Has Ripple price reached fair value with impression inflation will jump?

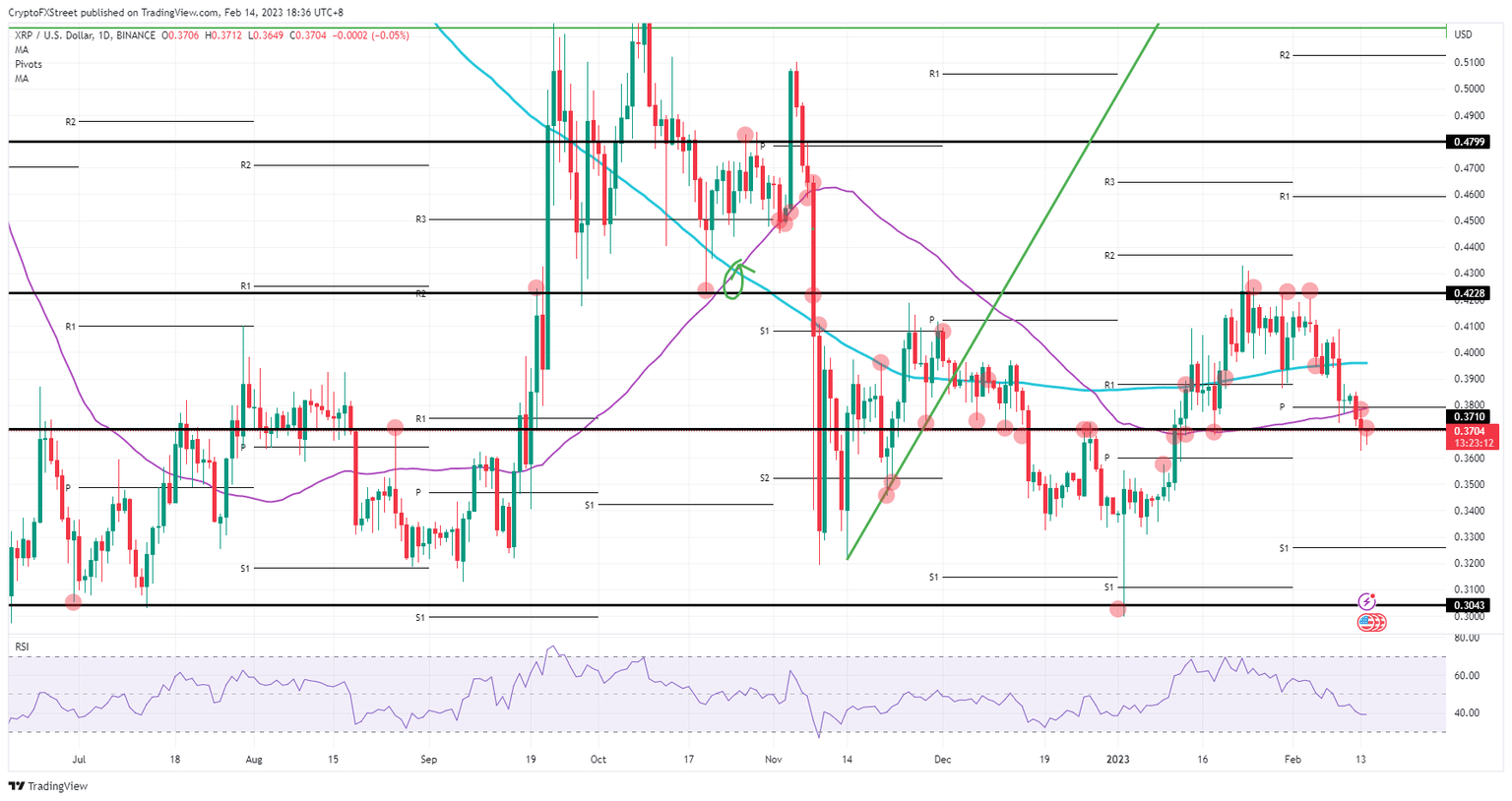

- Ripple price tanked 12% since last week after hitting the cap at $0.4228.

- XRP could tank further as another technical breakdown happened on Monday.

- Expect a surprise bullish price action as XRP bulls could enter the market with a firm bid.

Ripple (XRP) price sees traders bracing for the US inflation data this evening. Markets are seeing expectations erupting that the inflation number could be an upside surprise. A knee-jerk reaction looks granted, although XRP has already sold off 12%, and a stronger Consumer Price Inflation reading could already be priced in.

Ripple price trading in sell-the-rumor-buy-the-fact environment

Ripple price could be primed for a strong knee-jerk reaction in a short time frame of just one or two trading days. Markets have been gearing up for a stronger inflation number as several news websites and bank analysts warned that inflation could jump higher. The firm technical break below the 55-day Simple Moving Average (SMA) spells trouble once the number has been processed.

XRP traders could be in for short-lived gains with a jump back to $0.38. Should the jump in inflation be minor or even a surprise drop, a move toward $0.40 looks granted with the 200-day SMA getting taken out. Bear in mind that this will be short-lived as the rally has been broken, and a small drop in inflation would confirm that the Fed said inflation would remain sticky with more hikes needed.

XRP/USD daily chart

The big risk will be if inflation breaks higher and far above the number from December. That would mean that XRP has not adjusted enough to the current market conditions and needs another correction to the downside. The Relative Strength Index (RSI) still has room to go, meaning that the Ripple price could tank toward $0.33 near the monthly S1 support before being labeled as oversold.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.