GALA price rallies 5% ahead of Version 2 tokens airdrop

- The upgrade of Gala Games ecosystem to version 2 will be carried out Monday.

- All users holding the Version 1 token will receive a new token in a 1:1 airdrop.

- GALA price climbed 5% overnight, before the airdrop.

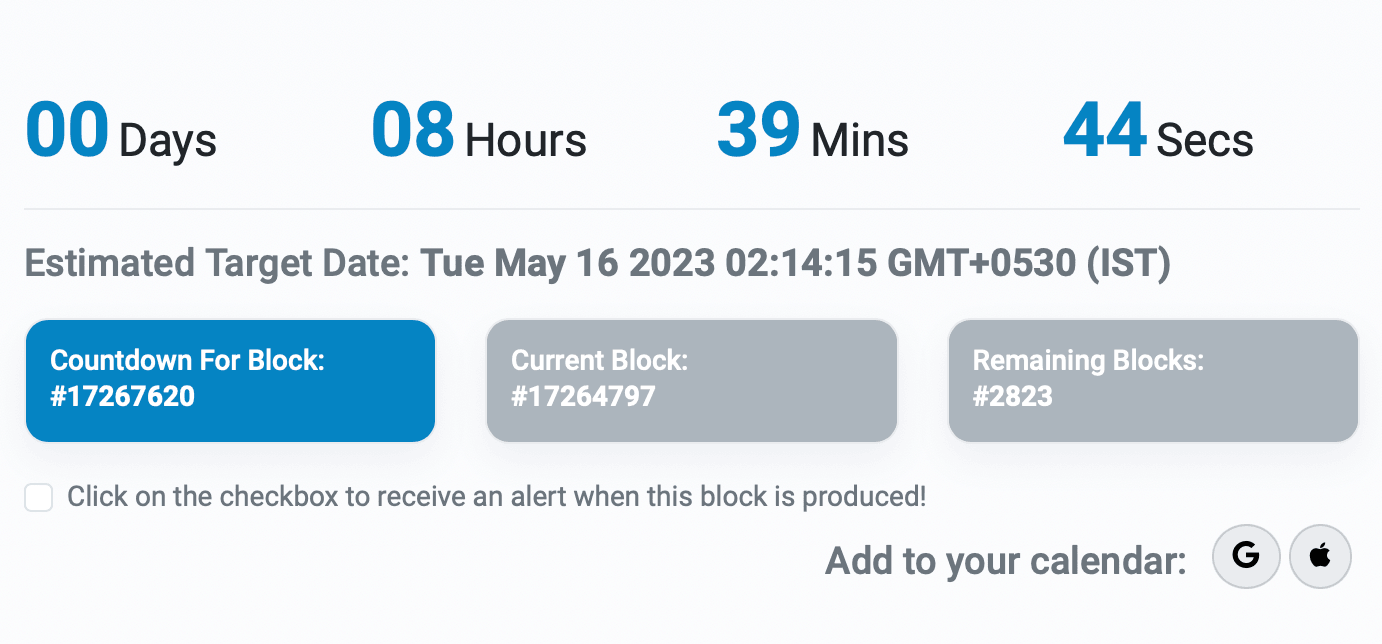

The decentralized Gala Games ecosystem has announced the launch of its Version 2 (V2) and the corresponding airdrop for all GALA Version 1 (V1) token holders. With the snapshot for the airdrop less than ten hours away, the token is rallying, yielding nearly 5% gains for holders overnight.

Also read: Lido Version 2 rollout on the Ethereum mainnet likely to be a sell-the-news event

GALA V2 airdrop snapshot scheduled hours away

GALA’s Version 2 airdrop is scheduled to occur on Monday, as the games ecosystem prepares for the event. All holders of GALA V1 tokens will receive a 1:1 airdrop of the V2 token following the snapshot.

Gala Games ecosystem asked users to ensure that their V1 tokens are held in their private wallets or wallets of exchanges that support the Version 2 rollout.

REMINDER: We are ~12 hours away from the snapshot for v2 $GALA!

— Jason Brink aka BitBender (@BitBenderBrink) May 15, 2023

GET YOUR TOKENS OUT OF SMART CONTRACTS OF EXCHANGES THAT ARE NOT SUPPORTING v2.

Countdown here: https://t.co/bYLqKPPDAa

More info here:https://t.co/GBiUvNbz18

Developers asked users to remove their GALA tokens from liquidity pools or smart contracts before snapshot on May 15 as there is no guarantee that tokens dropped to liquidity pool contracts will be recoverable.

Countdown to GALA V2 token snapshot

Ahead of the token airdrop, the protocol’s token yielded 5% gains for traders in a 24-hour timeframe. GALA price could correct in response to the airdrop, given the token has been rallying for a week in anticipation of the event.

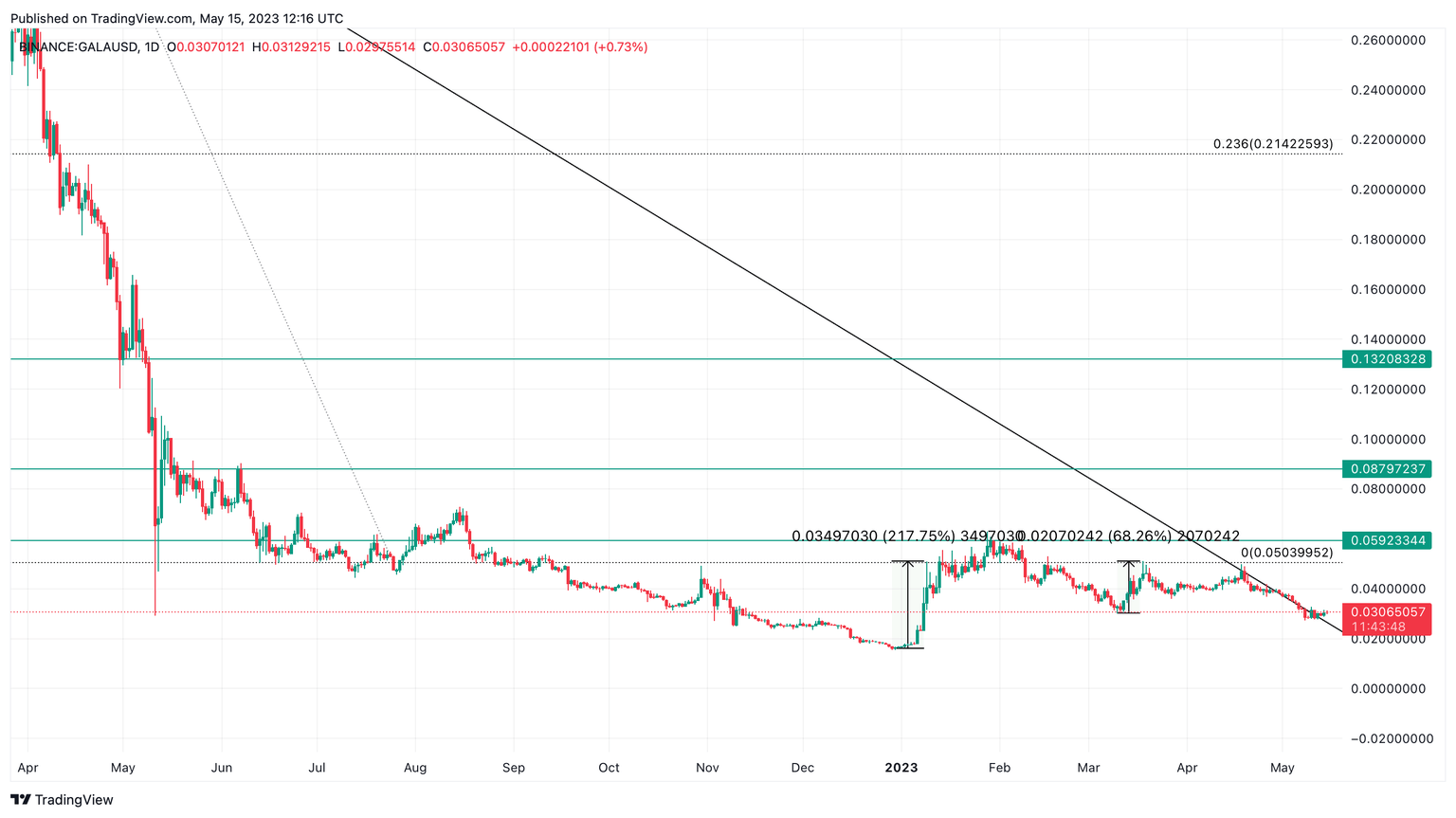

If the event turns out to be sell-the-news, GALA price could pullback to support at $0.028.

GALA price analysis

GALA price is in a downtrend that started in February 2022. The token started its recovery in the beginning of 2023 with a 217% gain in the first week of January and 68% rally in the second week of March. With a definitive close above the descending trendline, GALA price could be poised for a similar price rally in May.

GALA/USD 1-day price chart

The immediate resistances are at $0.0592, $0.0879 and $0.1320, key levels for GALA throughout the second half of 2022. In the event of a decline, GALA price could nosedive to $0.0200, a level previously seen in the beginning of 2023.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.