariously popular DeFi, use stablecoins in most of their operations, so if USDT goes bust or gets banned, they will all find themselves deep in trouble holding a bag of nothing. No wonder the industry would do whatever it takes to support the stablecoin.

On December 2, a group of Democratic legislators from the US House of Representatives introduced the Stablecoin Tethering and Bank Licensing Enforcement (STABLE) Act that requires any institution that issues tokens backed by a reserve asset to be registered with the banking authority. If the bill is enacted, USDT will be cooked as there is virtually no chance Tether will get the banking license.

Once this happens, the whole industry will be staring into the abyss.

Author

Tanya Abrosimova

Independent Analyst