Fetch.ai, SingularityNET, and Ocean Protocol to merge AI tokens

- Three AI tokens will merge into one, creating the Artificial Superintelligence token ASI.

- Prices of FET, OCEAN, AGIX jump after the news of the merger.

- AI tokens may be set for growth following the merger.

AI tokens are making moves that may ignite the AI narrative again after three AI projects announced on Wednesday that they entered a proposed agreement to merge their tokens into one called Artificial Superintelligence (ASI).

Read more: Fetch.AI steals spotlight with 100% weekly gains as Musk, Altman fight AI battle

ASI to decentralize artificial intelligence

In a proposed merger dubbed the "Artificial Superintelligence Alliance," data and AI projects Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN) plan to merge their tokens as one – Artificial Superintelligence (ASI), the three projects said in a joint statement.

With the rising popularity of AI solutions and Big Tech dominating the headlines, web3 companies are looking to change the game by introducing the features of blockchain into the AI world.

The newly formed ASI collective wants “to ensure that AGI (Artificial General Intelligence) and ASI, as they develop, are not owned and controlled by any particular party with its biased interests. They should be rolled out in an open, democratic and decentralized way," said Dr. Ben Goertzel, Founder and CEO of SingularityNET.

Based on web3 tenets of decentralization and privacy, the partnership would help facilitate direct relationships between developers and users, bypassing traditional gatekeepers and enhancing privacy, said Humayun Sheikh, CEO and Founder of Fetch.ai.

Also read: Crypto AI token rally persists, ignited by NVIDIA AI conference

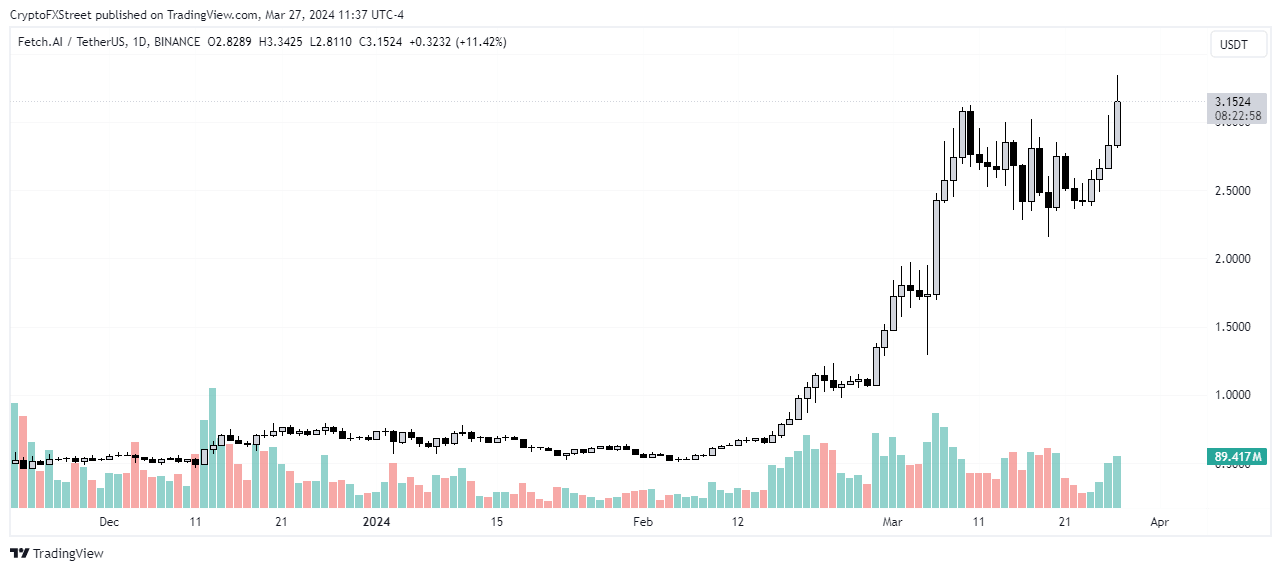

The merger announcement led to a sharp increase in the prices of the three tokens involved in it. FET has gained 9.23%, OCEAN is up about 22%, and AGIX has increased 11% in the last 24 hours.

FET/USDT 1-hour chart

OCEAN/USDT 1-hour chart

For the merger to take place, the three projects have to submit proposals to their different governance communities. If approved, the newly formed ASI will have a diluted market cap of about $7.5 billion based on the current prices of their individual tokens.

Regardless of the merger, the underlying organizations Fetch.ai, Ocean Protocol Foundation, and SingularityNET Foundation will operate as separate entities but work together to manage the Superintelligence collective and the shared ASI tokenomic ecosystem.

AI narrative may begin another rally

With the partnership, AI-themed tokens may begin to post gains in the coming days. For example, Internet Computer (ICP) recently demoed an AI smart contract that runs on blockchain. Its ICP token rallied afterward.

Read more: ICP, NEAR, Toncoin and GALA are among largest gainers amid weak market

On Tuesday, Stablecoin giant Tether (USDT) announced an expansion into AI that will allow it to "pioneer the development of open-source, multi-modal AI models." NEAR Protocol also announced the launch of new features that will grow its blockchain-powered AI future.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi