Hedera Hashgraph price: What HBAR needs to recover from the FTX-induced 30% crash

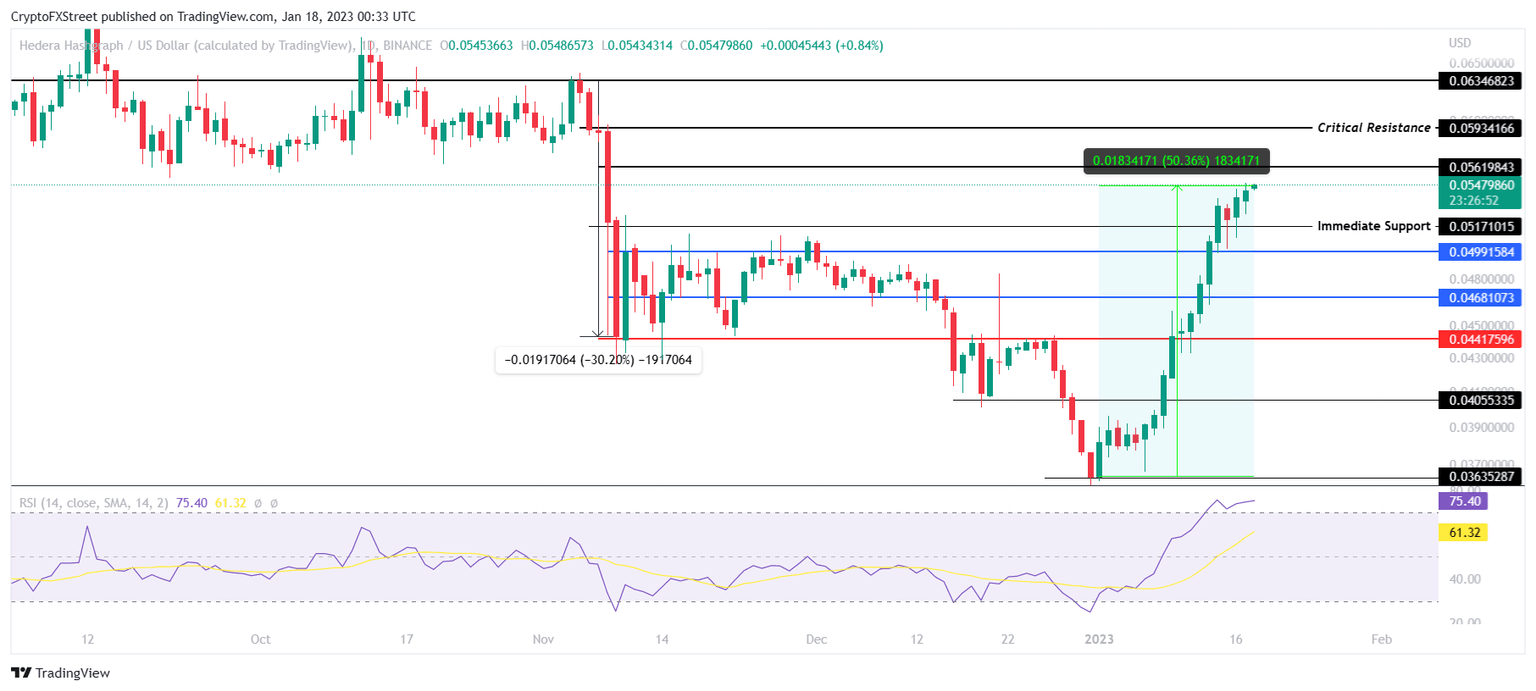

- Hedera Hashgraph price has managed to register a 50% increase in value year-to-date.

- Support from the buyers is necessary to generate another 16% rally and reclaim $0.063.

- HBAR overbought condition may lead to a negation of the bullish outlook below $0.044.

Hedera Hashgraph price is currently enjoying backing from the bulls that have managed to push the altcoin to a two-month high. However, going forward, HBAR will need to see a consistent bullish effort in order to prevent a relapse and regain the November 2022 highs.

Hedera Hashgraph price uptrend could be in trouble

Hedera Hashgraph price rose from the lows of $0.036 at the beginning of 2023 and rallied by more than 50.3% to trade at $0.054 at the time of writing. While the broader crypto market is maintaining its bullish stance, HBAR needs to reclaim the critical support of $0.059 to cement its rally.

In order to do so, HBAR bulls would need to keep going with their buying spree to push the price above the resistance level at $0.056. Flipping it into a support floor would allow Hedera Hashgraph price to breach the critical resistance at $0.059, after which the altcoin would be able to rally towards the November 2022 highs of $0.063 and invalidate the losses noted since FTX collapsed to bankruptcy.

HBAR/USD 1-day chart

However, enthusiastic traders should watch for a price correction in the near future as HBAR is vulnerable to a decline in price. The Relative Strength Index (RSI) is currently above the 70.0 mark in the overbought zone, which indicates a trend reversal would take place if the indicator slips below 70.0.

In such a case, Hedera Hashgraph price would first fall through the immediate support level at $0.051, losing which would give the altcoin a few opportunities to bounce back before tagging the critical support level at $0.044.

A daily candlestick close below this level would invalidate the bullish thesis, bringing HBAR back to December 2022 lows.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.