Here’s what to do if you missed the recent AVAX price rally

- AVAX price is likely to pull back after its 22% rally to the $25.83 support level, providing an opportunity for the next leg.

- The retracement is key in determining if it investors should add more to their holdings or consider booking profits.

- A daily candlestick close that flips the $25.83 level into a resistance barrier will invalidate the bullish thesis.

AVAX price shows no signs of stopping as it bounced off a stable support level on August 2 and triggered a massive run-up. This move seems to have reached an upper limit for now and is likely to pull back a little.

AVAX price remains unfazed

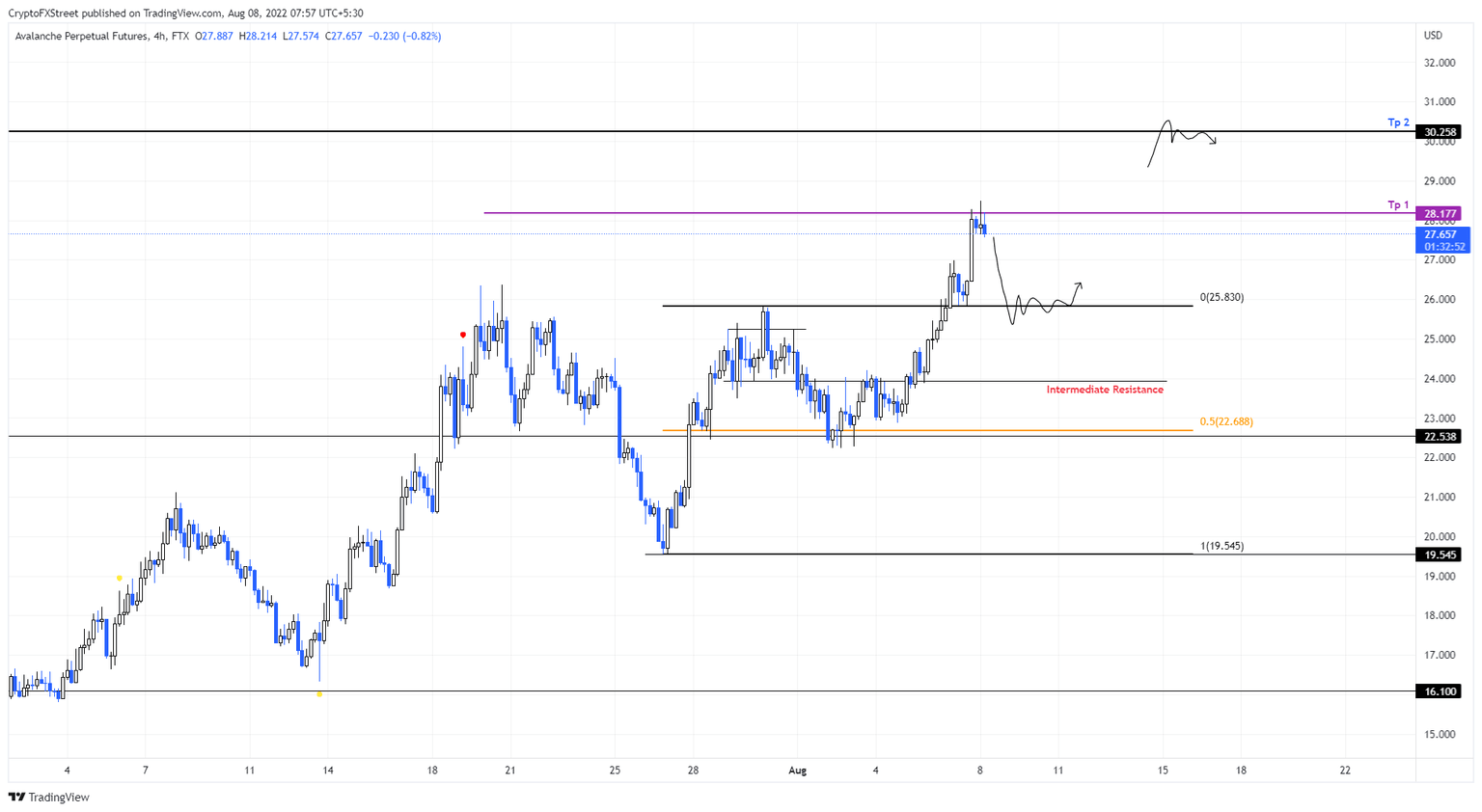

AVAX price surged 32% between July 26 and July 30, creating a range, extending from $19.54 to $25.83. This massive move retraced to the range’s midpoint at $22.68 over the next two days, forming a base for the next leg-up.

Soon enough, AVAX price kick-started its next ascent to the first target at $28.17. As investors continue to book profits, the uptrend is likely to exhaust a little, leading to a potential retracement to $25.83.

If this move shows strength after a pullback and holds above the aforementioned level, investors can bid here and expect the next target at $30.25 to be tagged. In total, this move would constitute a 17% ascent and is likely where the upside is capped for AVAX price.

AVAX/USDT 1-day chart

While the outlook for AVAX price is bullish, without a doubt, investors need to pay close attention to the upcoming pullback. A retest and hold of the $25.83 support level will be a positive development.

However, if AVAX price produces a daily candlestick close below the aforementioned level, flipping it into a resistance level, it will invalidate the bullish thesis and potentially trigger a deeper pullback to 23.93 or $22.68.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.