Floki Inu price fails to rally despite Bitfinex listing – 5 trillion FLOKI hanging in loss

- Floki Inu price needs a trigger powerful enough to initiate a recovery.

- The news of the Bitfinex listing failed to be a bullish catalyst.

- 5.17 trillion FLOKI will only become profitable if the altcoin touches $0.00003346.

- Nearly 25% of the entire supply is still underwater, a climb back to March highs would make it profitable again.

Floki Inu price has witnessed one of the most volatile movements amongst some of the top altcoins and meme coins. The cryptocurrency swaying this aggressively is resulting in about half of the entire supply swinging between unrealized profits and losses.

Floki Inu price needs stability and a recovery

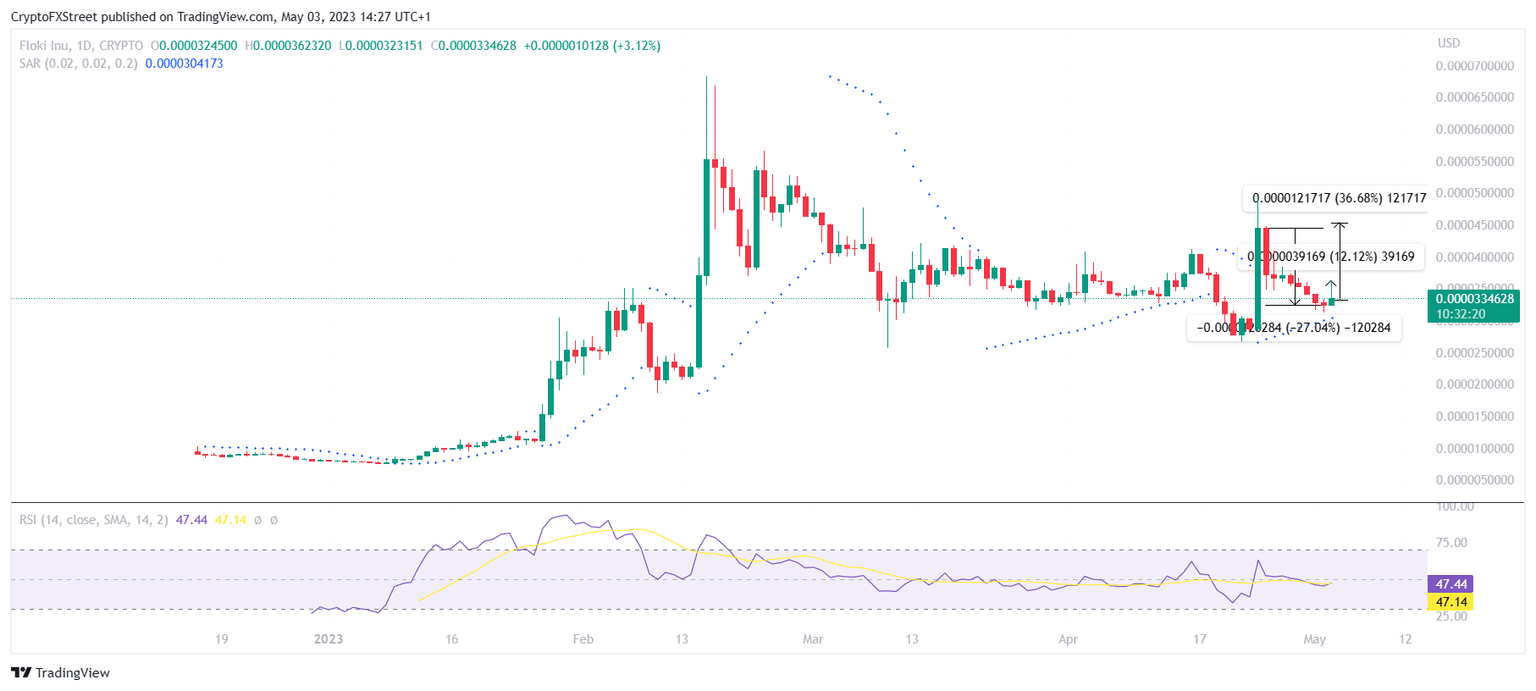

Floki Inu price has declined by more than 27% in the last couple of days following a 55% rally on April 24. The market was expecting a similar rally on May 3 as the cryptocurrency made its way on the crypto exchange Bitfinex, listing alongside the rest of the meme coins.

However, this was not the case as FLOKI, despite marking a 12% rise during the intraday trading hours, slid back down to trade at $0.00003346.

FLOKI/USD 1-day chart

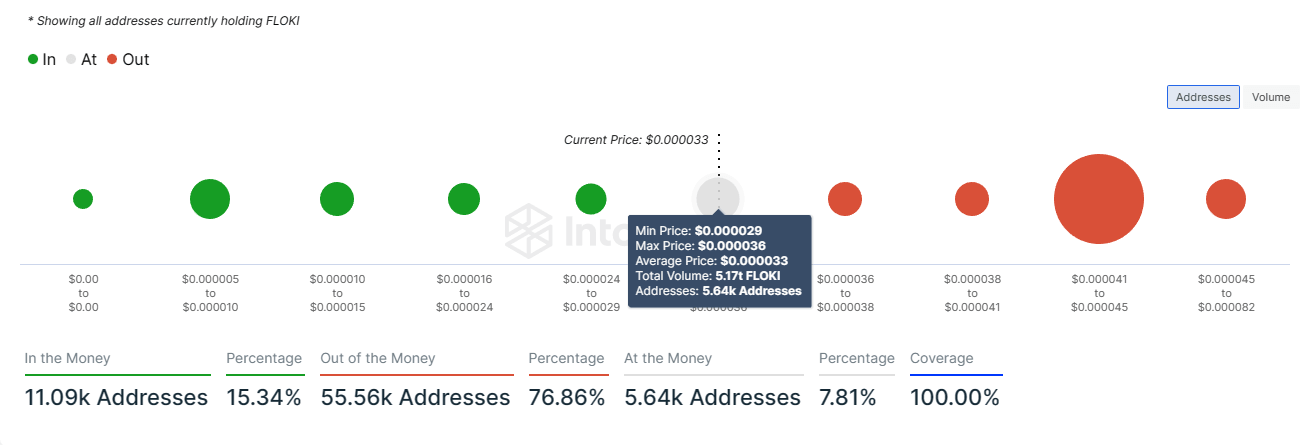

As a result of this fluctuation, more than half of the entire circulating FLOKI supply is hanging between profits and losses. About 5.17 trillion FLOKI worth nearly $172 million bought between $0.00002900 and $0.00003600 can become profitable or plunge into losses depending on the broader market cues.

In addition to this, about 25% of the circulating supply is also underwater since the April 25 crash and would become profitable once FLOKI hits the March high of $0.00004500. Close to 2.4 trillion SHIB worth $80 million bought between $0.00003600 and $0.00004500 would bear profits to its 50,000 addresses once Floki Inu price marks 36% gains.

Floki Inu GIOM

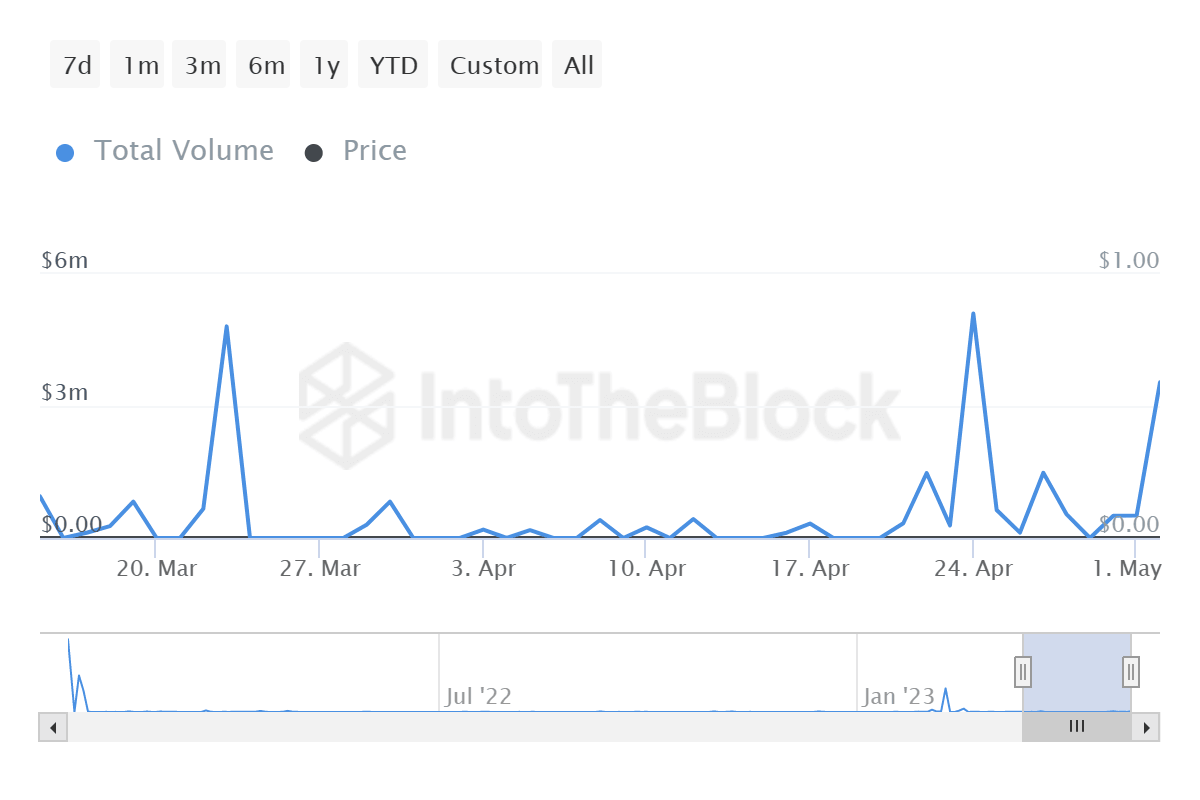

The volatile price action could bring about losses at any time given there is no support from the investors at the moment. Apart from the lack of participation on the network, the large transactions are also reacting only to extreme price rises or crashes.

Over the last two weeks, the most activity observed in transactions worth more than $100,000 was during the 55% rise of April 24 and on May 3 after the token was listed on Bitfinex.

Floki Inu large transactions

Thus Floki Inu price needs to find some stability and attempt to decouple itself from the “meme coin standard”.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.