Here We Go Again

Sentiment slightly improved as BTC reclaimed 8200 levels

We’ve seen green across the cryptocurrency space as the prices of bitcoin recovered the 8200 levels in the early Monday Asia session. Sentiment has slightly improved overall in the crypto markets with major altcoins rebound around 2 to 6 percent. However, the rebounds are still far from anything significant because the majority of the crypto pairs remained in range trading or just off from recent lows. Investors could need to evidence more positive price actions and stronger sentiment shifts before making major moves.

Libra has made another headline galore over the weekend, as global regulators have raised concerns about Facebook’s crypto project. The Financial Action Task Force (FATF) red-flagged global stablecoins “could potentially lead to new risks regarding money laundering and terrorist financing”, and that could further deepen Libra’s regulatory challenges.

On top of that, the CEO of JP Morgan Jamie Dimon also expressed his pessimism on Libra. During a conference of the Institute of International Finance at Washington DC, Dimon believes that Libra is not going to happen because it has lost many of its big backers like eBay and MasterCard. He also said the project doesn’t have any incentive comparing to his company’s JPM Coin.

Meanwhile, Facebook hinted that the company could take a different approach on the Libra project. David Marcus, the head of the Libra project said Libra could use various fiat-based stablecoins, instead of the initially proposed token.

Price Analysis

BTCUSDT

The pair has broken out of the down channel on a 4-hour chart and returned to one of the key resistance levels which formed in late September.

Interestingly, the stochastic oscillator seems to have formed an uptrend since late last week, indicating that positive momentum has been built up despite the price has been going downward.

A similar situation has happened earlier this month, momentum up while the price was down, and ultimately, brought the pair to 8500 levels. We will see if the same situation could be repeated this time. In other words, momentum would be key to watch.

It’s worth noting that OKEx’s Long/Short Ratio has been hovering near the recent highs, suggesting the potential profit for traders with short positions is higher.

Figure 1: BTCUSD 4-Hour Chart (Source: FX Street).

Figure 2: OKEx’s BTC Long/Short Ratio (Source: OKEx).

XLMUSD

Stellar has traded about 2 percent higher against USDT at the time of writing, its 4-hour chart suggests that a major breakout could be in sight, but the direction of the breakout remains unknown.

The pair has formed a symmetrical triangle pattern on a 4-hour chart, indicating that the pair has been in consolidation since mid-October.

The Bollinger Bands also confirms that consolidation, the bands seem to produce a squeeze, suggesting volatility may increase.

Figure3: XLMUSD 4-Hour Chart (Source: FX Street).

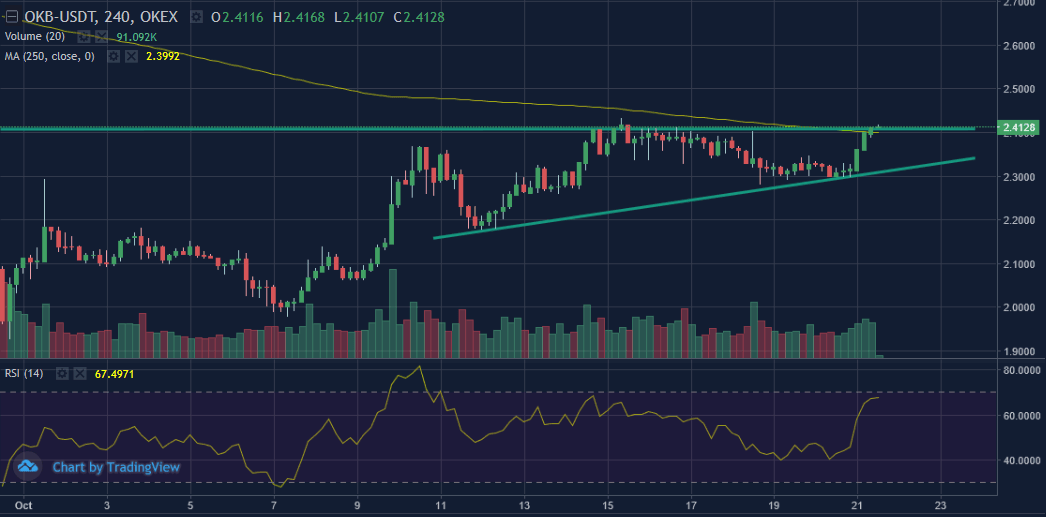

OKBUSDT

OKB surged about 5 percent against USDT during the Monday morning session in Asia and traded above the 250-MA on a 4-hour chart.

The pair seems developing an ascending triangle pattern, however, it’s too early to determine a breakout could happen as we need more evidence to make that call.

Key levels to watch: 2.28 and 2.4019.

Figure 4: OKBUSDT 4-Hour Chart (Source: OKEx, Tradingview).

NEOUSDT

NEOUSDT has come to a critical point as the pair seems trying to break a down channel on a 4-hour chart, which has formed since early this month.

A red hammer candlestick occurred just recently (yellow circle); this could indicate that bulls were unable to push the price above the candle’s opening price despite positive momentum, even though bulls were still dominated. MACD also produces a positive signal.

Key levels to watch: 7.35 and 7.19.

Figure 5: NEOUSDT 4-Hour Chart (Source: OKEx; Tradingview).

Author

Cyrus Ip

OKEx

Cyrus Ip has the privilege to work with OKEx as a Research Analyst, where he found some of the brightest talents in the crypto space.